TDCC has provided the bonds and bills market with a two-tier legal structure for book-entry, as well as Delivery Versus Payment (DVP) service for nearly 20 years. With numerous market participants, including the central bank, bonds and bills dealers, issuers, guarantors, investor custodian banks, agent clearing banks, and physical securities deposit banks, the delivery nodes of settlement are highly complex. To understand the status of a single settlement, bonds and bills dealers often needed to query each settlement instruction one by one through TDCC’s Bonds and Bills Clearing and Settlement System (BCSS) or make multiple phone calls to different units to piece together information. Under the pressure of the T+0 settlement cycle, a significantly larger workforce was required to manage settlement progress.

According to statistics, the total annual transaction amount of bonds and bills in 2023 reached NT$81 trillion, with an average daily transaction amount exceeding NT$320 billion. As the market expanded, issuers, bonds and bills dealers, and investors demanded greater efficiency in fund allocation for primary issuance, secondary trading, and maturity redemption. This resulted in a tighter processing timeline of every single settlement. Additionally, after the outbreak of the pandemic and the shift to remote work, relying solely on phone communication significantly increased time costs. To ensure the smooth and timely execution of large-scale settlement operations, TDCC drew on the delivery tracking services of ICSDs and SWIFT, combined years of experience in assisting the market in managing settlement processes and visualized applications, launching a new dynamic inquiry service platform for bonds and bills settlement information: SyncOnline. This ushered in a new era of communication between TDCC and bonds and bills dealers.

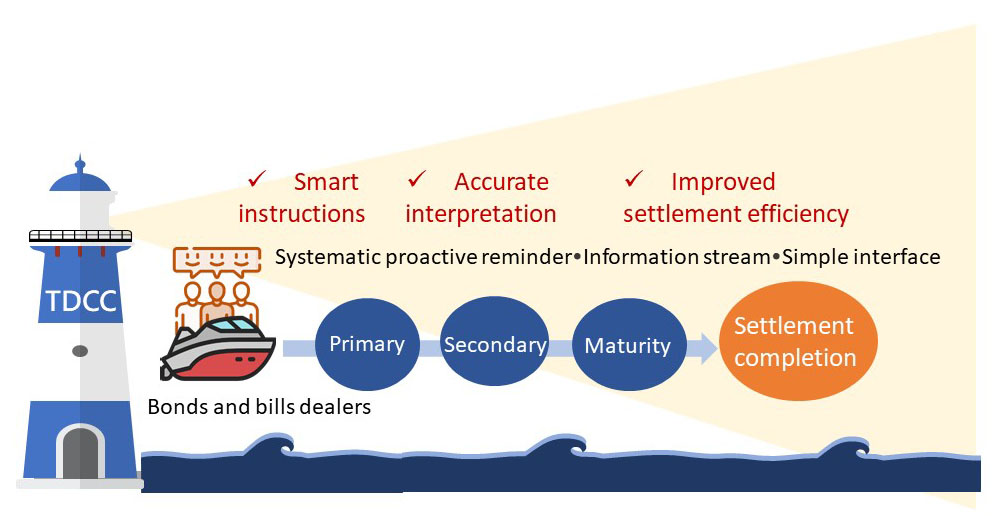

SyncOnline integrates primary, secondary, and maturity settlement dynamics across the BCSS. Also, it includes the issuance progress from the issuing side in the Short-Term Bills Registration System, as well as issuance and redemption payment records from the physical securities custodian banks. It also incorporates supplementary information obtained through TDCC staff’s settlement management inquiries. All of these above are provided in a single query interface, which enables bonds and bills dealers to instantly track the progress of bills and payment processed by counterparties and to obtain contact information of relevant intermediaries. The platform simplifies the settlement dynamic inquiry process and provides reminders for prioritized settlement handling, next-step suggestions, and corresponding measures. Moreover, SyncOnline offers in-depth exploration features, allowing bonds and bills dealers to check the detailed progress of each settlement systematically. If any uncertainties arise, users can access links to information such as the description page and instructions on canceling a settlement. This greatly enhances the transparency of the settlement process and enables dealers to manage settlements more efficiently.

TDCC has always been committed to serving the bonds and bills market and improving market settlement efficiency; the launch of SyncOnline is a demonstration of our long-standing efforts. In recent years, due to typhoon disruptions, trading volumes have surged significantly after holidays, and bonds and bills dealers have been able to grasp incomplete settlement information through SyncOnline effectively. This has significantly improved the efficiency and accuracy of settlement information handling. Looking ahead, as bonds and bills trading volumes continue to grow, TDCC will continue optimizing the features that SyncOnline offers, striving to make SyncOnline even more convenient for the market and dealers, and further promote the steady development of the market.