Trust

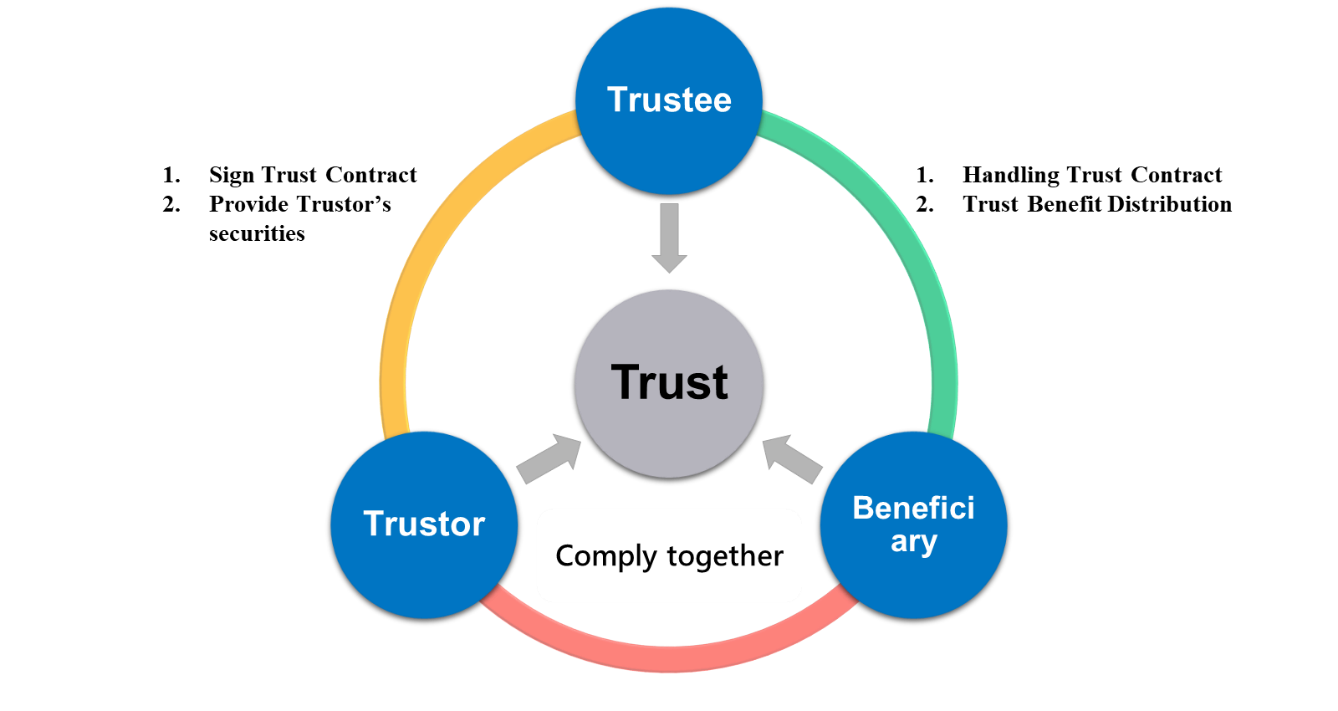

TDCC has been providing central custody and book-entry transfer services for securities trust since 2004, including creation of trust securities, distribution of trust interest, transfer of trust securities when the trust ceases to exist, and distribution of stock dividends for trust securities.

Introduction

Regulations

AnnouncementTrust

TDCC has been providing central custody and book-entry transfer services for securities trust since 2004, including creation of trust securities, distribution of trust interest, transfer of trust securities when the trust ceases to exist, and distribution of stock dividends for trust securities.

(Chinese version only)