To ensure that investors receive their dividends promptly after annual general meetings, TDCC assists issuers and transfer agents in executing book-entry distribution and delivery operations. Under the previous process, however, issuers or transfer agents were required to compile distribution data into physical media and submit it to TDCC for multiple rounds of verification. This approach was labor-intensive and resource-consuming. In addition, it was subject to significant time pressure.

To enhance operational efficiency and security, TDCC initiated the development of the Issuance Operation Platform. During the design phase, careful consideration was given to issuers’ and transfer agents’ system-building costs (such as dedicated terminals and leased lines), the need to transmit large volumes of sensitive data, and network bandwidth constraints. The resulting platform was designed to operate securely over the Internet, adopting an MVC architecture with certificate-based authentication. It was officially launched in 2006.

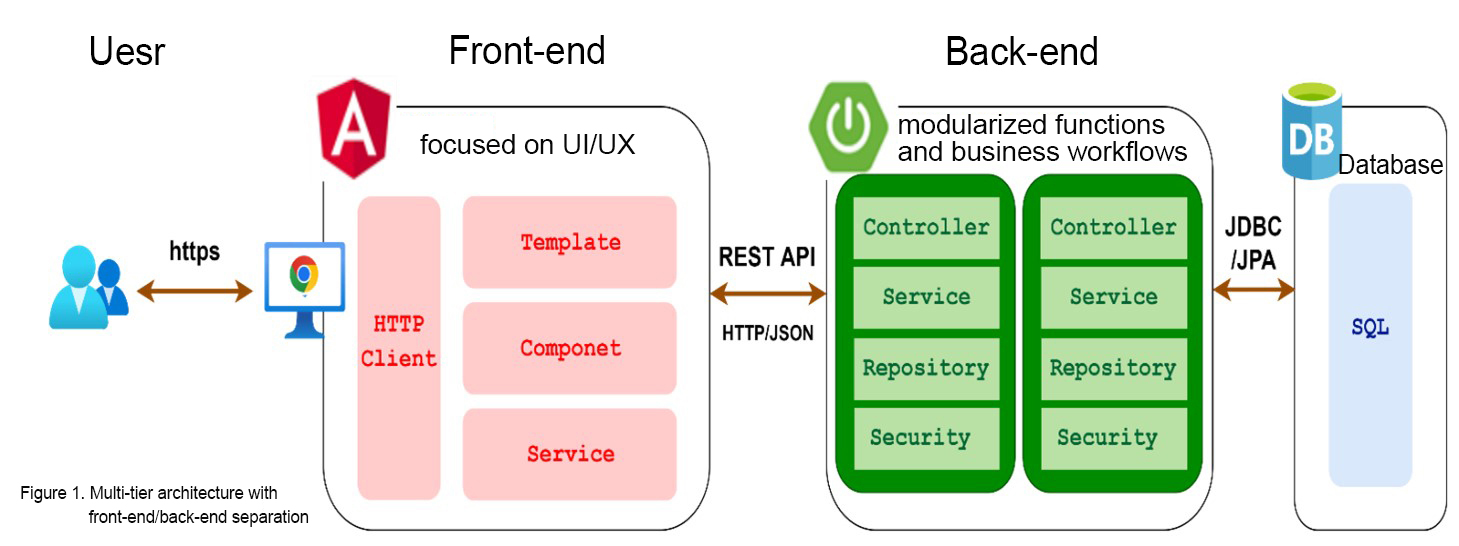

As Internet usage has become ubiquitous and web technologies have advanced rapidly, the Issuance Operation Platform has faced challenges, including a legacy architecture, layered technical patches, rising expectations for user experience, and increasingly stringent cybersecurity requirements. To ensure the platform can respond quickly and securely to market changes, TDCC began a complete system transformation in 2024, introducing a multi-tier architecture with front-end and back-end separation (see diagram). Compared with traditional websites (such as PHP or ASP.NET), which require reloading the entire HTML page with every action, the new architecture utilizes a modern front-end framework that dynamically updates the interface, focuses on the design of UI/UX, and prevent the front end from involving business data logic—resulting in smoother and more secure operations. The back-end framework adopts a modularized design in which functions (e.g., SFTP, report generation) and business workflows (e.g., distribution, dematerialized registration) are separated into independent modules with single-responsibility and clear logic. These individual modules communicate through clearly defined interfaces or APIs, which achieve mutual isolation, resulting in clearer division of system labor and more flexible operation and maintenance.

The new Issuance Operation Platform follows a two-phase transition strategy. The first phase focused on establishing the foundational system architecture and validating it through new business processes. Login operations, basic data maintenance, warrant automation workflows, and the fund instruction platform were migrated to the new system. This ensured seamless parallel use of both the old and new systems and enabled users to experience a more intuitive, user-friendly UI/UX.

During this phase, TDCC also advanced the digitalization of fixed-income securities. Users can now retrieve bond reference information from the Taiwan Stock Exchange’s Market Observation Post System via the new system, adjust the data as needed, and submit applications directly online. Once verified and approved by TDCC, users receive digital registration certificates instantly. As a result, issuing a bond no longer requires printing physical certificates or spending time and human resources on in-person document pickup, drastically cutting processing time by approximately threefold and significantly enhancing overall issuance efficiency.

The second phase involves ongoing migration and optimization of each business system. Enhancements include modularizing the dematerialized registration review process and introducing real-time checks to ensure the accuracy of dematerialized amounts, thereby improving input accuracy and timeliness. In terms of modularizing shared functions: in addition to email dispatch and TDCC’s two-factor authentication module, this phase introduces a PDF recognition module. In the future, when users upload various certification documents (e.g., a Securities Broker Specialist Qualification Certificate) during the declaration process, this module can be utilized to extract key data such as the attachment header and name. It will then perform automatic matching to verify the accuracy of the uploaded attachment, thereby reducing the time TDCC reviewers spend downloading, comparing, and validating the files. This is to meet the high demand for personnel qualification reviews during the peak season of annual general meetings.

The first phase of the new system has been operating smoothly for a full year. All remaining business subsystems are scheduled to go live by the end of 2025. TDCC will continue monitoring emerging technologies and evolving market needs to enhance the platform further, deliver improved services, and ensure long-term system stability.