I. Introduction

Video shareholders’ meetings have been practiced in advanced countries for many years. Although Taiwan’s Company Law adopted this system during its amendment in 2015, it seemed that there had not been any companies utilizing it until 2021, when the outbreak of COVID-19 caused serious local cluster infections. Despite the large number of shareholders in public companies, which should theoretically indicate the higher demand for video shareholders’ meetings, relevant technical concerns in Taiwan had led to the prohibition of shareholders’ meetings by law.

The Asian Corporate Governance Association (ACGA) had suggested that Taiwan consider following other countries’ practices in adopting the video shareholder’s meeting system in response to the digital age. This would provide shareholders with diverse choices for participating in shareholders’ meetings, implementing shareholder activism, and even helping improve corporate governance. It might also have been possible that legislators and decision-makers had already created a blueprint for the video shareholder’s meeting system before the pandemic outbreak.

The development of video shareholders’ meetings can be divided into two stages so far. The video-assisted shareholders’ meeting launched in July 2021 was an emergency response to disease prevention, and TDCC established the Video-Assisted Shareholder Meeting Platform, known as eMeeting 1.0. The Shareholder Virtual Meeting Platform, launched on April 1st, 2022, was built under a complete and formal legal framework and is referred to as Video Shareholders’ Meetings (eMeeting 2.0). This article will follow this context and introduce the development of the video shareholders’ meeting system.

II. Background of the Video Shareholders’ Meeting System

Shareholders’ meetings are the highest decision-making unit of companies limited by shares. The selection of members for important corporate bodies such as the execution unit Board of Directors, the supervision unit Supervisory Board, as well as significant decisions such as amendments to the articles, capital reduction, capital increase through retained earnings, capital increase through surplus, dissolution, merger, division, or business transfer, all of which are involved in fundamental corporate laws, capital changes, the continuity of the company, or significant organizational changes, must be resolved by shareholders’ meetings. Therefore, companies are obliged to make it convenient for shareholders to exercise their rights to participate in shareholder meetings. Over the past decade, in addition to conventional physical attendance or proxy representation, there has been the addition of written or electronic methods for exercising voting rights (electronic voting) and the use of video conferences for attending shareholders’ meetings. The various channels for shareholders’ meeting participation have been implemented to uphold the spirit of corporate governance in shareholder activism.

As for the regulations on video shareholders’ meetings, they first appeared in close companies. Company Law was amended in July 2015 for the addition of a special chapter for close companies, and Article 356-8(1) explicitly states: “A close company may explicitly provide in its Articles of Incorporation that its shareholders’ meeting can be held by means of visual communication network or other methods promulgated by the central competent authority.” In addition, the August 2018 amendment added Article 172-2, stating that shareholders’ meetings of companies limited by shares may also be proceeded via a visual communication network, but not applicable to public companies. The legislative rationale was that “Given the large number of shareholders in public companies, concerns related to shareholder identification, handling of video conference disruptions, and feasibility of synchronized vote counting technology, implementation remains challenging. Therefore, these provisions do not apply to public companies.”

In mid-2021, due to the severity of the COVID-19 pandemic, the Financial Supervisory Commission (FSC) announced on June 29th that from August 16th to August 31st, 2021, public companies meeting certain conditions could hold their physical annual general shareholder meetings with video assistance (video-assisted shareholder meetings). On August 17th, Ta Ching Securities, Mitake Information Corporation, and Oriental Securities first held the shareholders’ meetings via video conference, which initiated a new era for public companies to hold shareholders’ meetings via video conference.

III. Formation of video shareholders’ meetings accelerated by the pandemic

1.The implementation of video shareholders’ meetings resulting from the pandemic

The COVID-19 pandemic was initially under proper control in Taiwan. As required by regulations, public companies, which had a large number of shareholders, were to hold their annual general shareholders’ meetings by the end of June each year, and these meetings had been scheduled accordingly. However, in May 2021, the pandemic suddenly worsened, raising the alert level to Level 3. To contain local community transmission, the Central Epidemic Command Center (CECC) adopted a Zero-Covid policy, banning indoor gatherings of more than five people and outdoor gatherings of more than ten people, making it extremely difficult for public companies to convene shareholders’ meetings.

In response to adjustments in pandemic prevention policies, the FSC announced Measures for Public Companies to Postpone Shareholders’ Meetings for Pandemic Prevention on May 20th, stating that shareholders’ meetings of public companies would be suspended from May 24th to June 30th, 2021. The FSC also mandated TDCC, whose digital business development had reached maturity for years, to evaluate the feasibility of improvising a video conference platform. Drawing on years of experience in organizing the electronic voting platform, TDCC collaborated with Lumi, a British company with extensive experience in assisting companies worldwide in organizing video shareholders’ meetings. TDCC assessed that it could combine its existing electronic voting platform with Lumi’s livestream platform to construct a video conference platform with livestream and voting functions in a very short time.

On June 29th, the FSC announced amendments to the Measures for Public Companies to Postpone Shareholders’ Meetings for Pandemic Prevention, specifying that the postponed shareholders’ meetings should be held from July 1st to August 31st, 2021. Additionally, to reduce the number of shareholders attending the annual general meetings in person, companies were allowed to hold physical shareholders’ meetings with video assistance. However, due to system development time constraints, video assistance was only applicable to companies holding their annual general meetings between August 16th and August 31st, 2021. Also, shareholders could participate in video shareholders’ meetings only if they agreed to waive their rights to propose and exercise temporary motions, vote on original proposal amendments, and participate in physical shareholders’ meetings.

- TDCC Establishes Video-Assisted Shareholders’ Meeting Platform

In accordance with the FSC’s emergency response to the pandemic, TDCC spared no effort and managed to offer assistance in system design, complete system planning, system development, and market testing in less than two months, finally establishing the Video-Assisted Shareholders’ Meeting Platform. Between August 16th and 31st, a total of 17 TWSE -listed Companies, TPEx-listed companies, OTC-listed companies, and public companies applied to use the platform, marking the inception of video shareholders’ meetings in Taiwan.

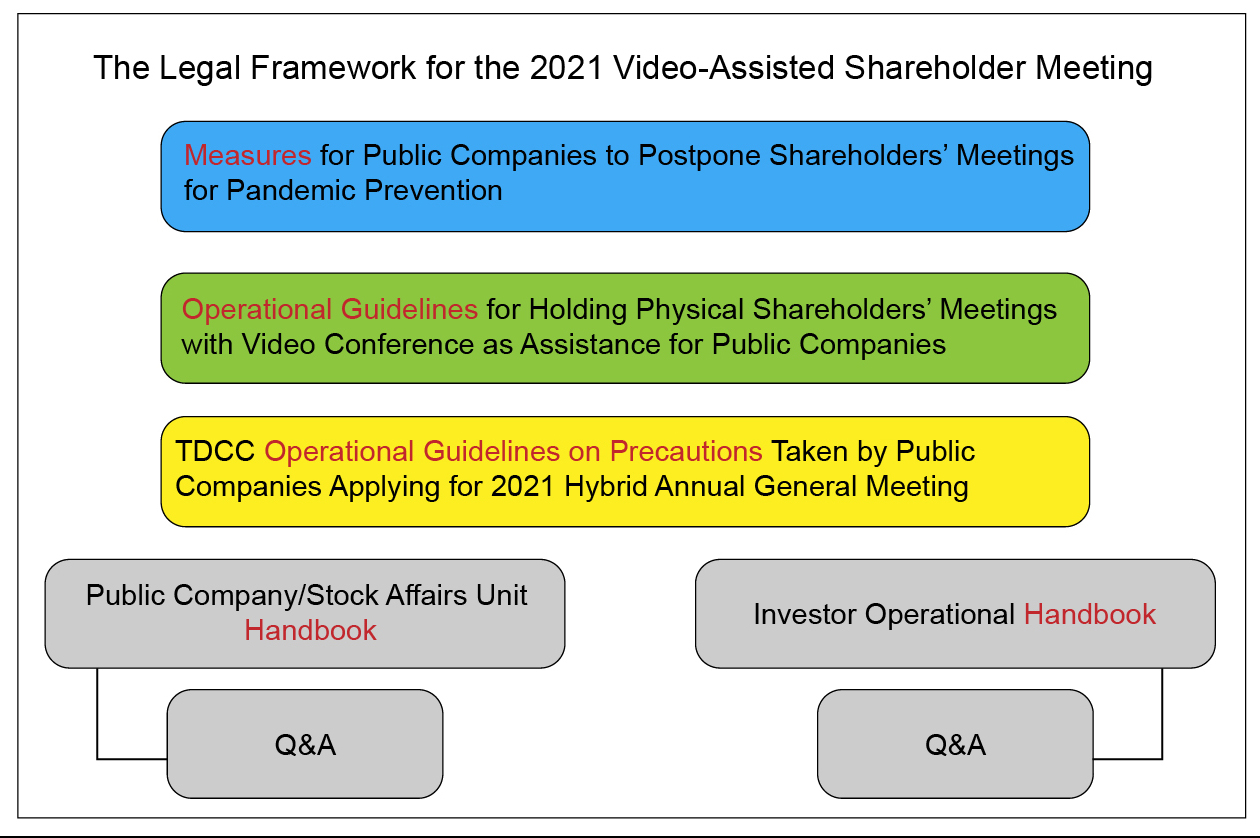

- Legal Framework under the Special Act

(I) Authorization Basis of the Special Act

According to Article 172-2, Paragraph 3 of the Company Act, public companies are not allowed to hold video shareholders’ meetings. However, due to the severity of COVID-19, a special act was implemented to address relevant pandemic prevention matters for shareholders’ meetings.

- Special Act for Prevention, Relief, and Revitalization Measures for Severe Pneumonia with Novel Pathogens

In response to the severe pandemic, the Legislative Yuan stipulated the Special Act for Prevention, Relief and Revitalization Measures for Severe Pneumonia with Novel Pathogens as a special act for the pandemic. Article 7 of the Act states, “The Commander of the Central Epidemic Command Center may, for disease prevention and control requirements, implement necessary response actions or measures.”

- Communicable Disease Control Act According to Article 37, Paragraph 1, Subparagraph 6 of the Communicable Disease Control Act, “When communicable diseases occur or are expected to occur, local competent authorities shall, by considering actual needs, take the following measures in collaboration with organizations (institutions) concerned: 6. other disease control measures announced by government organizations at various levels.” The same article, paragraph 3 states, “Measures mentioned in Paragraph 1 that shall be taken by local competent authorities shall be implemented during the period when the central epidemic command center is in existence in accordance with instructions of its commander.”

(II) Measures for Public Companies to Postpone Shareholders’ Meetings for Pandemic Prevention

Based on the aforementioned special act, the FSC drafted the Measures for Public Companies to Postpone Shareholders’ Meetings for Pandemic Prevention. After obtaining approval from the CECC Commander, the FSC announced the measures on June 29th (amendment to the original announcement of May 20th). Introduction to section 6 of the measures states that, from August 16th to August 31st, 2021, public companies that meet certain conditions may hold physical annual general meetings with the assistance of video conferencing.

(III) Operational guidelines for holding physical shareholders’ meetings with video assistance for public companies

According to Section 6, Paragraph 2 of the Measures for Public Companies to Postpone Shareholders’ Meetings for Pandemic Prevention, video assistance should be adopted from TDCC’s platform, and companies should comply with the guidelines for holding physical shareholder meetings with video assistance stipulated by TDCC. TDCC drafted Operational Guidelines for Holding Physical Shareholders’ Meetings with Video Assistance for Public Companies and announced its implementation on July 14th after obtaining the FSC’s approval.

(IV) Relevant Rules and Regulations stipulated by TDCC

Article 13 of Operational Guidelines for Holding Physical Shareholders’ Meetings with Video Assistance for Public Companies states, “For other shareholder meeting procedures not covered by these guidelines, follow the precautions stipulated by TDCC and the corporate rules for shareholders’ meeting procedures.” TDCC established the TDCC Operational Guidelines on Precautions Taken by Public Companies Applying for Video-Assisted 2021 Annual General Meeting to serve as the operational guidelines for companies applying for video-assisted shareholders’ meetings.

IV. Summary

From August 16th to 30th, 2021, 17 companies held video-assisted shareholders’ meetings in accordance with the Measures for Public Companies to Postpone Shareholders’ Meetings for Pandemic Prevention. These meetings were not yet formally recognized under the legal system, and shareholders’ rights to exercise their voting power were partially limited. However, the successful trial process led to the subsequent amendment of Article 172-2 of the Company Law on December 29th, 2021. Public companies were allowed to hold video shareholders’ meetings. Additionally, on March 4th, 2022, Regulations Governing the Administration of Shareholder Services of Public Companies was amended, and a dedicated chapter, Video Shareholders’ Meetings, was added; therefore, a complete legal foundation was established. (To be continued)