To enable Taiwan’s asset management providers to better tailor services to investors’ requirements, design new products satisfying investors’ needs, and raise marketing and business operation efficiency, the Securities & Futures Institute conducted the “2021 Survey of Fund Investors’ Investment Behavior and Preferences,” and some major results are outlined in this report. This time, 4,096 effective samples are retrieved. In addition to the statistics of fund investors’ behavior models and preferences, investors are categorized by their basic information to observe each category’s behavior further. Overall, age is a significant factor in fund investment behavior. Fund information sources, ways of buying mutual funds, and fund distribution channels differ noticeably between younger and older generations. The report categorizes fund investors into five age groups: under 29 years old, 30-39 years old, 40-49 years old, 50-59 years old, and 60 years old and above to explore the discrepancies among different investor age groups.

I. Investors in different age groups have diverse information sources

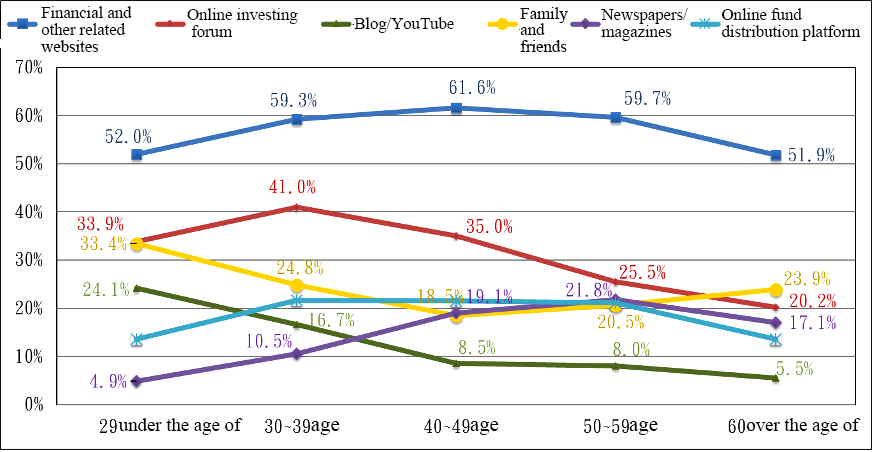

In the survey, when investors are asked what their fund information sources are, over half of the investors in each age group gain their fund information from “financial and other related websites (such as different leading news websites, Stock Q, and so on). However, the highest percentage (61.6%) of gaining information through this channel lies in the 40-49 age group (see figure 1).

On the other hand, younger generations gain their fund information from “online investing forums” and “blog/YouTube” more often. The proportions of these two information sources generally experience a downward trend as investors’ ages increase. Over 40% of investors in the 30-39 age group gain fund information through “online investing forums,” while the proportion drops to approximately 20% of the investor group over 60. The percentage of investors under 29 gaining information from “blog/YouTube” is around 24%, but the ratio drops to a mere 5.5 % of the 60 and above age group.

Figure 1: What are the sources you gain fund information from? (up to three items)

By comparison, seniors gain fund information more often from “newspapers/magazines,” “banks,” as well as “investment trust and consulting companies.” Around 4.9% of investors aged 29 and under gain fund information from “newspapers/magazines.” The ratio rises as ages increase, reaching 21.8% of the 50-59 age group. Approximately 25.1% of investors aged 29 and younger gain fund information from “banks,” but 36.8% of the investors aged 60 and older do so. 13.6 % of investors aged 29 and under gain fund information from “investment trust and consulting companies,” whereas the percentage reaches 31.8% of the 50-59 age group.

II. Investors of different age groups buy mutual funds from different ways

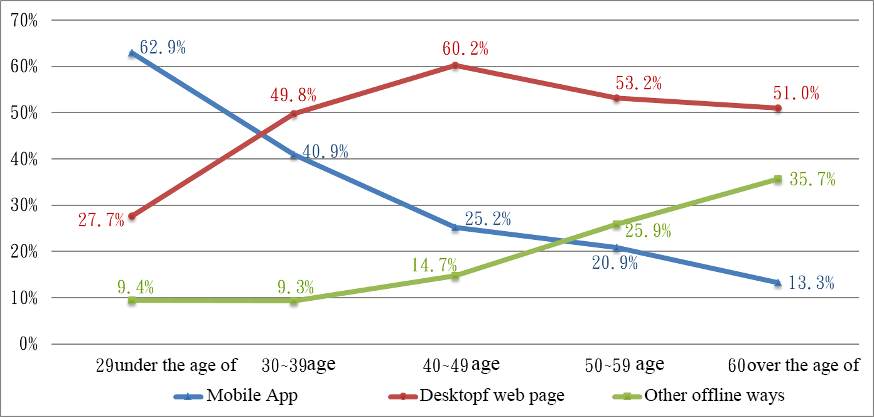

The survey also researches investors’ ways of buying mutual funds in different age groups. Although one investor may buy mutual funds on mobile , desktop web page, and other offline ways , the investor is required to choose one main way to buy. The result shows (figure 2) that on the whole, the highest percentage falls in the category “desktop web page,” especially the 40-49 age group, with a massive 60% of investors buying funds on “desktop web pages.” Over half of the investors elder than 50 also buy mutual funds on “desktop web pages.”

In addition, younger generations have the highest percentage of using “mobile App” to buy mutual funds. The percentage drops to just under half (49.8%) of the investors aged 30-39 buying funds on “desktop web pages,” while the percentage of “mobile apps” rises to 40.9%. This narrows the gap between the two ways. 62.9% of investors who are 29 years old and younger use “mobile apps” for fund buying, and this figure far exceeds the figure of “desktop web pages” (27.7%). The number of investors buying funds through “other offline ways” goes up as investors’ ages increase, reaching 35.7% of investors aged 60 and above.

Figure 2: What is your primary way to buy mutual funds?

As the chart shows, “desktop web page” is the most prevalent buying way; however, younger generations tend to buy mutual funds through “mobile apps” more, while older generations are more likely to buy mutual funds through offline channels. In further research into the main fund buying channels, fund investors who have chosen “mobile apps” or “desktop web pages” are asked to choose their currently main online channel. In addition, fund investors choosing “other offline ways” are required to choose one major offline channel. (For simplifying this part, a minority of non-mainstream channel samples are not taken into consideration in the content below).

The result shows that for those who are used to buy mutual funds through “mobile apps,” “banks” are the primary online channel for those frequent app users under 49 years old. As the ages decrease, the percentages of investors choosing “banks” rise, with 37.7% of investors under 29 years old using this channel. Frequent app users who are 50 and older are more likely to choose “investment trust and consulting companies” as their primary online channel, with the percentage exceeding 30%. However, “securities firms” are favored by younger app users, with 26.4% of investors aged 29 and below choosing “securities firms” as the main online channel. The percentage slides as the ages go down, reaching only 11.7% of investors aged 60 and above. In contrast, “online fund distribution platforms” do not seem to appeal to younger app users, and the figures for “insurance companies” only occupy approximately 3% of any age group.

As the result shows, for fund investors who use “desktop web pages,” for investors who are 39 and younger, the percentage of choosing “online fund distribution platforms” as primary online channel is more than the percentage of any other channel. The highest percentage, 47.2%, lies in the 29 and below age group. The percentage drops as the ages decrease, with less than 30% of those aged 40 and above using the platforms. “Investment trust and consulting companies” still appeal to seniors, with nearly 40% of investors aged 60 and above using these companies’ online channels. “Banks” are relatively unappealing to the 29 and below age group (23.3%), but 30% of investors who are 30 or older choose this online channel. In general, the percentage of frequent web page users who choose “securities firms” as their main online channel is not very high, but the ratios of younger generations using these firms are higher than those of seniors. As for “insurance companies,” the percentages of all web page users choosing these companies are generally low.

A further comparison is conducted between the investors who are frequent “mobile app users” and frequent “desktop web page users.” The survey finds that “banks” relatively appeal to more younger investors using apps to buy mutual funds. Strikingly more frequent app users under 39 years old choose this channel than frequent web page users, while the gap is not so wide between these two kinds of users who are 40 years old and above. “Online fund distribution platforms” are on opposite, which are more attractive to young frequent web page users than young frequent apps users. Only 14.7% of frequent app users under 29 choose this online channel, while a massive 47.2% of frequent web page users of the same age use the online platforms. As for the older generations, the difference between these two buying ways is not noticeable. Overall, frequent web page users are more likely to choose “online fund distribution platforms” as the main buying channel online. The possible explanation for the difference is that domestic banks’ app development is relatively more mature, yet online fund platform distributors’ app development is still in the primary stage. “Investment trust/consulting companies” are more favored among senior for both web page and app users; “securities firms” are preferable among younger generations for both web page and app users ; app users tend to prefer “securities firms” no matter their age. As for investors buying mutual funds mainly through offline ways, the result shows that “banks” are the most prevalent channel no matter how old these investors are, and it is obvious to see the influence that the banking industry exerts due to its long-term devotion to physical ways. Besides, “banks” gain more privileges when it comes to seniors. 60% of over-60-year-old investors who frequently use offline ways buy mutual funds from banks. In addition, “insurance companies,” which occupy a lower percentage of all online channels, overtake other offline channels and become preferable for younger generations who frequently buy funds offline. The percentages of under-39-year-old frequent offline users choosing “insurance companies” (18.2%, 24.7%) are not less than the figures for securities firms (18.2%, 18%) or “investment trust/investment consulting companies (16.7%, 14.6%).

III. Investors who are the same age differ in frequent buying channels

Although it can be shown from the result that age is a crucial factor in influencing investors’ behavior, the differences among them may result from other factors. The analysis below focuses on the differences in fund information sources, and it takes into account investors’ ages and their frequent mutual fund buying ways.

Do investors gain fund information from “financial and other related websites”? The result shows that despite age differences, about 60% of investors who frequently use apps or web pages gain fund information from “financial and other related websites.” Only approximately 40% of investors who are used to offline ways gain fund information from “financial and other related websites.”

Do investors gain fund information from “online investing forums”? The result shows that whatever the buying ways are, a higher percentage of the younger generations gain information from “online investing forums.” For investors accustomed to buying funds offline, the percentage of gaining fund information from “online investing forums” is lower than the percentage of investors who frequently use apps or web pages.

Do investors gain fund information from “blog/YouTube”? The result shows that whatever the buying ways are, a higher percentage of younger generations gain fund information from “blog/YouTube.” However, those who use mobile apps more frequently tend to gain information from “blog/YouTube” more. Those who are more familiar with offline ways show relatively less tendency toward making use of this information source.

Do investors gain fund information from “family and friends”? The result shows that even though there are age differences, the investors who buy funds offline gain fund information from “family and friends” more often than those who frequently use apps or web pages.

Do investors gain fund information from “newspapers/magazines”? The result shows that a higher percentage of seniors gain information from “newspapers/magazines,” but the differences in buying ways are not so noticeable.

IV. Conclusion

Through the cross analysis of ages and fund information sources from the survey “2021 Survey of Fund Investors’ Investment Behavior and Preferences,” younger generations gain fund information from “online investing forums” and “blog/YouTube” more often. In contrast, seniors gain fund purchasing information from “newspapers/magazines,” “banks,” and “investment trust and consulting companies” more.

Through the cross analysis of ages and frequent fund buying ways, the most common buying way is “computer web pages.” However, younger generations buy mutual funds more frequently through “mobile apps,” while older generations buy mutual funds from “other offline ways” more often. “Banks” are the most popular channel among both frequent app users and frequent offline users, and “online fund distribution platforms” appeal more to younger investors who use web pages more frequently. “Investment trust/ investment consulting companies” are preferable to older generations who use web pages frequently.

In addition to age differences, the sources from which investors gain fund information are also related to their frequent buying ways. Investors who are familiar with offline buying ways gain information from “online investing forums” and “blog/YouTube” less often, but they gain information from “family and friends” more. By contrast, investors who are more familiar with the Internet tend to gain information and buy mutual funds online. The data are quantified through this questionnaire survey, and the differences in investors can be presented more objectively. This report can serve as a reference for asset management companies to promote their business to investors in each age group.