As the market anticipated, the U.S. Securities and Exchange Commission (SEC) officially approved the applications for 11 Bitcoin spot Exchange-Traded Funds (ETFs) submitted by companies including Blackrock, ARK Invest, and Grayscale on January 11, 2024. This move is undeniably a significant milestone for the cryptocurrency industry, officially marking the entry of Spot Bitcoin ETFs as a qualified investment tool in the capital market. While the public was still digesting this significant news, SEC Chairman Gary Gensler also issued a statement emphasizing that Bitcoin was a speculative and highly volatile asset also used for illegal activities, including ransomware, money laundering, sanctions evasion, and terrorist financing. He noted that the SEC’s approval of Spot Bitcoin ETFs did not indicate the endorsement or approval of Bitcoin and reminded investors to be aware of the risks and evaluate cautiously.

A Bitcoin spot ETF is a fund traded on an exchange and designed to track the performance of Bitcoin’s price. Unlike traditional Bitcoin investment methods, Spot Bitcoin ETFs are traded in a more convenient way for investors to buy and sell directly through stock exchanges. Just like trading stocks, investors don’t need to create a virtual asset wallet or deal with private keys, which significantly simplifies the process of participating in the Bitcoin market.

Before the approval of Spot Bitcoin ETFs, the most common method for investors intending to trade Bitcoin was to select a cryptocurrency exchange (such as Binance or Coinbase), open an account, and trade after depositing fiat or virtual currency. The purchased virtual currency was kept by the exchange. However, this method carried risks; investors could lose everything if the exchange collapsed or was hacked. On the other hand, keeping virtual currency in a private wallet could avoid exchange-related risks. However, investors needed to safeguard their wallet’s private keys personally, so there were concerns about loss or theft. Additionally, due to the complexity of operations, this kind of investment was not easily adopted by the general public. In contrast, the launch of Spot Bitcoin ETFs allows investors to participate in the market without directly owning physical Bitcoin and to avoid the potential risks associated with trading through exchanges or self-custody.

After the approval of Spot Bitcoin ETFs, issuers provide a dual structure of primary and secondary markets. In the primary market, investors can purchase Spot Bitcoin ETFs, and the subscription funds are used to buy actual Bitcoin, which is stored at specialized custodians (such as Coinbase or Bitgo). In the secondary market, whether professional investment institutions or general investors can directly buy and sell Bitcoin ETFs through stock exchanges, lowering the barrier to entering the virtual currency market.

In fact, before the approval of Spot Bitcoin ETFs in the U.S., financial products using Bitcoin as an investment target had already existed in the market. Among them, the Grayscale Bitcoin Trust (GBTC) fund issued by Grayscale Investments was the most well-known and largest in terms of asset management scale. Its operation started with investors purchasing GBTC funds, and Grayscale used the subscription funds to buy actual Bitcoin. The actual Bitcoin served as collateral for the fund, and the GBTC fund could be listed on the exchange. Investors could indirectly own the collateralized Bitcoin by purchasing and holding the GBTC fund. Thus, GBTC’s price should have theoretically been linked to the actual price of Bitcoin. The launch of GBTC provided a convenient path for investors who intended to invest in the Bitcoin market but were unwilling or unable to purchase and place Bitcoin in custody directly. Investors could buy GBTC funds through stock exchanges without dealing with the trading and custody issues of virtual assets. However, GBTC carried some drawbacks. As the fund was traded on the over-the-counter (OTC) market, its price was potentially subject to premiums or discounts, so the net value of actual Bitcoin could not entirely be reflected. There were other downsides, such as high custody fees, relatively lower share liquidity, net value not being disclosed in real-time, and investors’ reliance on reports provided by Grayscale.

It's worth mentioning that although the Toronto Stock Exchange in Canada listed BTCC in February 2021, which was the first Bitcoin spot ETF in North America, it did not receive widespread attention because it was not traded on a U.S. exchange. The New York Stock Exchange also listed the BITO Bitcoin futures ETF in October 2021. However, because the fee rates were too high and price tracking was not real-time, it did not meet market demands. Therefore, the market’s hopes remained for the issuance of Spot Bitcoin ETFs in the U.S. securities trading market.

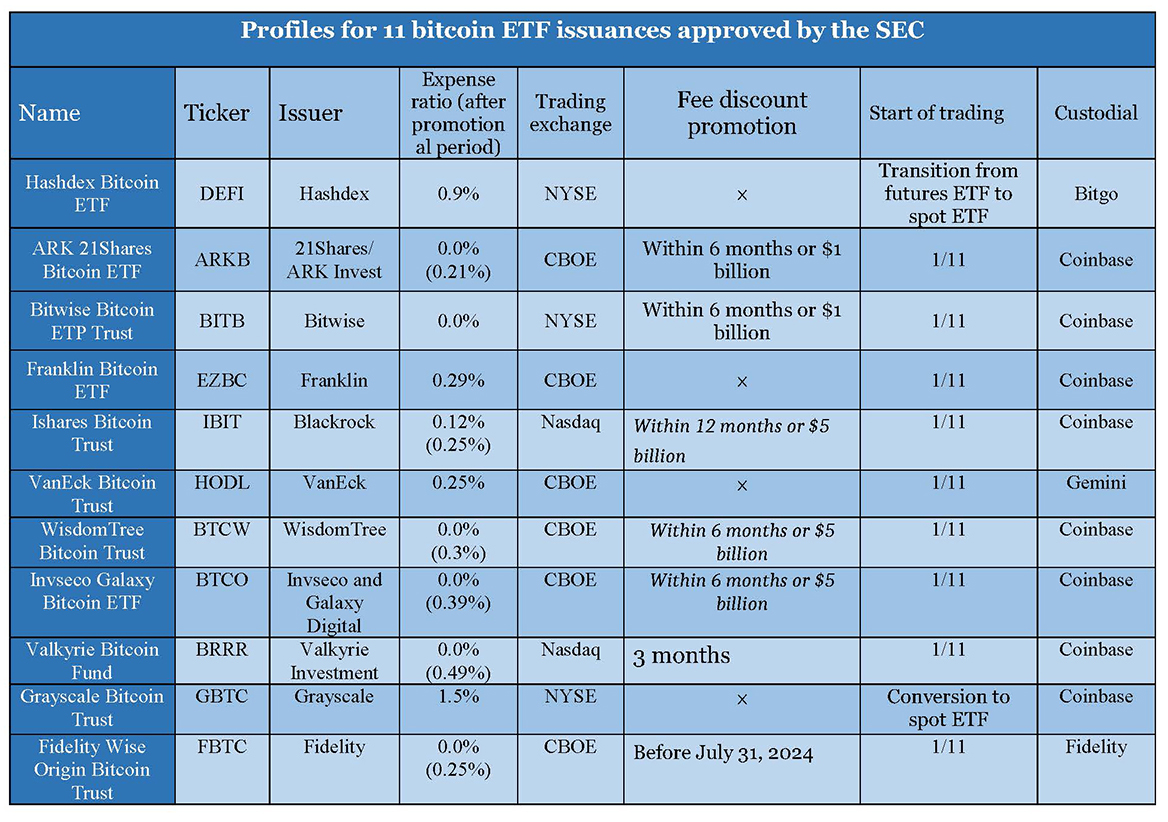

The 11 Spot Bitcoin ETFs approved this time have expense ratios ranging between 0.21% and 1.5%, which are slightly higher compared to other ETFs tracking U.S. stocks. Therefore, to encourage active participation from investors, most ETFs offer fee waivers or discounts for a certain period or scale. Additionally, they all share the common feature of cash creation and redemption, meaning transactions are carried out in cash for subscription or redemption. Investors do not actually receive Bitcoin when applying for redemption from the issuer; instead, the issuer sells the Bitcoin and returns an equivalent value of cash to the investor. Although issuers like BlackRock had initially planned to adopt physical creation and redemption, they ultimately reverted to cash creation and redemption.

Market speculation suggests several reasons for the SEC's preference for cash subscription and redemption. First, it aims to simplify the subscription and redemption process, making it more transparent and more accessible for regulation and auditing. Second, it hopes to reduce the involvement of companies not registered with the SEC in the coin flow process during redemptions, which could potentially compromise investor protection. Lastly, the use of cash minimizes the impact of large-scale redemptions or purchases on the Bitcoin trading price. That is mainly because the volatility of the virtual currency market often exceeds that of other types of financial assets.

Following the approval of Spot Bitcoin ETFs, the market's focus quickly shifted to the issuance of ETFs for Ethereum, the second-largest virtual asset. There were ongoing debates with the SEC over whether Ethereum constitutes a security, including concerns about fund security, transparency, and market manipulation prevention. Consequently, a divide still exists in the market on whether the SEC will approve an Ethereum ETF in May 2024. Attention can still be paid to the ripple effects of the spot Bitcoin ETF approval and whether the SEC will approve ETFs for other virtual assets in the future.

Regarding the regulatory aspect in Taiwan, the Financial Supervisory Commission drew on regulations from countries such as the EU, Japan, and South Korea, took the Anti-Money Laundering Act as the basis, strengthened self-regulation among industry practitioners as the principle, and considered opinions from domestic industry practitioners, experts, and scholars. In September 2023, it issued the Guidelines for the Administration of Virtual Asset Service Provider (VASP), enhancing customer protection in areas involving transaction transparency, customer asset custody methods, platform operator internal control, and external expert assistance. It required VASP businesses to regulate aspects such as virtual asset issuance, review mechanisms for listing and delisting, segregation of platform and user assets custody, transaction fairness and transparency, contract establishment, cold and hot wallet management, and internal controls. VASPs were required to promote industry self-regulation, with related VASP associations developing self-regulatory standards based on the above-mentioned guidelines to instruct businesses to strengthen internal controls and further enhance customer rights protection. The Financial Supervisory Commission indicated that whether specialized legislation would be stipulated to regulate virtual currencies and VASPs is currently under study, and results would be expected by September 2024 at the earliest.