TDCC, the back office of the capital market, has been assisting the market in promoting innovative digital development. In recent years, the company has also been actively promoting 4e’s services for stock affairs, one of which is the digitalization of shareholder meeting souvenirs (“e-Gift”) service. In the past, shareholders had to spend time and money on the commute and souvenir collection during the shareholder meeting season. Companies also consumed a significant amount of labor and resources. Therefore, TDCC is considering launching the e-Gift service, which digitalizes shareholder souvenirs to reduce costs for both shareholders and companies. Also, this initiative implements ESG actions to reduce carbon emissions. TDCC has looked to related systems of neighboring countries as guidance for implementation.

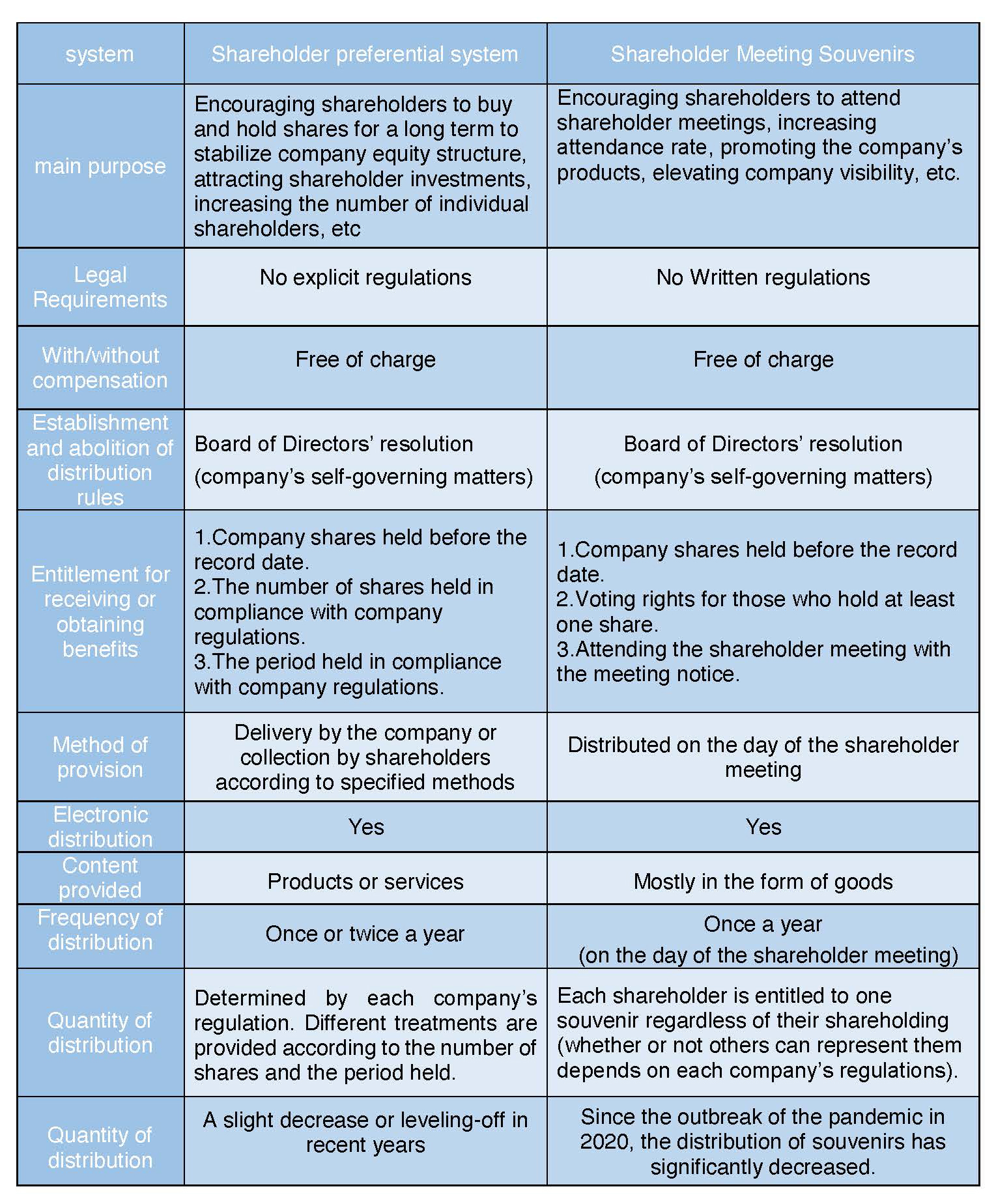

In Asia, Japan is comparatively similar to Taiwan in the capital market structure. In addition to being geographically closer to Taiwan, Japan has a significant historical background and shares many similarities and inheritances in terms of legal systems. On the other hand, from the observation of shareholder composition structure in Japan’s capital market, corporate shareholders and institutional investors are the major capital providers. However, due to the prosperity of its capital market, the number of stock exchanges is also considerable. Currently, there are 3,831 companies listed on the Japanese stock exchange groups (including groups where the Tokyo Stock Exchange and the Osaka Exchange are), so there must be a certain number of individual shareholders, commonly referred to as retail investors. In terms of the practical operation of Japan’s securities market, in addition to distributing dividends to shareholders through shareholder meetings resolutions, Japanese listed companies also offer two types of shareholder benefits. The first is the shareholder benefit system: companies provide shareholders who meet specific qualifications with physical items, coupons, stored-value cards, vouchers, admission tickets, and other products or services to reward shareholders. The second is the distribution of shareholder meeting souvenirs: companies provide physical items, discounts, or other benefits for shareholders who attend the shareholder meetings to show gratitude. Although both options are quite similar in providing complimentary benefits to shareholders, there are still some differences between them.

According to statistics, the number of listed companies adopting the shareholder benefit system has increased annually since the 1990s. However, due to the opposition from institutional investors, corporate shareholders, and foreign investors, there has been a slight decline or leveling off in the trend in recent years. The main reason why companies adopt the shareholder benefit system is to establish a long-term, stable shareholding structure by providing shareholders with benefits. Meanwhile, this can also attract investments from individual investors, further promoting companies’ products and services, increasing market share, and improving reputation. For shareholders, in addition to receiving dividends annually, the shareholder benefit system also has specific economic value. It is considered one of the ways to increase their stocks’ cash dividend yield. This has led to a trend of researching various companies’ shareholder benefit systems, and some investors even rely solely on receiving shareholder benefits to cover their daily expenses.

On the other hand, regarding the distribution of shareholder meeting souvenirs, the Japanese government issued several emergency declarations due to the spread of Covid-19 in 2020, and listed companies also took strict measures to prevent infection at shareholder meetings, encouraging shareholders to exercise their voting rights in writing or electronically to avoid physical attendance. In addition, the Japanese government appealed to citizens to reduce attendance at “3Cs” places (closed spaces, crowded places, and close-contact settings). These reasons led to a sharp decline in the number of shareholders attending physical meetings. Many companies canceled the distribution of souvenirs accordingly to prevent the risk of infection due to shareholder gatherings. This phenomenon was most notable in 2021 and continued until 2022. Most companies have canceled the distribution of shareholder meeting souvenirs, and some have adopted the shareholder benefit system. Regarding the origin of the shareholder benefit system, there is still debate in the academic community in Japan. However, most believe that it can be traced back to 1899 (Meiji 32), when Tobu Railway was the first company to implement it. According to the company’s records, the company provided preferential train passes for the entire operation line for 41 shareholders holding 300 or more shares. Later, Sanyo Railway (public transportation industry) provided complimentary tickets, Teikoku Theater and Shochiku Cinema (theatrical arts industry) provided complimentary theater tickets, and Hakuraku-ya Department Store provided coupons, and so on. Other companies began to emulate and adopt the system, and the industry ranged from public transportation and railway to various areas. The reason the railway and theater industries is the birthplace of the shareholder benefit system may be due to the characteristics of these industries, which involve fixed costs (such as stations, rails, trains, and theater hardware facilities) as their major expenses. Therefore, when there are vacant seats (such as seats available on trains or in theaters), even if there is an increase in users, the overall operating costs are minimally affected. Hence, the concept of providing remaining vacant seats to reward shareholders and win their long-term support emerged.

Table: Comparison between Shareholder Benefits Program and Shareholder Meeting Souvenirs: