Among the flourishing new technologies, big data and Artificial Intelligence (AI) have gradually become the mainstream in the digital development of the financial industry. TDCC, the vital infrastructure of Taiwan’s capital market, has always been striving to find new possibilities and breakthroughs in the pursuit of innovation and efficiency. As early as 2018, the company established a big data platform and introduced AI applications in 2021 to assist the Authority in supervision. With the advent of generative AI tools such as ChatGPT, the development of AI has attracted even more attention worldwide. How TDCC responds to and grasps this technological wave is especially noteworthy.

From BI to AI

The financial industry has intended to develop AI applications; the more comprehensive the preliminary work, the more stable the subsequent development. Therefore, in 2018, TDCC started building a big data platform, integrating a massive amount of long-accumulated data from various systems. Through extract, transform, and load (ETL) processes, data is inducted and organized onto the big data platform. The data is visualized in reports for data analysis, achieving the initial goal of Business Intelligence (BI). Moreover, data governance is crucial for the efficient operation of the big data platform. Throughout the BI development process, TDCC has consistently strengthened data governance from four elements: people, data, system, and tools. The company has established data assets, delineated roles and responsibilities for individual data governance, ensured efficient collaboration, and maintained data quality.

Three Major AI Applications

Since 2021, the big data platform has become more stable, and regulatory technology projects have gone live gradually. Therefore, TDCC has begun exploring AI application scenarios. The company has completed three primary applications so far to assist the Authority in market supervision.

Smart account consolidation

TDCC, the back office of the entire capital market, has to deal with many data submissions from various units. However, during analysis, some data, though different in titles, such as industry or corporate group titles, actually belonged to the same project. This difference in titles led to analytical errors. Therefore, TDCC defined a similarity calculation method and used AI clustering techniques to predict the category of each data submission. This process helps to classify data of the same category but under different names, facilitating subsequent analysis.

Anomaly Detection in Reporting

Another common application of AI is its ability to identify anomalies through big data analysis. TDCC traditionally relied on human judgment for the content reported by external units, supplemented with cross-table verification. Through AI detection models and automatic model classification, anomalies can be detected from vast amounts of transaction or reporting data. Besides, warnings can be rapidly issued before an irregularity occurs, serving as a reference for financial market supervision.

Bills Issuer Behavior Analysis

In the primary bills market, effectively assessing the risks of bills issuers’ payment not received upon maturity and the risks of securities houses’ underwriting is crucial preliminary work in risk management. After tagging the issuers’ big data information, AI technology is employed to analyze these tags to predict if there are any potential risks associated with the issuers.

Future Outlook

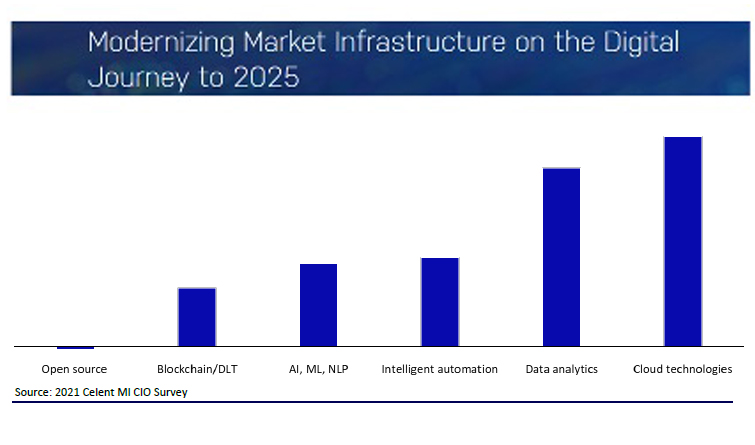

The Depository Trust and Clearing Corporation of the USA (DTCC) has put forward predictions for the top five technological applications for 2023, with generative AI being one of them. The head of DTCC’s Internal Technology Research and Innovation department pointed out this February that generative AI will become a part of our daily lives. Moreover, Nasdaq’s survey on the leading technology investment projects in the capital market infrastructure up to 2025 shows that items such as “data analysis” and “artificial intelligence/machine learning/natural language processing” occupy significant proportions.

Since the advent of generative AI tools such as ChatGPT, they have demonstrated immense potential and substantial influence, especially in various language-related tasks, including text generation, question-answering systems, chatbots, and so on. In the future, large language models will only become more mature and increasingly integrated into people’s daily lives.

In light of this, TDCC will also invest in more scenarios, deepen AI applications, enhance supervisory services, and further contemplate using generative AI to empower employees and strengthen information security applications. The goal is to offer more efficient, safer, and more personalized financial services, injecting new vitality into the financial market development.