In recent years, the rise of Real World Assets (RWA) tokenization has introduced new applications to blockchain technology. For example, JPMorgan has issued and managed tokenized bonds and stock tokens through its Kinexys blockchain platform. Société Générale issued tokenized bonds on the Ethereum blockchain, while Securitize has focused on simplifying the issuance process of digital token and assisting companies in achieving asset tokenization. These are some notable blockchain applications in recent years.

In June 2024, the Financial Supervisory Commission officially established the "RWA Tokenization Task Force," with TDCC acting as a supporting institution. The task force collaborated with multiple financial institutions to study and discuss the feasibility of verifying business operations through blockchain technology and the core characteristics and developmental trends of blockchain and tokenization. Blockchain has three core features:

- Decentralized Peer-to-Peer Payment System:

Bitcoin was designed to enable peer-to-peer (P2P) transactions without intermediaries. It allows any two users to trade directly, regardless of location, without the need for third-party verification, achieving a fully decentralized electronic payment system.

- Transaction Verification and Immutability:

All transactions are encrypted and recorded in a public ledger (i.e., the blockchain). Each participant (node) possesses a complete copy of the ledger. The verification and consensus process of the transaction is conducted collectively by most network nodes. Once a block is added, it cannot be modified, which ensures data immutability.

- Open and Transparent Transaction Records:

Blockchain utilizes distributed ledger technology (DLT), making transaction records publicly available to all participants. This includes transaction token amounts, sender’s and receiver’s addresses (i.e., wallet addresses), and timestamps. Transparency enhances trust in blockchain among participants and enables every participant to verify the authenticity of transactions.

Bitcoin pioneered cryptocurrency and introduced a revolutionary currency issuance and transaction system, further drawing global attention to the development of decentralized finance (DeFi) and blockchain technology. Subsequently, Ethereum was officially launched in 2015. Its innovation lies in "smart contracts," which are pieces of code that can be automatically programmed when certain conditions are met. This allows developers to create various decentralized applications (DApps) on the blockchain.

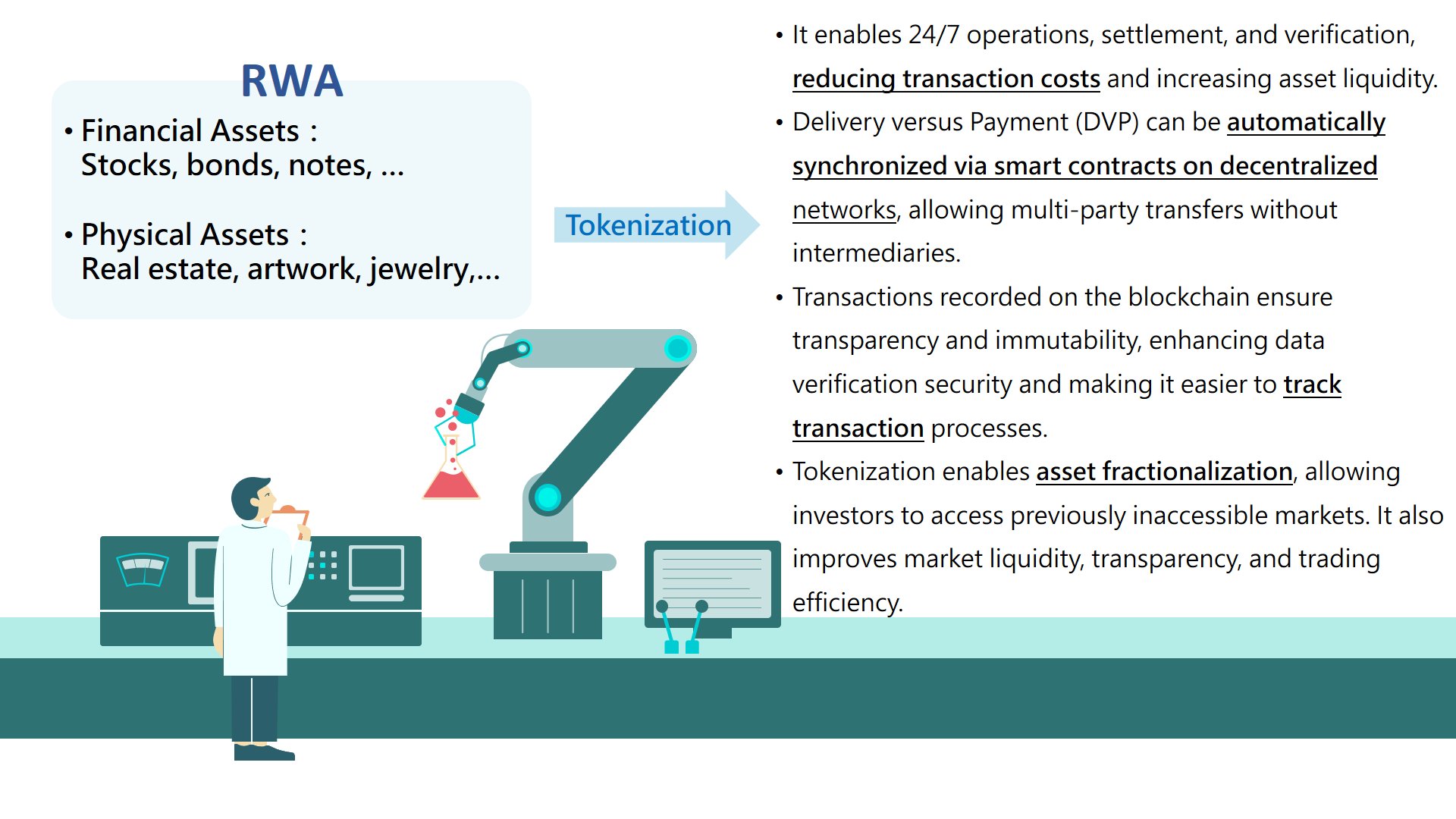

The introduction of Ethereum formalized the concepts of smart contracts and tokenization. The Ethereum ERC proposals have become the foundation for creating tokens. Tokens can be any form of digital asset, such as real estate, securities, commodities, intangible assets, and artworks. Tokenization is the process of converting RWA into digital tokens.

Tokenization and the programmability of smart contracts have introduced new financial models in many fields, with their benefits reflected in the following features:

- Enhanced Asset Liquidity:

Tokenization enables the division of assets into smaller, tradable token units, making assets more flexible. It also attracts more participants to engage in investment with lower barriers, thereby enhancing asset liquidity.

- Implementation of Atomic Swap:

Smart contracts are self-executing programs based on blockchain that automatically complete transactions under predefined conditions. They allow two parties to exchange different tokens without intermediaries and ensure that both parties fulfill the transaction simultaneously.

Despite the many innovative application scenarios brought by tokenization, it also faces challenges and risks:

- Technical Risks and Security Concerns:

Blockchain may have vulnerabilities and attack risks, particularly in application layers. These could include smart contract flaws, attacks on blockchain platforms, and the loss of private keys, which could all lead to financial losses.

- Issues of Regulations and Supervision:

Different countries and regions have different jurisdictions, and their definitions and regulatory policies for digital assets and tokenized assets vary. This causes uncertainty in the adoption of tokenized financial instruments, which is unfavorable for cross-border transactions and capital flow.

In addition, as the application of blockchain technology gradually develops and expands into different fields, it also brings forth some noteworthy and thought-provoking future trends. For example, with the rise of various blockchain platforms, secure and efficient cross-chain bridges have increasingly drawn the attention of experts and scholars. In the future, blockchain will place greater emphasis on collaboration and interoperability between different chains.

Through the observation of blockchain applications and POC trials in foreign capital markets, there are still no widely collaborative examples. Distributed innovation and the use of diverse technologies and standards have led to a lack of interoperability. Therefore, industry experts and scholars advocate strengthening cross-chain interoperability and establishing industry standards as key factors for a robust ecosystem of emerging digital assets.

It is expected that this "RWA Tokenization Task Force" will not only test business feasibility but also propose recommendations for applicable business standards and governance principles. These recommendations will serve as references for institutions developing related businesses, ensuring that emerging tokenized products are as efficient as current markets. Client protection will also be incorporated; standards and governance necessary for promoting ecosystem growth will be introduced to ensure market security and stability.