取扱?象有?証券

?社?1989年設立以?、長年???証券市場??率化?向上???、?係??事業体???株券?係?事務作業?負???減????、保管?象有?証券??大?努????????。?社?取扱?象有?証券?次??????????: 証券取引所?上場?????株式???新株引受証書、新株??証書、新株予約?付?特別株、新株予約?証書。

- 証券集中取引所?上場?????株式???新株引受証書、新株??証書、新株予約?付?特別株、新株予約?証書。

- 証券集中引所?上場?????受益証書。

- 証券集中引所?上場?????預託証書。

- 証券集中取引所?上場??????換社債型新株予約?付社債(?換社債)、交換社債、新株予約?付社債、社債及?新株引受?付証書。

- 証券集中取引所??買?????債券。

- 証券集中取引所?上場????????型(???型)????。

- 証券集中取引所?上場?????受益証券、資??保証券。

- Over-the-Counter市場(以下「OTC」?表記???)??買?????新株引受証書、新株??証書、新株予約?付?特別株、新株予約?証書。

- OTC??買?????受益証書。

- OTC??買?????預託証券。

- OTC??買??????換社債型新株予約?付社債(?換社債)、交換社債、新株予約?付社債、社債及?新株引受?付証書。

- OTC??買?????債券。

- OTC??買????????型(???型)????。

- OTC??買?????受益証券、資??保証券。

- ?????????。

- 公開?行?社??行??株式?、?該?行株????合併印刷???電子化?行??。

- 公開?行?社??行??私募株、私募株式??証書、私募新株引受?付証書、私募社債、私募金融債???、?該??行株????合併印刷????????化(電子化)????。

- 公開?行?社??行??私募新株予約?付特別株、私募新株予約?付社債、私募?換社債型新株予約?付社債(?換社債)、私募交換社債???、?????化(電子化)????。

- ?????化?????型受益証券、金融債。

- 受託機????特定目的?社??行??私募受益証券????資??保証券???、?????化(電子化)????。

- ?渡性預金証書(NCD)。

- 公開?行?社???????????行???人民元建?社債???、??????????????(OBU)、???????化(電子化)????。

- CP1(取引?????行??約束手形)。

- CP2(資金調達?目的????行??約束手形)。

- 外貨建CP。

- 銀行引受手形(BA)。

- 短期受益証券及?資??保証券。

- 地方債。

- ??他規制監督機??許可?受??有?証券???短期債務証書。

有?証券?保管

?社?取扱?象有?証券?保管方法??混?保管?個別保管?????。

(一)混?保管

混?保管?、投資家??加者?通???社?預??有?証券?預??者???個別?保管????????、他?預??者?同銘柄?証券??別??????混合??保管?????。返還?際??同種同量?証券?返還????。

(二)個別保管

個別保管?、預??証券?預??者???、個別?保管?、引換??顧客?有?証券保管証?交付???。顧客?返還請求???場合、?社??該顧客?預??記名株式?返還???。 個別保管?、?行?社?取締役、監?役、及?特定株主等?保有?、規則?基???渡?制限?????記名株式?限???。 個別保管?株券預託?返還?係?手???????削減、及?株券電子化??施????、?社?管理的混?保管制度?導入?、?行?社?取締役、監?役及?特定株主?規則?基???渡制限?記名株式?振替制度?適用?象?????。

短期手形???短期金融商品?保管

短期金融商品?取扱?金融業者(Bill Financial Company)?利便性???、?社?合作金庫商業銀行(Taiwan Cooperative Bank )?台???建?券保管業務、兆豐國際商業銀行(Mega International Commercial Bank Co., Ltd.)?外貨建?券保管業務?委託?、?加者?通貨別?最寄??指定保管銀行??券?預託、?期償還、引受、購入、及??期償還?伴?資金決??行????????。

�, while the investors can find relevant fund information through the information announcement platform. The system thus greatly enhances the information transparency by allowing investor to obtain information directly online。Futures Trust Fund Information Reporting and Announcement

To provide investors with comprehensive information services, enhance information transparency and investor protection, TDCC and the Chinese National Futures Association together launch “The Futures Trust Fund Observation Post System” (http://www.fundclear.com.tw/), providing daily information of futures trust funds which have been approved by the Financial Supervisory Commission (FSC) or filed for effective registration.?

The “TDCC's Futures Trust Fund Observation Post System” is divided into two separate platforms, the information reporting platform and the information announcement platform. Futures trust enterprises can use the information reporting platform to report daily fund's net worth and related material information to the competent authority, and custodian institutions can carry out monthly statement review operations through this platform. In addition, investors can look for information of futures trust funds through the system, including basic information on the futures funds approved by the competent authority, as well as their net worth, annual financial reports, public prospectuses, and material information.

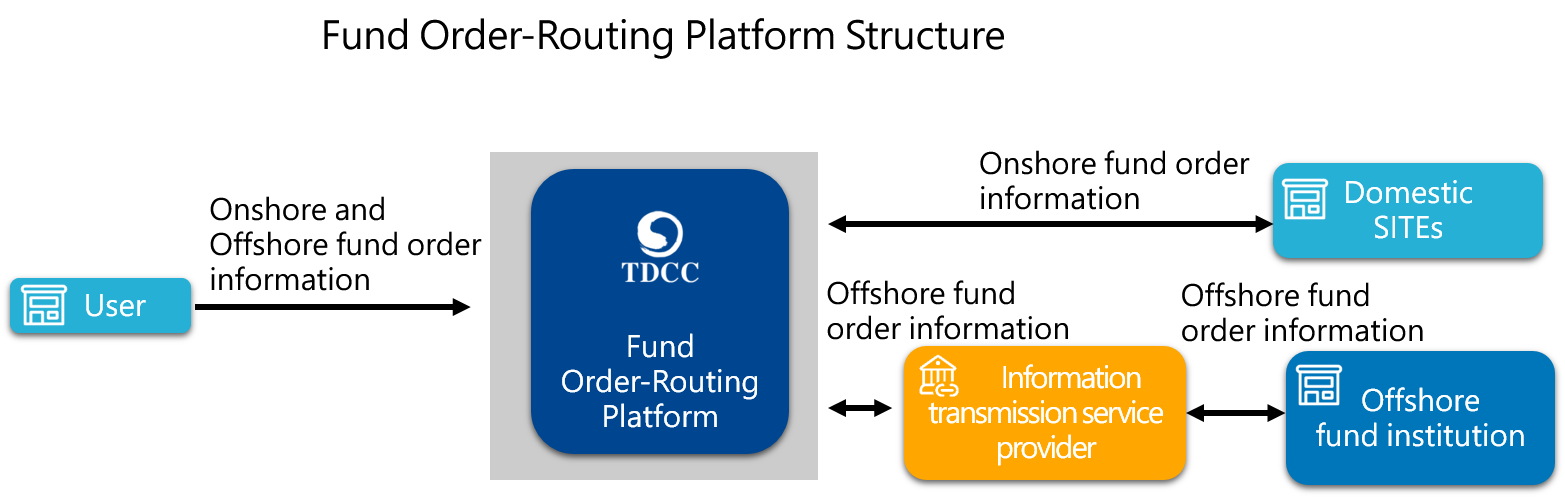

Fund Order-Routing Service

To improve the current manual operation of master agents, sub-distributors, and insurer-entrusted custodians (collectively referred to as “user” hereunder) placing orders for funds by fax, TDCC has established a fund order-routing platform that provides automated transmission service to enable users to transmit order information on the subscription, redemption and transfer of funds (collectively referred to as “order information” hereunder) to domestic securities investment trust firms (SITEs) and offshore fund institutions and receive order status report and transaction confirmation from them. This platform provides automated transmission service not only for the order of domestic funds, but also for the order of offshore funds through collaboration with information transmission service providers. It provides domestic users a single window for the transmission of order information, thereby reducing their manual operation risks, while improving the operating efficie??諤9???�???�und market.