I.Introduction

To promote the widespread use of electronic signature, the amendment to the Electronic Signatures Act was promulgated and took effect on May 15, 2024. In response to this amendment and to realize the spirit of digital transformation and sustainable governance, TDCC, under the cross-ministerial cooperation and guidance of the Financial Supervisory Commission (FSC) and the Ministry of Digital Affairs (MODA), launched the new Shareholder Services eCounter (eCounter Platform). This platform is a successful example of smart government’s cross-ministerial collaboration and digital transformation. Shareholders of public companies can process their stock affairs online free of charge through a digital certificate and a digital signature with their issuing companies or their transfer agents. This greatly enhances efficiency, convenience, and information security. As of July 14, 2025, the number of companies signing up to use the platform has reached 1,890, and the number of applications for shareholder services through the eCounter Platform has exceeded 10,000. The platform has indeed received an enthusiastic market response.

II.Introduction and Benefits of the eCounter Platform

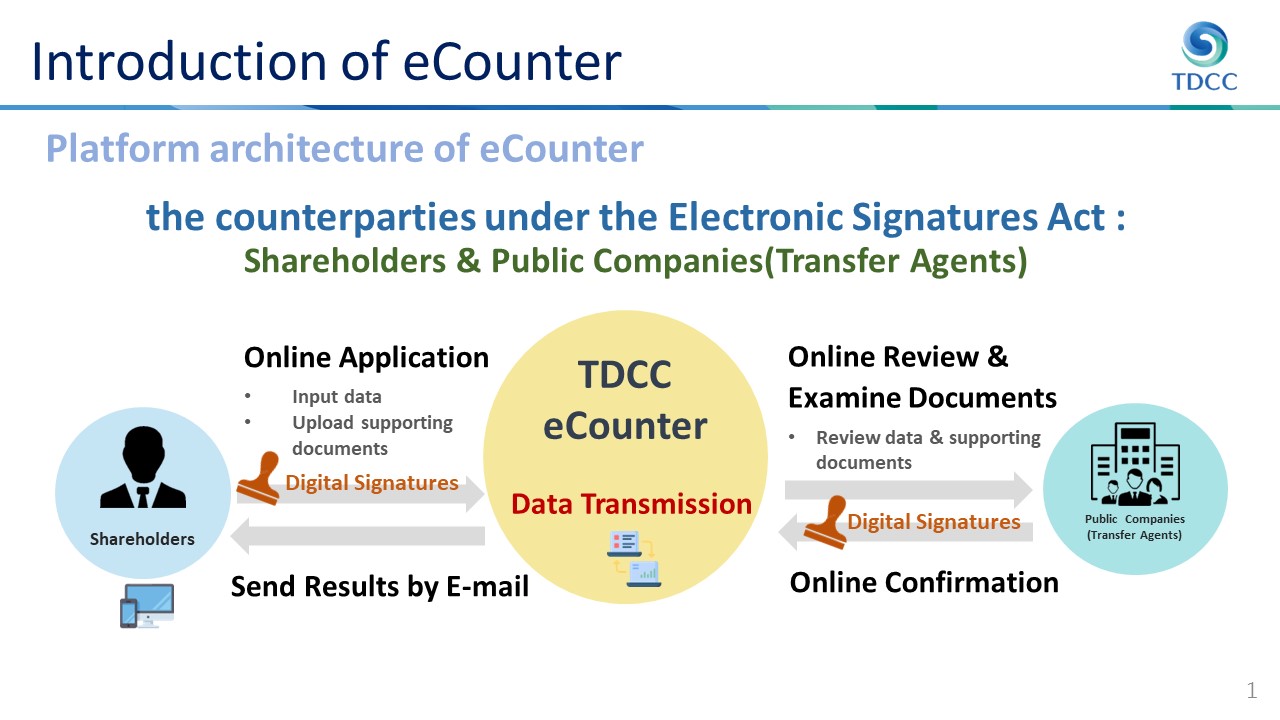

(I) Platform Architecture

The primary parties operating on the platform are shareholders and issuing companies, which constitute the counterparties as defined under the Electronic Signatures Act. An issuing company must sign a user agreement with TDCC to use the eCounter Platform, and shareholders must agree to the terms and conditions upon their first login. This ensures both counterparties consent to the use of electronic documents and electronic signatures. The eCounter Platform is positioned as an information transmission channel between the shareholders and the issuing companies (or their transfer agents). This includes transmitting the shareholders’ electronic application forms, supporting documents, the review results of the issuing companies or their transfer agents, along with related digital signature information.

(II) Available Application Items

TDCC has been promoting the platform’s functional expansion in phases. The online shareholder application services launched on May 19 this year cover shareholder account opening in the shareholder register and updates to basic shareholder information (including name, ID, household registration address, correspondence address, contact number, changes to central depository account for stock dividend distributions, and changes to bank account for cash dividend payments).

(III) Shareholder Application Process

- The shareholder logs into the eCounter Platform using an electronic certificate. The platform verifies the user’s identity and completes certificate validation through the digital certificate. The shareholder must complete the registration process (email verification) and agree to the platform’s terms of use and the contents of the consent clauses.

- The shareholder selects the application item, enters the application information, uploads supporting documents, and selects the target securities. The eCounter Platform uses the shareholder’s electronic certificate to digitally sign the shareholder’s application data PDF file (which includes the shareholder’s entered information, supporting documents, and declaration text) and transmits it instantly to the issuing company or its shareholder services agent.

- After the issuing companies or their transfer agents complete the review on the platform, the eCounter Platform notifies the shareholder of the result via email. Shareholders can also log into the platform to check the review progress and results provided by the issuing companies or their transfer agents.

(IV) Platform Benefits

- For shareholders’ benefits, the platform eliminates the need for paperwork, counter visits, and service fees, while allowing shareholders to access innovative digital shareholder services without being restricted by business hours. This significantly reduces transportation costs and waiting time. In addition, using electronic certificates for identity verification and digital signatures ensures the confidentiality, integrity, and non-repudiation of the application information.

- For issuing companies and their transfer agents, through the electronic transmission and storage of documents, companies eliminate the need for paper retention and the risk of loss or damage. This aligns with the digital trend and implements the spirit of ESG corporate sustainability.

- For issuing companies or their transfer agents, the platform supports real-time online review as well as automatic batch file intake and review. This significantly reduces the cost of manual processing and the risks associated with paper-based operations, thereby decreasing the burden on counter staff and enhancing the efficiency and convenience of managing shareholder services for both the company and its shareholders.

III. Conclusion

The eCounter Platform is being rolled out progressively in phases. Recognizing that mobile phones are the most frequently used tools for most people, TDCC has collaborated with TWCA to allow shareholders to apply for a digital certificate for free through the “TDCC ePassbook” app by the end of December 2025. This digital certificate can be used for digital signatures on the eCounter platform, offering a simple, secure, and convenient service. Additionally, the desktop and mobile functions for share transfers , share pledges, and reporting of lost stock certificate are expected to go live by the end of March 2027, supporting the capital market’s transition toward comprehensive digitalization.