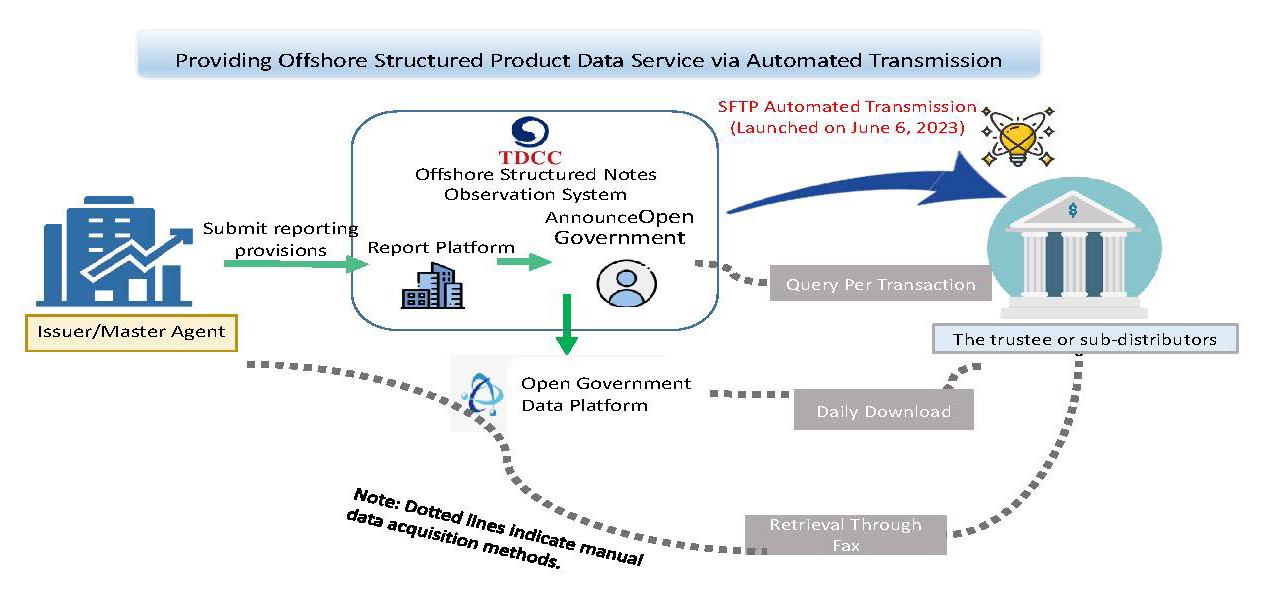

Offshore structured products are highly complex, and non-professional investors often find it challenging to fully understand their product characteristics and risks. To strengthen the transparency of overseas structured commodity markets and protect the rights and interests of investors, the Financial Supervisory Commission issued the “Regulations Governing Offshore Structured Products” on July 23, 2009. TDCC was designated to establish the “Offshore Structured Notes Observation System” and to process reporting provisions from issuers and master agents in accordance with the regulations, including the information of product, of the trustee or sub-distributors, reference prices, dividend , product prospectus/financial reports, investor brochure, attorneys’ opinion letters, important news and subscription/redemption. TDCC discloses the information in real-time on the announcement platform of Offshore Structured Notes Observation System or the Open Government Data platform, making it available for public query and as a reference for asset management.

Through sub-brokerage, wealth management, or non-discretionary money trust investments, investors can subscribe or redeem offshore structured products at the trustee or sub-distributors, such as securities firms, banks, or insurance companies. Given that there are over ten thousand of offshore structured products in circulation, the trustee or sub-distributors needed to provide investors with product information within a specific period upon request. To do so, they had to obtain information themselves from various issuers and master agents or collect information from the Offshore Structured Notes Observation System or the Open Government Data platform. Due to the different data formats presented by each channel, the trustee or sub-distributors had to employ a significant amount of workforce to organize the information before providing it to investors. Issuers and master agents also indicated they faced difficulties in meeting the data retrieval demands of the trustee or sub-distributors, leading to both parties’ inefficiencies in providing investors with real-time and comprehensive product information.

To reduce the operational costs of the trustee or sub-distributors, TDCC started to conduct interviews with market leading the trustee or sub-distributors in March 2022. Based on market research for demands, TDCC planned a service (hereinafter referred to as “the Service”) that allowed the trustee or sub-distributors to obtain related information of offshore structured products daily through SFTP automated transmission. The Service offered two data package options: Package One (including reference prices, announcement information, and market information) and Package Two (including dividend information, product information, and investor brochure). The information was provided to the trustee or sub-distributors in an automated, standardized, and encrypted submission manner to meet the needs of serving customers.

After system testing, the Service was launched on June 6, 2023. Since its launch, several the trustee or sub-distributors have applied to use it, accounting for approximately 30% of the entire market (excluding issuers and master agents that are also the trustee or sub-distributors) in terms of the number of products. Their operational efficiency has significantly improved, and they received positive feedback. Our company will continue to promote the Service and collaborate with market participants to provide more value-added services.