To comply with anti-money laundering policies, increase corporate information transparency, and respond to the third round of mutual evaluation conducted by Asia-Pacific Group on Money Laundering (APG) in Taiwan in November 2018, the Ministry of Economic Affairs contacted TDCC, a company with practical experiences in anti-money laundering and counter-terrorism financing, to establish the Company Transparency Platform (referred to as the CTP platform) at the end of December 2017. The platform’s functions include declaration and inquiry. Since November 1, 2018, the platform’s declaration service has processed information on the board of directors, supervisors, executives, and major shareholders from more than 690,000 domestic companies. Also, since February 25, 2019, the platform has provided paid inquiry services for financial institutions and non-financial industries or individuals required by law to identify ultimate beneficial ownership. The platform is planned to integrate government resources such as the companies and business registration system, MOEA, the National Health Insurance Administration System, MOHW, and the Taxation Administration information, MOF. In addition, the platform is planned to interface with the Taiwan Stock Exchange and Taipei Exchange’s public market observation post system as well as TDCC’s anti-money laundering and counter-terrorism financing screening system (referred to as AML/CFT system). Taking “innovative thinking, technological expertise, and efficient services” as the premise for planning and operation, TDCC assists in implementing the country’s anti-money laundering policies.

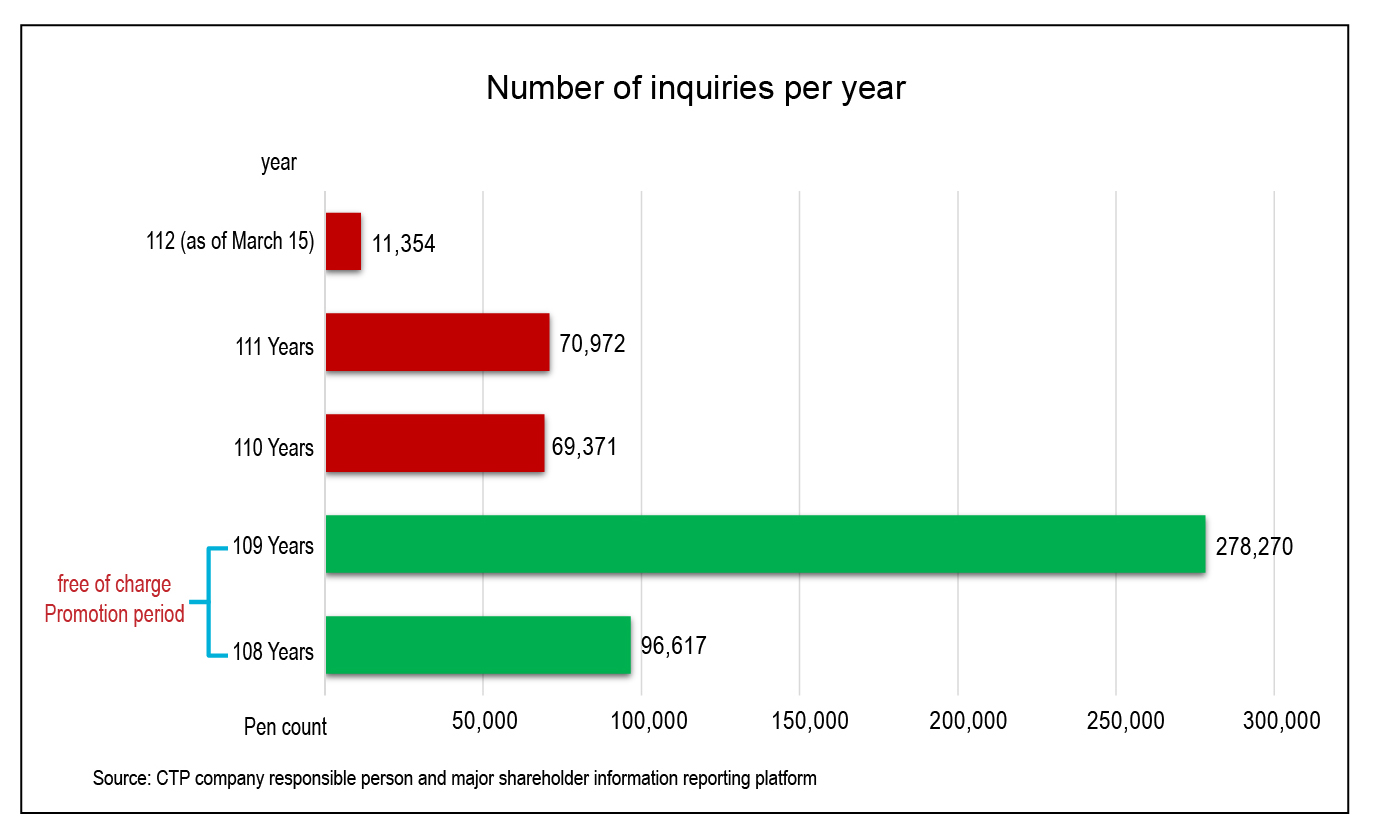

The CTP platform’s declaration service planning aligns with government policies to construct a platform for corporate transparency in line with international trends. The platform enables domestic companies to declare information on their board of directors, supervisors, executives, and shareholders holding more than 10% of the issued shares or capital. It operates 24 hours a day throughout the year and is open for registration and declaration without restrictions from computer equipment, time, or location, thus increasing the declaration rate. In addition, a friendly declaration environment for companies is created, so companies don’t have to enter the declaration information one by one. The platform interfaces with the companies and business registration system, MOEA, to obtain initial data from declaring companies. When logging in to the platform for declaration, companies can choose to import data from the Ministry of Economic Affairs, verify it for accuracy or modify it, and then confirm the declaration. Thus, the obligation of confirmation is complete. Since the inception of the declaration service in November 2018, in less than a year, the first declaration rate of companies has exceeded 90%. In addition, since 2019, companies have been required to conduct annual declaration through the platform in March each year, and the annual declaration completion rate has exceeded 90% every year (Figure 1). This shows that an efficient and friendly declaration design helps to increase the declaration rate and policy implementation.

As for the inquiry service, due to the sensitive personal information in the CTP platform data, which exceeds 2.8 million records, the platform is currently exclusive to financial institutions and non-financial industries or individuals required by anti-money laundering regulations to conduct customer due diligence and identify ultimate beneficial owners. By the end of February 2023, the number of users had exceeded 3,600. For units that have already used TDCC’s AML/CFT system, they are provided with integrated scanning lists for similarity score service to integrate two systems’ data from and simplify their customer due diligence process, saving operational costs and increasing efficiency. Moreover, to meet users’ anti-money laundering operation requirements and follow the trend of data transmission automation, in April 2022, TDCC added a function allowing users to employ application programming interfaces (APIs) to interface with TDCC’s platform for company inquiry. When there are regular reviews and requests for large volumes of company data, the API interface mode can significantly reduce manual work and increase efficiency. The inquired media-format company data can be imported into users’ internal systems for added value application to improve the efficiency of their customer due diligence process. This function has been tested and adopted by many banks. In addition, the CTP platform helps users to identify ultimate beneficial owners, so the accuracy of the data is essential. Therefore, the platform is equipped with an abnormal data report mechanism. When users have doubts about the content of the data obtained, they can make descriptions and reports on the platform. Then the platform system will immediately transmit the reported data to the Ministry of Economic Affairs’ dedicated mailbox. The reported data is also compiled monthly and provided to the Ministry of Economic Affairs as a verification reference.

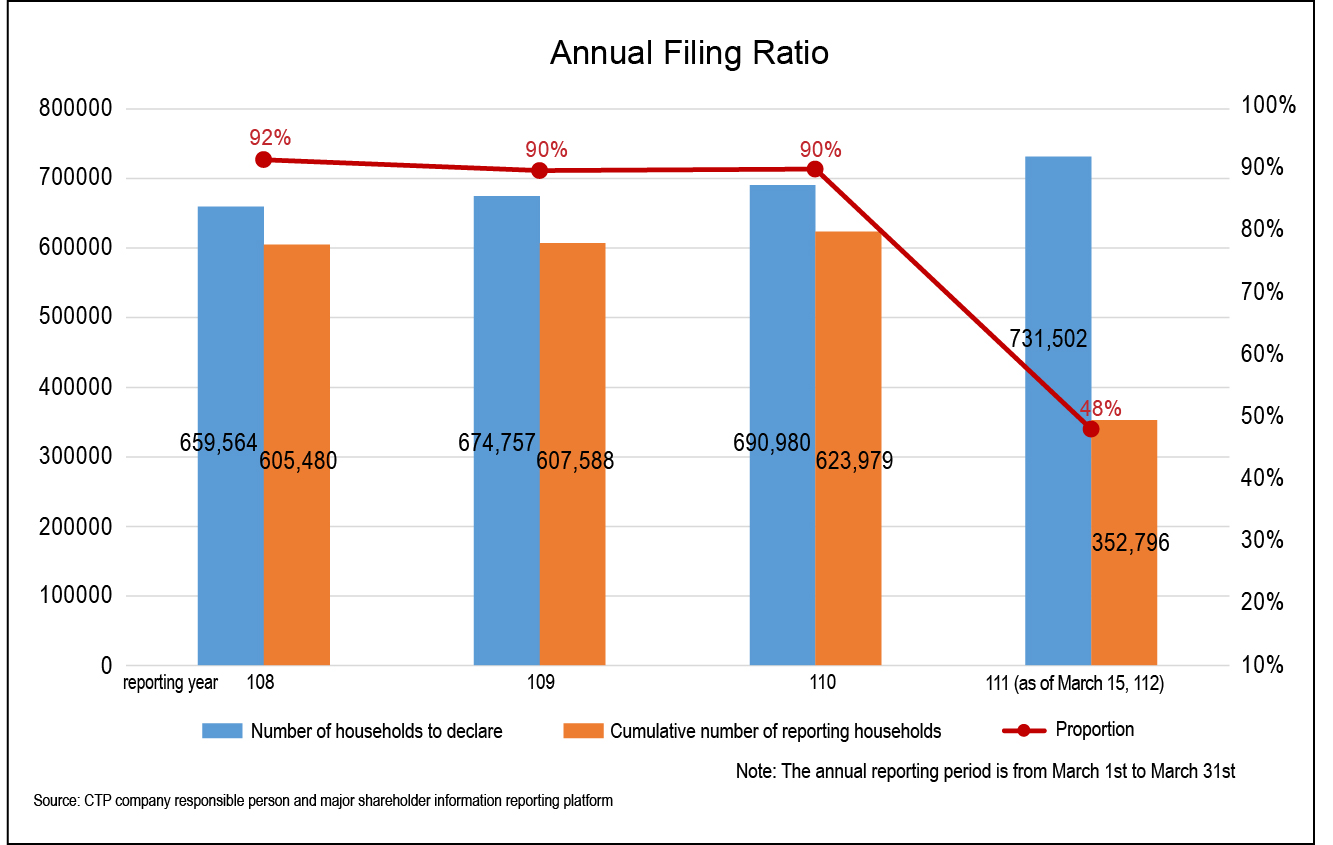

To implement anti-money laundering policies and improve corporate information transparency, our government has completed the legislation for Article 22-1 of the Company Act within a very short period and designated TDCC to establish the only one platform in the Asia-Pacific region that allows users to inquire about ultimate beneficial owners online. This has earned Taiwan a “regular follow-up” rating in the 2019 APG. The CTP platform has received high praise from many countries, and Taiwan has been invited to many countries to share the rating experience. By the end of February 2023, the number of CTP platform user codes had reached 3,600, and the number of inquiries had reached over 520,000 (Figure 2). It provides inquiry services for 29 types of financial institutions and non-financial businesses or personnel, assisting them in conducting customer due diligence and identifying ultimate beneficial owners.

Recently, Dr. Gordon Hook, the Secretary-General of APG, was invited by the AMLD, Ministry of Justice Investigation Bureau, to a seminar in Taiwan. There was a special visit to TDCC to learn about the CTP platform’s contributions to promoting anti-money laundering and improving information transparency. Dr. Gordon Hook expressed his recognition for the CTP platform’s construction and operation. TDCC, the essential back office in the capital market, will respond to market development to stabilize financial order and elevate financial flow transparency. The company will actively comply with the national anti-money laundering policies to realize the goal of “financial flow transparency, worldwide recognition.”

Figure 1: Annual declaration ratio

Figure 2: Number of inquiries per year