In recent years, FinTech has been the mainstream of the global financial industry, and big data has been the most significant area. Different sectors have been actively employing big data analysis to stay on top of market dynamics and customer behavior, conduct digital transformation, and explore new business opportunities to create corporate value. TDCC, the only back office of Taiwan’s securities market, has five core business systems: stocks, bonds/bills, funds, futures, and cross-border business. In addition to processing millions of trade and settlement data daily and ensuring the accuracy of book entry, TDCC has been developimg its big data capabilities based on these abundant and various data. For many years, TDCC has used big data analysis to recreate the value and application of data. The company has set four major target users: Supervisors, market participants, investors, and TDCC internal employees to develop a “Big Data Information Platform.”

TDCC is the only central depository and clearing corporation of short-term bills in Taiwan. TDCC takes charge of the custody, settlement and delivery operation for underwriting, buy and sell, redemption at maturity of commercial papers and negotiable certificates of deposit within one year. The settlement process adopts Delivery Versus Payment, DVP, and Real-Time Gross Settlement, RTGS, protecting the security of the trade and delivery process. Based on the capacity of payment, bill, price, and volume, TDCC can take big data as its cornerstone. From providing supervisors with multidimensional, interactive, and visualized data application services in the beginning to extending the services for market participants in November 2020, TDCC constructed the Customer Relationship Management Information Platform (CRM) exclusively for bill dealers. Bill dealers can utilize big data analysis to obtain precise information of the short-term bills market and customers as well as strengthen risk management mechanisms. The CRM service integrates multilevel price and volume information, presenting the differences through graphs, lines, proportions, and colors. The service replaces the traditional statements and helps the companies achieve the following targets:

(1) Know the market: through the cross-time, cross-product, and cross-category comparisons, bil dealers can quickly grasp the overall market situation.

(2) Know yoursel: this service provides bill dealers the trading price and volume information of their own bills and that of the whole market. As a result, bills finance companies can further know their positionin the short-term bills market.

(3) Know the customers: starting from the largest scale in the commercial paper market, the NTD-dominated non-guaranteed commercial paper issuers, this service allows bill dealers to gain more insight into their customers’ industry, issuing balance, underwriting balance, and net worth. Therefore, bill dealers can carry out risk management.

CRM service conducts data definition, data cleansing, and personal information protection for daily settlement and delivery information of short-term bills. Then the information is visualized on an interactive dashboard, which can elevate the user experience of the bill dealers’ users. Through the intuitive operational interface and the selection of the analyzed information, bill dealers are offered real-time, flexible, and interactive services. The information provided includes market information, interest rates information, comparison with the market, and short-term bills market monthly report. The contents are as follows: (1) Market information: the information includes the short-term bills market’s underwriting and repurchase agreement volume, the trend of underwriting interest rates in the primary market, and the trend of trade interest rates in the secondary market- over the last five years.

(2) Interest rate information: the service provides transaction-by-transaction underwriting interest rates in the primary market and the transaction-by-transaction trade interest rates in the secondary market, which keeps the bill dealers updated with the highest, lowest, and average interest rates.

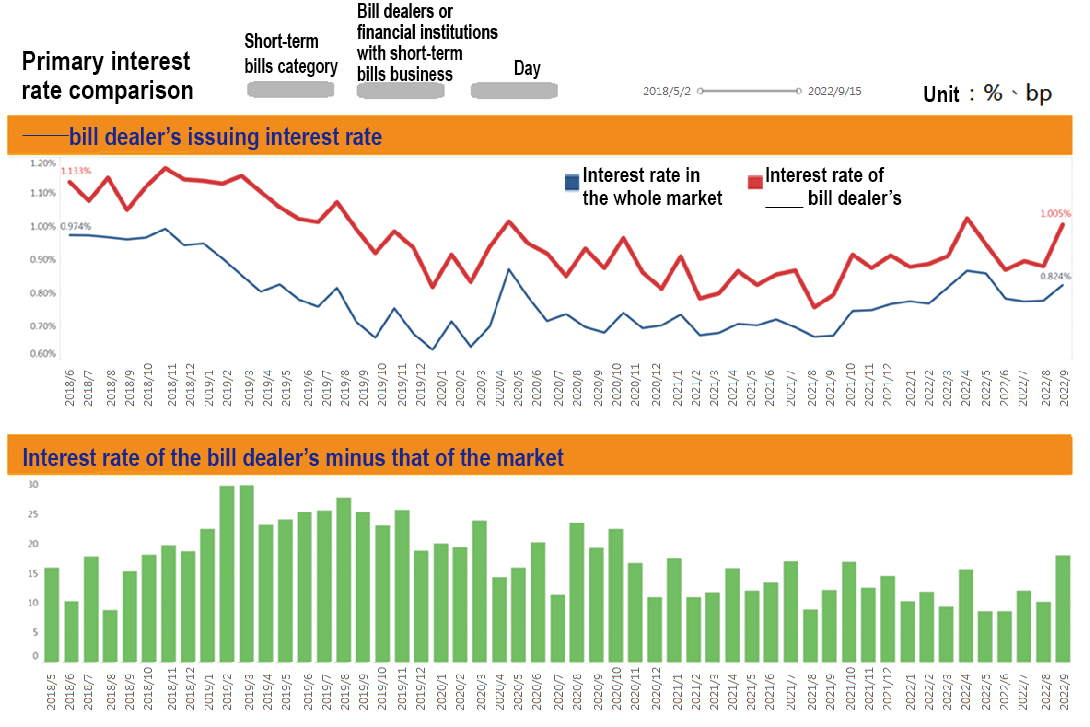

(3) Comparison with the market: bill dealers are equipped with the function to compare themselves with the whole market so that they can precisely grasp their own underwriting, buying and selling interest rates, and the management of credit risks from non-guaranteed clients. Besides, they can learn about their own position in the whole market and among the non-guaranteed clients to adjust business direction and strategies anytime according to market conditions.

(4) Short-term bills market monthly report: the report provides bill dealers with monthly information of the overall market so that the companies can gain the monthly market overview efficiently.

Figure 2: example of the comparison with the market

Figure 2: example of the comparison with the market

Since the launch of the CRM service, many bill dealers have applied for it, and the efficient operation of the service has won positive feedback from the users. Looking into the future, TDCC will keep utilizing its data analysis capabilities to develop big data applications, provide even more comprehensive, integrated market information, construct data application platforms, strengthen customer relationship management, and create more dynamic market values.