Custody Businesses

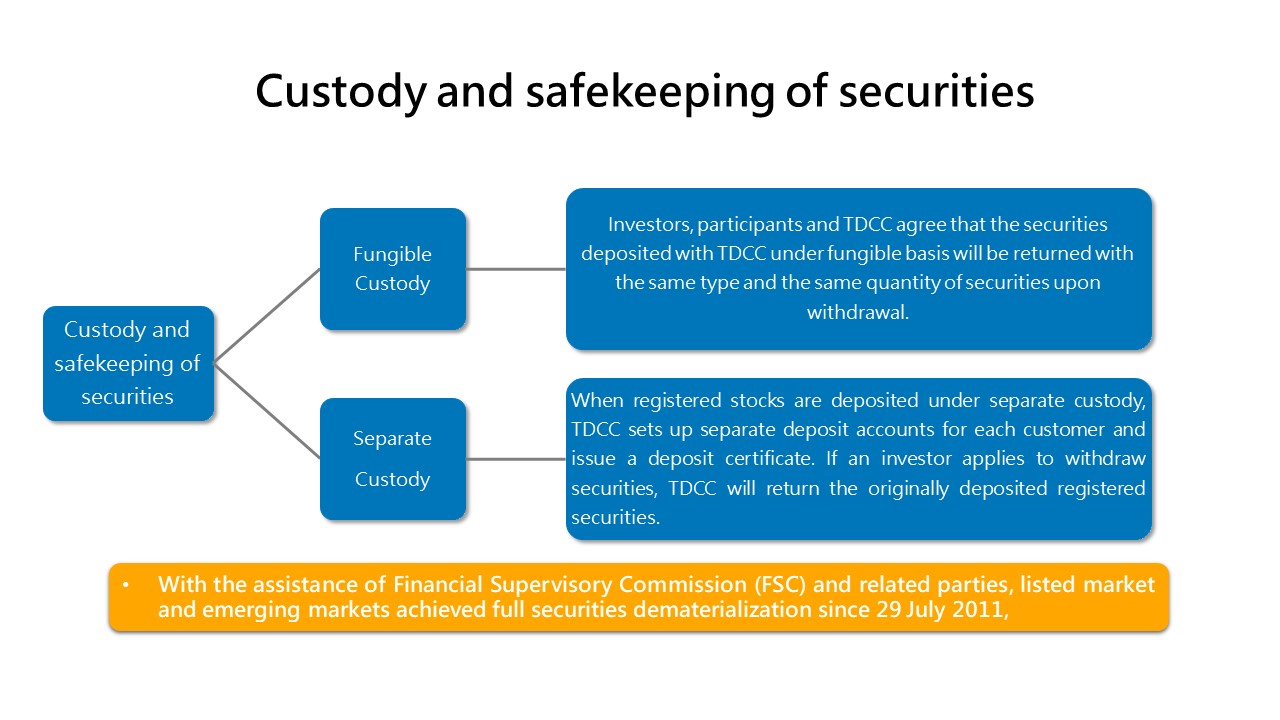

Securities under TDCC's custody are divided into Fungible Custody and Separate Custody.

Introduction

Regulations

AnnouncementCustody and safekeeping of securities

Securities under TDCC's custody are divided into Fungible Custody and Separate Custody.

(Chinese version only)