Given the emphasis on the construction of anti-money laundering systems worldwide, in 2012, Financial Action Task Force (FATF) amended 40 recommendations for anti-money laundering and counter-terrorism financing to strengthen important points of administrative work against money laundering. In addition, each country was required to adopt a “risk-based approach” to establish risk judgment standards. In this way, money laundering and terrorism financing risks can be prevented or decreased.

In compliance with Money Laundering Control Act, TDCC, the institution administering anti-money laundering, established the Anti-Money Laundering and Counter-Terrorism Financing Inquiry System in April 2016 to implement customer screening required by FATF. To improve the work efficiency of national anti-money laundering and counter-terrorism financing and to reduce each unit’s costs of constructing a database by law to execute anti-money laundering, TDCC therefore opened the application for the system to external units to achieve the efficacy of shared resources. In the beginning, the units that made use of the system were securities firms, bill finance companies, futures commission merchants, securities finance enterprises, and investment trust (consulting) enterprises. Then the use of the system was expanded to financial institutions, mandated non-financial enterprises or personnel who are obligated to implement money-laundering and counter-terrorism financing under Money Laundering Control Act and all other laws.

The Anti-Money Laundering and Counter-Terrorism Financing Inquiry System allows TDCC and user institutions to meet international standards when executing customer due diligence for anti-money laundering and countering terrorism financing. In addition, the system raises the awareness and penetration of anti-money laundering operations in each unit. This synergy also won APG’s recognition during Taiwan’s third-round mutual onsite evaluation in 2018.

The Anti-Money Laundering and Counter-Terrorism Financing Inquiry System adopts the USA’s DOW JONES Risk & Compliance database, which many renowned international financial institutions also utilize. There are about 3.24 million pieces of information, including four categories: Global Sanctions List, Politically Exposed Persons, Relatives & Close Associates, and Special Interest Persons.

The Anti-Money Laundering and Counter-Terrorism Financing Inquiry System has two major functions:

1.Online inquiry: the function offers users the service of instant single inquiry. The user can enter name or title, registered nationality, and birthdate for inquiry. Then the system will conduct the fuzzy match function, comparing the information entered with the list in the database. The RC value is generated according to the degree of correlation; the higher the value, the stronger the correlation.

2.Bulk upload: users can upload a fixed number of lists for inquiry according to their needs. The system will provide comparison results for download within three business days after the lists are uploaded.

Since the Anti-Money Laundering and Counter-Terrorism Financing Inquiry System went live, a total of 6862 units have registered for its use, including 969 financial enterprises, 5850 non-financial enterprises, and 43 government organizations. By the end of September 2022, the accumulated information has reached 10.24 million pieces for online inquiry and 16.81 million pieces for bulk upload. It is clear that the Anti-Money Laundering and Counter-Terrorism Financing Inquiry System can assist users in conducting anti-money laundering effectively. After collecting feedback from securities firms and cryptocurrency operators, TDCC learned that the method of conducting inquiries manually online and bulk upload could not meet the rising demands in practice. Therefore, the Anti-Money Laundering and Counter-Terrorism Financing Inquiry System has adopted API (Application Programming Interface), an automated interfacing technology that corresponds to the current trend to eliminate users’ pain points.

The Anti-Money Laundering and Counter-Terrorism Financing Inquiry System adopts RESTful API, the software framework style put forward by Dr. Roy Thomas Fielding, as the framework for information exchange among systems. Through a simple and clear web address and the API processing logic presented in HTTP methods, the system shows API response status in HTTP Status Code and uses JSON(JavaScript Object Notation)as the information exchange format. This equips the system with highly flexible system expandability, which allows IT personnel of the user institutions to accelerate system development and raise the efficiency of system operation and maintenance.

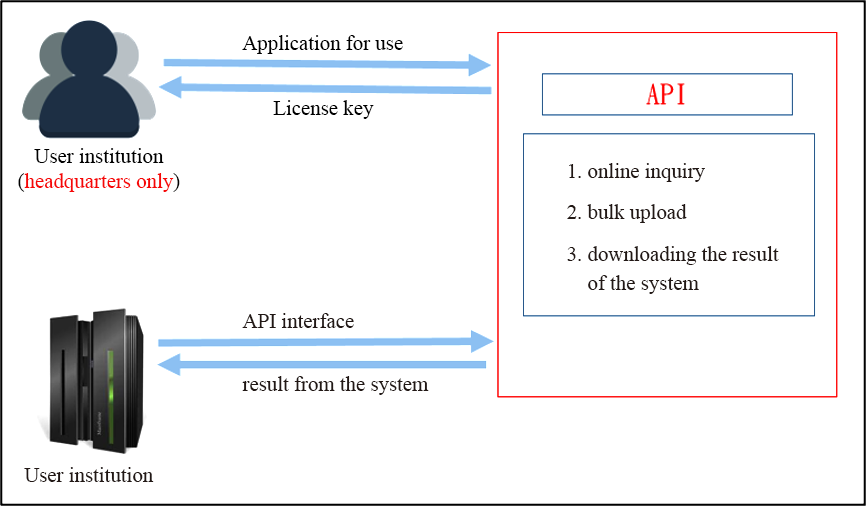

As a user institution applies for API interfacing to conduct “online inquiry” and “bulk upload,” the user can offer six sets of IP at most as an allowlist for interfacing among systems. After TDCC department’s review, the system submits an API interface license key to the user to ensure the security of information transmission and exchange. The illustration is as follows:

The Anti-Money Laundering and Counter-Terrorism Financing Inquiry System adds an API interface for “online inquiry” and “bulk upload,” making the system’s function even more comprehensive. The system assists users in increasing the efficiency of anti-money laundering operation and saving the human labor of processing customer due diligence. The function was launched for users’ applications on October 1, 2022.