The first and second parts of this series discuss the origin, purpose, distribution methods, eligibility, and adoption practices of Japan’s shareholder benefit system. This concluding article will delve into the current state of shareholder meeting souvenirs.

Compared to the shareholder benefit system introduced in the earlier parts, another method to directly provide shareholders with privileges is distributing shareholder meeting souvenirs. The distribution of the souvenirs means that companies offer free goods or services to shareholders present at the shareholder meetings (or to those who exercise voting rights through written votes, electronic voting, or by proxy, depending on the company’s regulations). The primary distinction is that the shareholder benefit system emphasizes criteria such as “the number of shares held” and the “duration of shareholding;” the souvenirs are directly mailed by the company to shareholders. Whether or not a souvenir is given during the shareholder meeting, just like regulated in the shareholder benefit system, the gift is a complimentary provision to shareholders. It can typically be determined by the company’s board of directors, and it’s not generally considered a right of the shareholders. Thus, even if a company decides to cease the distribution, it is challenging for shareholders to seek compensation or make other claims against the company.

Objectives of Distributing Shareholder Meeting Souvenirs

Encouraging Shareholder Participation

By distributing souvenirs, companies can motivate shareholders to actively attend shareholder meetings, which can increase the attendance rate at these meetings. On the one hand, it prevents meetings from being adjourned and resolutions from being dropped due to lack of quorum. On the other hand, through media coverage, the system displays a positive relationship between the company and its shareholders, which aids in enhancing the company’s image. Especially with the rise in retail investors in recent years, the souvenirs companies provide have become one of the most anticipated annual events for investors.

Promoting the Company’s Own Products or Services

Shareholder meetings serve as an excellent means of promotion. Companies can present operations and prospects to shareholders and have the opportunity to market their products. Giving away shareholder meeting souvenirs allows shareholders to taste or use the company’s products and deepens their understanding of the products. This can further expand the market and the company’s market share. Some companies even distribute luxurious souvenirs, prompting shareholders to check in and upload the photos on social media platforms. This significant viral impact cannot be ignored.

Methods of Distributing Shareholder Meeting Souvenirs

On-site Distribution

Shareholder meeting souvenirs are primarily aimed at encouraging shareholders to attend in person. Consequently, the most straightforward option for distribution is the meeting venue. The timing for handing out these souvenirs can be roughly categorized into “upon check-in” and “after the meeting.” Both methods are adopted by different companies. There are no regulations governing this aspect, so companies are generally free to decide on the best approach.

Mailing Distribution

While the majority of companies provide souvenirs only to shareholders who attend in person, some companies focus on encouraging shareholders to exercise their voting rights. For shareholders who have exercised voting rights in advance, either in writing or electronically, or for those who have appointed a proxy to attend the meeting, the companies mail the souvenirs to the shareholders’ addresses listed in the shareholder registry. However, this practice isn’t the norm. Due to the pandemic, on the one hand, some companies intended to discourage shareholders’ physical attendance to minimize the risk of infection. On the other hand, they aimed to boost shareholders’ willingness to exercise their voting rights and increase the total attending shares. As a consequence, they adopted the mailing method. Readers of this article are particularly reminded to take special note of this.

Distribution through Electronic Platforms

Owing to the COVID-19 pandemic in 2020, there was a significant acceleration in companies adopting video conferencing for their shareholder meetings. The majority of the companies transitioned to a hybrid model. The Japanese government, in 2021, amended its regulations to allow purely virtual shareholder meetings under specific conditions. Consequently, with the change in meeting formats, the distribution of souvenirs has also seen a gradual shift towards electronic modes. For instance, digital gift (デジタルギフト, also known as eGift) distribution platforms were developed in practice. Companies contract with eGift platform providers and proceed with the distribution of digital gifts based on the regulations established by the companies (such as including shareholders who logged in to watch the shareholder meeting).

Regulation Establishment and Eligibility Criteria

The process for collecting shareholder meeting souvenirs is similar to that in the shareholder benefit system. Shareholders must meet specific criteria to qualify. There are three main criteria below:

Shareholder Status on the Record Date

As stated in the shareholder benefit system, one must be a shareholder by the record date to receive the shareholder meeting souvenir. The record date is determined by the corporate law. A company must set a settlement month in its articles of incorporation; in the settlement month, the company shall establish a record date (also known as the settlement date). Shareholders must purchase stocks no later than two business days before the record date (the final purchase date) to be listed in the shareholder registry and thus be eligible for shareholder benefits. The settlement month is at the company’s discretion; while many companies set March as their fiscal month, some companies, depending on their business types and models, set February, September, December, or others as their settlement month. Shareholders shall be responsible for confirming the settlement month set by the company they invest in.

Shareholders with Voting Rights (holding at least one unit of required shares)

The second condition is that shareholders must have voting rights at the shareholder meeting, which means they are allowed to participate in various resolutions. Notably, as stated in the shareholder benefit system, the prerequisite of the voting rights is that the shareholder must hold a certain number of shares to reach the “unit shares” specified by the company’s articles. Most listed companies specify in their articles that every 100 shares equate to 1 voting right. Therefore, shareholders with less than 100 shares do not have voting rights and cannot attend the shareholder meeting. In other words, meeting notices will only be sent to shareholders with at least one voting right.

Attending the Shareholder Meeting with a Meeting Notice (or exercising voting rights in another manner):

According to Japanese corporate law, the meeting notice should be mailed at least two weeks before the shareholder meeting takes place. In practice, about two weeks before the meeting, the meeting notice (including materials such as voting ballots for exercising voting rights in writing and a meeting agenda handbook) is sent to the address listed in the shareholder registry. Shareholders must register with this notice in person on the day of meeting to receive the meeting souvenir.

In addition, a few companies allow shareholders to exercise their voting rights through paper or electronically, and then shareholders can still qualify for the souvenirs. The company mails the souvenir to the shareholder’s address after the meeting. However, this is not common practice, and most companies only give souvenirs to shareholders who attend the meeting in person.

No official statistics are available regarding the distribution of shareholder meeting souvenirs in Japan. This article refers to a survey from a civil association “National Shareholder Discussion Union” (referred to as “National Shareholder Discussion”). Every year, the association conducts a questionnaire survey on its members about shareholder service practices, and the results are released to the public approximately in October of the same year. There are over a hundred survey items, one of which pertains to “Shareholder Relations,” including whether souvenirs are distributed, the amount and number of distributions, product types, distribution timing, whether a dedicated place is set for souvenir collection at the venue, and whether souvenirs can be collected by a shareholder’s representative. Although the members of the National Shareholder Discussion do not encompass all listed companies (over 3,800 companies), its membership of over 2,000 companies (most of which are listed companies, with a few being unlisted) still has a significant level of representativeness. It also serves as the formal statistical source for the number of souvenirs distributed. Hence, this article is based on the survey results of the National Shareholder Discussion to introduce the practice of souvenir distribution in Japan.

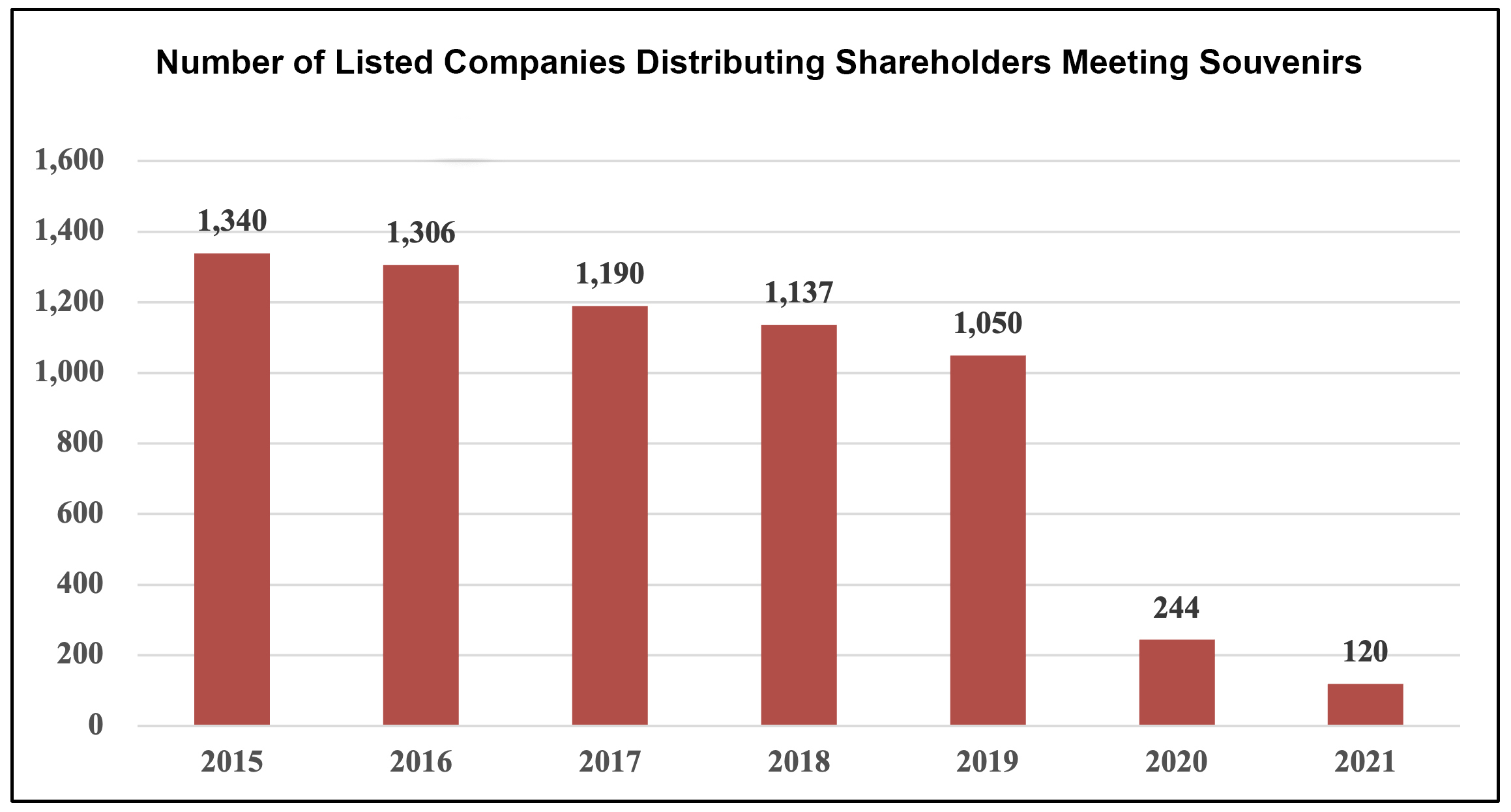

The following graph is created based on the data collected from the National Shareholder Discussion’s annual reports. The graph shows the number of companies distributing souvenirs decreased annually from 2015, with a sharp drop between 2019 and 2020. This could be due to concerns over crowd infections resulting from shareholders’ physical attendance, opposition from institutional and corporate shareholders, the inability of overseas shareholders to claim souvenirs, and calls for a unified dividend (that is, returning to distributing cash dividends only instead of distributing souvenirs or implementing the Shareholder Benefit System). This has led companies to take advantage of the pandemic and discontinue the souvenir distribution, with only a few companies still maintaining this “tradition.”

(Created by the author, data sourced from the “National Shareholder Discussion” survey results from 2015 to 2021. Link: [https://www.kabukon.tokyo/data/data/research/research_2021.pdf].)

(Created by the author, data sourced from the “National Shareholder Discussion” survey results from 2015 to 2021. Link: [https://www.kabukon.tokyo/data/data/research/research_2021.pdf].)

Besides, regarding the price range of souvenirs in the National Shareholder Discussion’s survey from 2019 to 2021, responses of listed companies to the survey on the types and market price range of souvenirs showed that most companies, regardless of whether souvenirs were their own products or came from other manufacturers, priced their souvenirs mostly under 2,000 yen. (There were 91 companies in 2021, accounting for 75.83%; 205 companies in 2020, making up 84.01%; and 897 companies in 2019, representing 85.42%). The data suggests that the typical “market” price for shareholder meeting gifts tended to fall within this range. When it comes to distributing companies’ own products or those from other manufacturers, the ratios roughly remained the same (In 2021, there were 39 companies distributing their own products, making up 32.5%; 81 companies did so in 2020, accounting for 33.19%; and 333 companies in 2019, representing 31.71%). While the survey did not directly concern the industries of the distributing companies and a joint observation could not be conducted, based on previous distribution patterns, companies in industries such as food, daily necessities, and public transportation tended to give out their own products. Other sectors, due to the nature of their products or services, might have difficulties distributing them to shareholders. Therefore, the companies purchased products from other manufacturers as shareholder meeting souvenirs.

This series of three articles briefly introduces the origin and current status of the Japanese shareholder benefit system and the shareholder meeting souvenir system. Hopefully, it can be a reference for readers interested in understanding these two systems. Most TWSE-listed, TPEX-listed, and emerging stock companies in Taiwan still distribute shareholder meeting souvenirs on a major basis, but in recent years, a small number of companies have begun to introduce the shareholder benefit system; perhaps they can draw inspiration from the long-standing Japanese model (End of series).