Every year, a small number of TWSE-listed, TPEX-listed, and emerging stock companies attract individuals interested in obtaining board seats through proxy solicitation due to long-term low shareholding by the corporate management, substantial assets owned by the companies, or unique market technologies. In 2021, to prevent proxy solicitation from becoming a method for interested parties to take over companies and to correct the social perception that proxies assist the market factions in gaining corporate control, the Financial Supervisory Commission (FSC) considered revising the Regulations Governing the Use of Proxies for Attendance at Shareholder Meetings of Public Companies and mandated TDCC to propose relevant suggestions. TDCC, committed to assisting the FSC in maintaining financial order, commissioned experts and scholars to study practices in the US, Japan, Singapore, and Hong Kong for amendment recommendations. The company also actively reviewed related issues during the regulatory amendment process. Besides, TDCC held multiple symposiums with industry practitioners before and after the regulatory announcement to discuss the amendment content and listen to practitioners’ opinions. This aimed to strengthen the management of proxy solicitation operations and align it with practical operations. The FSC amended the proxy rules again on August 17, 2022, aiming to maintain the proxy solicitation order in the securities market and eliminate chaotic practices by strengthening proxy solicitation management.

In practice, to intervene and lead the shareholder meeting deliberations and obtain a majority of board seats, one must not only increase company shareholding but often also entrust agents with venues across Taiwan (such as the three major channel operators, Chuan Tung Shareholder Service Co., Ltd, Chang Lung Meeting Consultancy Co., Ltd., and Lien Cheng Conference Consulting Co., Ltd) to solicit proxies from shareholders. Solicitation and the remuneration for handling used to be agreed upon by both parties without disclosure. This practice could be criticized by the market if it is not for normal consideration. Therefore, to strengthen the rationality of contract formation related to solicitation affairs, the newly published amendment to the proxy rules in 2022 added Article 7-3. For the first time, it is specified in regulations that those entrusted by shareholders to solicit or by solicitors to handle solicitation affairs must stipulate remuneration in contracts, conduct the proper Know Your Customer procedure, and renew contracts annually. Considering the operation time that practitioners need to comply with the regulatory changes, this amendment provided a transition period effective from January 1, 2023. The primary purpose of adding Article 7-3 is first to prevent appointing shareholders or solicitors from using remuneration deviating from market labor costs to appoint solicitors or agents to solicit proxies. Therefore, they are required to disclose remuneration information, calculations, and payment methods. Second, this prevents solicitors and soliciting services agents from signing excessively long contracts and raising concerns over long-term binding or monopolies.

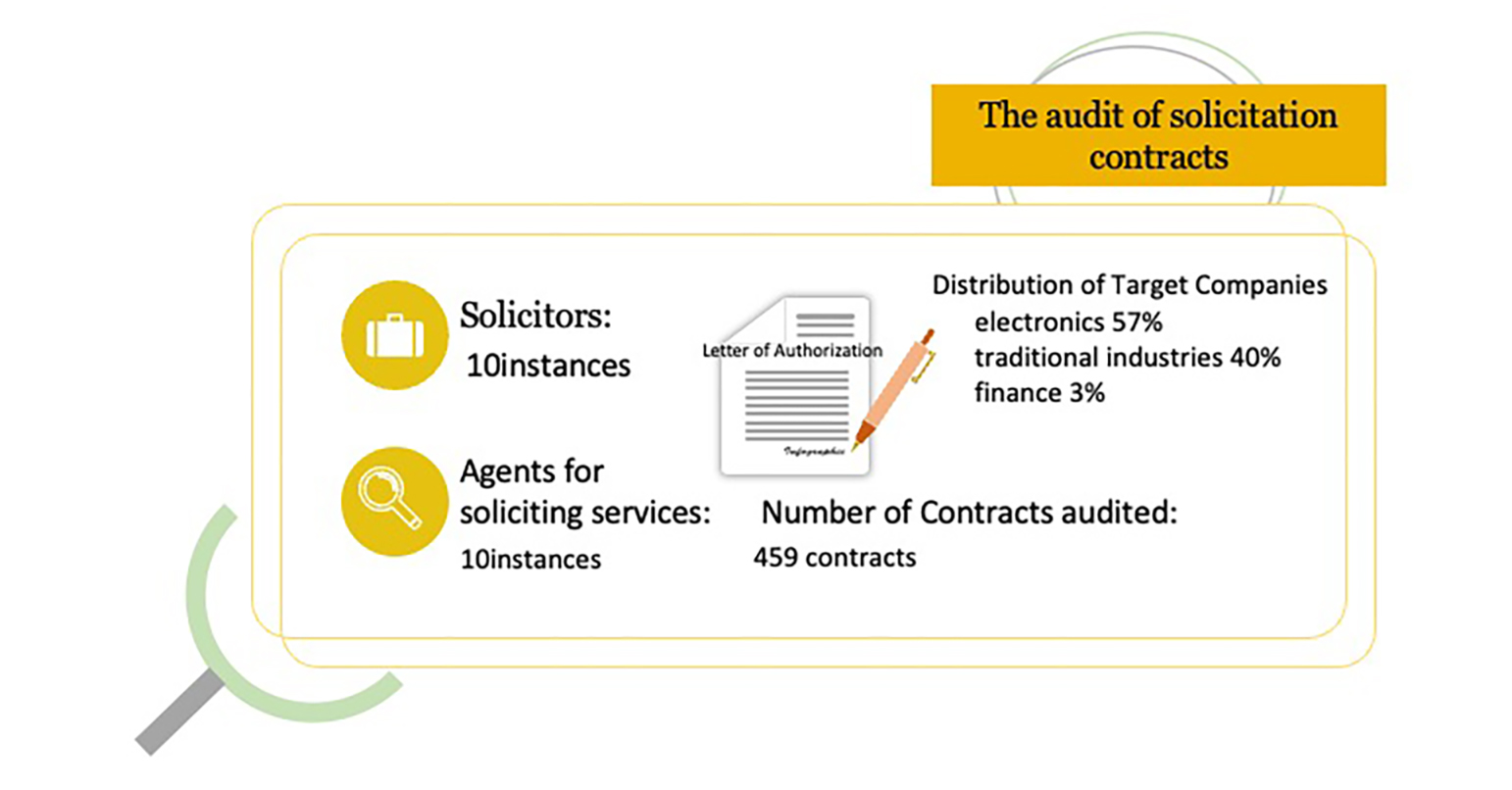

In line with this amendment to the proxy rules, TDCC, instructed by the FSC, included the audit of solicitation contracts in the annual audit plan. This year, for the first time, TDCC conducted contract audit operations, examining a total of 20 instances of solicitors and agents for soliciting services, with 459 contracts audited. The sampled contracts covering industry categories of the target companies were electronics at 57%, traditional industries at 40%, and finance at 3% (as shown in the attached figure). The audit results all complied with regulations, and no anomalies were found. To perfect the audit operations, TDCC held a post-audit symposium to cross-analyze and review the audit situation, process, and results. TDCC expects to urge solicitors to implement legal compliance and strengthen internal control systems by executing audit operations. Under the guidance of the FSC, through enhancing the rationality of solicitation contract formation and regulatory information as well as considering practical operations, this project can protect investors’ rights and shape a high-quality corporate operation environment. Therefore, the order of the proxy solicitation system in Taiwan’s securities market can be maintained, and the vision of assisting the FSC in market supervision can be achieved.