Financing Service

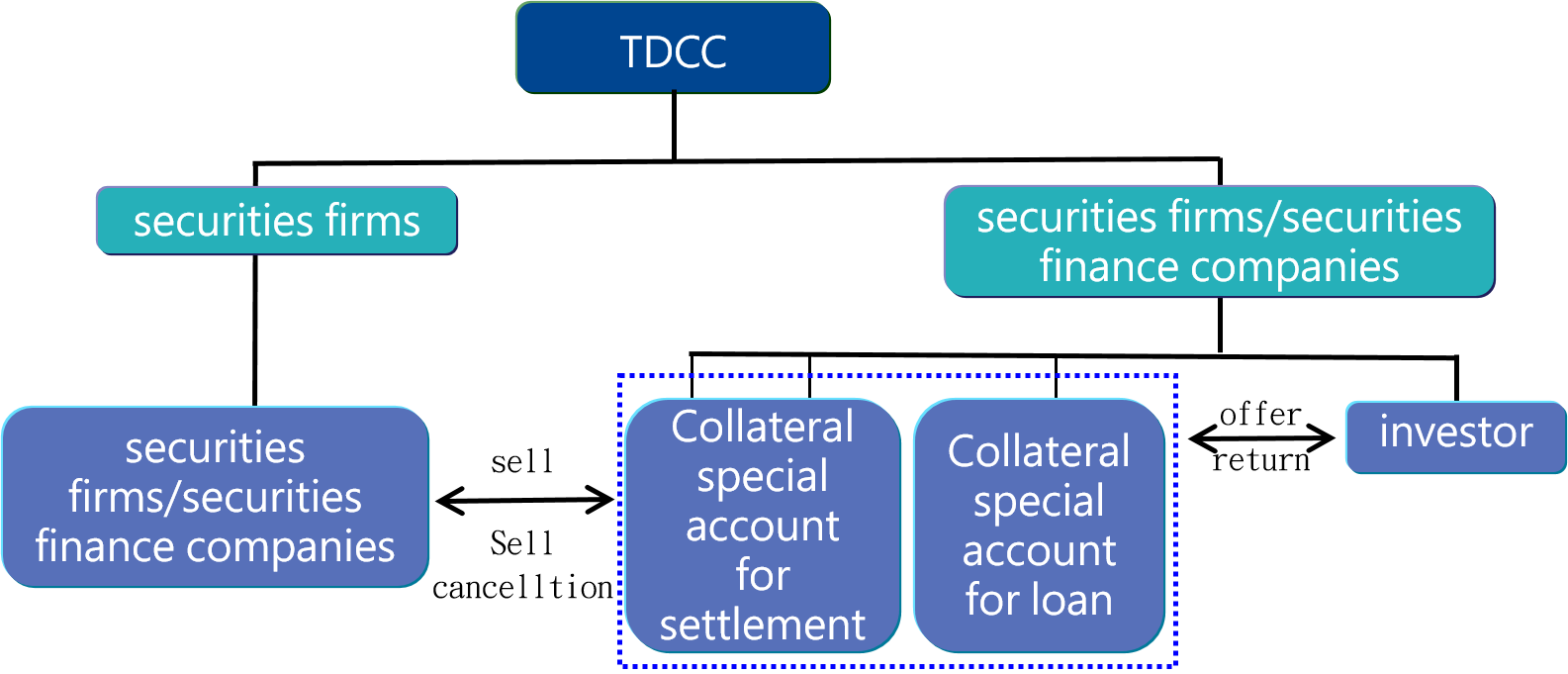

In 2006, the competent authority authorized lending in connection with securities business by securities firms.in 2016 for the securities firms to conduct lending business for unrestricted purposes and securities finance companies to handle lending business using securities as collateral.

Introduction

Regulations

AnnouncementFinancing Service

In 2006, the competent authority authorized lending in connection with securities business by securities firms.in 2016 for the securities firms to conduct lending business for unrestricted purposes and securities finance companies to handle lending business using securities as collateral.

(Chinese version only)