Optimizing Existing Services — Full Digitalization with Annual Savings of Approximately NT$2 Million

Aligned with corporate development strategies to address climate change and drive sustainable transformation through ESG practices, TDCC continues to optimize existing operations and promote low-carbon services. There are 22 district courts under the Judicial Yuan handling civil enforcement cases, which require inquiries into debtors’ TDCC-related information through a dedicated line for an electronic inquiry mechanism established by the Judicial Yuan and TDCC. Prior to February 5, 2025, although the dedicated line for the electronic inquiry process had already significantly reduced the exchange of paper documents and administrative approval procedures, manual intervention was still required. This included printing and mailing paper payment notices by registered mail to creditors for the collection of inquiry fees. After creditors completed payment, invoices also had to be printed and mailed to them. Each year, approximately 120,000 payment notices and invoices were sent, incurring related costs of around NT$2 million.

Balancing Stakeholder Interests: Streamlining Payment and Invoice Issuance Processes to One Day

This optimization project targets the above-mentioned procedures for issuing payment notices and invoices by transitioning to online payment and electronic invoicing. Under the new model, creditors input the required information and complete payment through the TDCC website, and electronic invoices are sent to designated email addresses. In addition to effectively reducing paper use and postage costs, this approach accelerates the execution efficiency of district courts, reduces labor-intensive operations, and achieves the objective of fully digitalizing the Judicial Yuan’s dedicated-line electronic inquiry services.

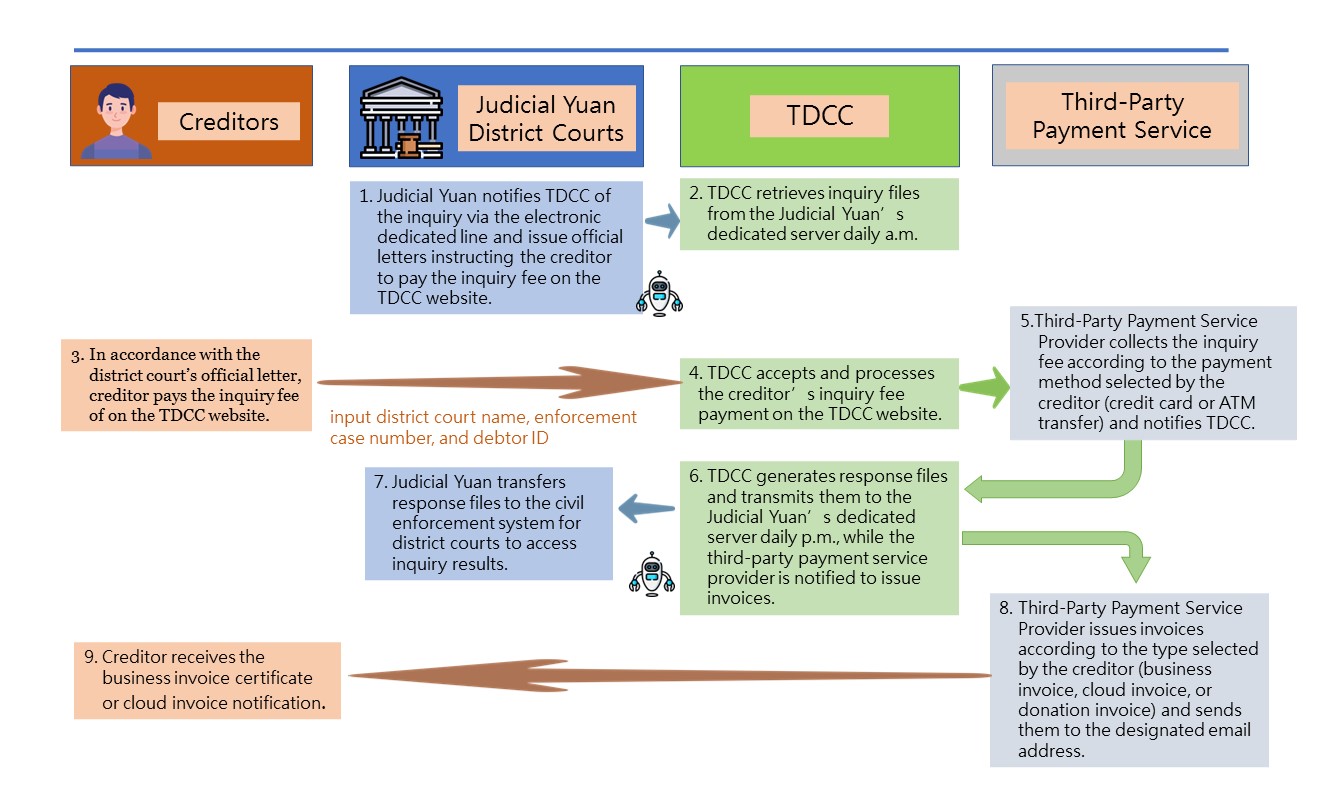

Optimized process description:

- Judicial Yuan notifies TDCC of the inquiry via the electronic dedicated line and issue official letters instructing the creditor to pay the inquiry fee on the TDCC website.

- TDCC retrieves inquiry files from the Judicial Yuan’s dedicated server daily at a.m.

- In accordance with the district court’s official letter, creditor pays the inquiry fee of on the TDCC website (input district court name, enforcement case number, and debtor ID)

- TDCC accepts and processes the creditor’s inquiry fee payment on the TDCC website.

- Third-Party Payment Service Provider collects the inquiry fee according to the payment method selected by the creditor (credit card or ATM transfer) and notifies TDCC.

- TDCC generates response files and transmits them to the Judicial Yuan’s dedicated server daily at p.m., while the third-party payment service provider is notified to issue invoices.

- Judicial Yuan transfers response files to the civil enforcement system for district courts to access inquiry results.

- Third-Party Payment Service Provider issues invoices according to the type selected by the creditor (business invoice, cloud invoice, or donation invoice) and sends them to the designated email address.

- Creditor receives the business invoice certificate or cloud invoice notification.

Review Existing Processes and Propose Five Process Improvements

- The key adjustments are as follows:The Judicial Yuan notifies TDCC of inquiry requests via the electronic dedicated line and issues official letters instructing creditors to pay inquiry fees through the official website.

- Upon receipt of the district court civil enforcement notice, creditors enter the court name, enforcement case number, and debtor ID number on the TDCC website, select a payment method, with a credit card or ATM transfer, and choose the invoice type (business invoice, cloud invoice, or donation invoice).

- TDCC receives the payment information entered by creditors on its website each business day and notifies the third-party payment service provider to process the collection. After payment is completed, the third-party payment service provider notifies TDCC to complete account reconciliation.

- The third-party payment service provider issues invoices according to the invoice type selected by the creditor (business invoice, cloud invoice, or donation invoice) and emails them to the creditor’s designated email address.

- For creditors unable to complete payment online, creditors may notify TDCC to issue a physical "Payment Notice" for payment processing.

Post-Optimization Benefits: Reduced Costs and Improved Efficiency

Through the optimized process described above, TDCC has achieved the following benefits:

- Decrease in paper consumption, with an estimated annual reduction of approximately 120,000 sheets.

- Savings in printing and postage costs amount to approximately NT$2 million per year.

- Reduction of manual operational bottlenecks, shortening creditor waiting time by enabling faster receipt of payment notices and electronic invoices, thereby accelerating the efficiency of civil enforcement by district court .

- Improved workforce efficiency by reducing paper printing, pressure sealer operation, registered mail handling, and communications with creditors related to invoice corrections. This allows flexible workforce allocation and greater focus on higher value-added tasks.

- Accumulated experience in collaboration with the Judicial Yuan and expanded the scope of electronic dedicated-line inquiry applications. Ongoing evaluations are being conducted on the feasibility of fully digitalized processes for consumer debt rehabilitation and administrative litigation cases. Going forward, TDCC will continue to optimize its existing operations, including evaluating whether additional Judicial Yuan inquiry cases can be incorporated into the electronic dedicated-line inquiry framework to enhance operational efficiency further. In addition, in alignment with corporate policies, TDCC remains committed to realizing its vision of enhancing the financial asset depository platform, leading digital innovation in financial services and promoting the sustainable development of financial markets.