Mutual Fund Services

Information Transmission and Cash Payment of offshore fund

Following the guidance of Financial Supervisory Commission (FSC), TDCC established the “Offshore Fund Observation Post System (OFOPS) - Information Transmission and Cash Payment Platform” in accordance with the provisions of the Offshore Fund Management Regulations drawn up in line with the requirements of the Securities Investment Trust and Consulting Act. The Platform is used to provide transaction information, receipts and payments services for master agents and distributors when undertaking offshore fund subscription and redemption.

Applicable Organizations

The above services are provided to master agents and distributors engaged in offshore fund subscription and redemption which has been approved by regulatory authorities.

Service Hours

From 9 a.m. to 5 p.m., Monday to Friday (national holidays excluded) The dates on which TDCC’s offices are closed basically the same as Taiwan’s banks. However, TDCC reserves the right to change these dates when necessary (or at the recommendation of the Securities Investment Trust & Consulting Association of R.O.C.) with the approval of the regulatory authorities

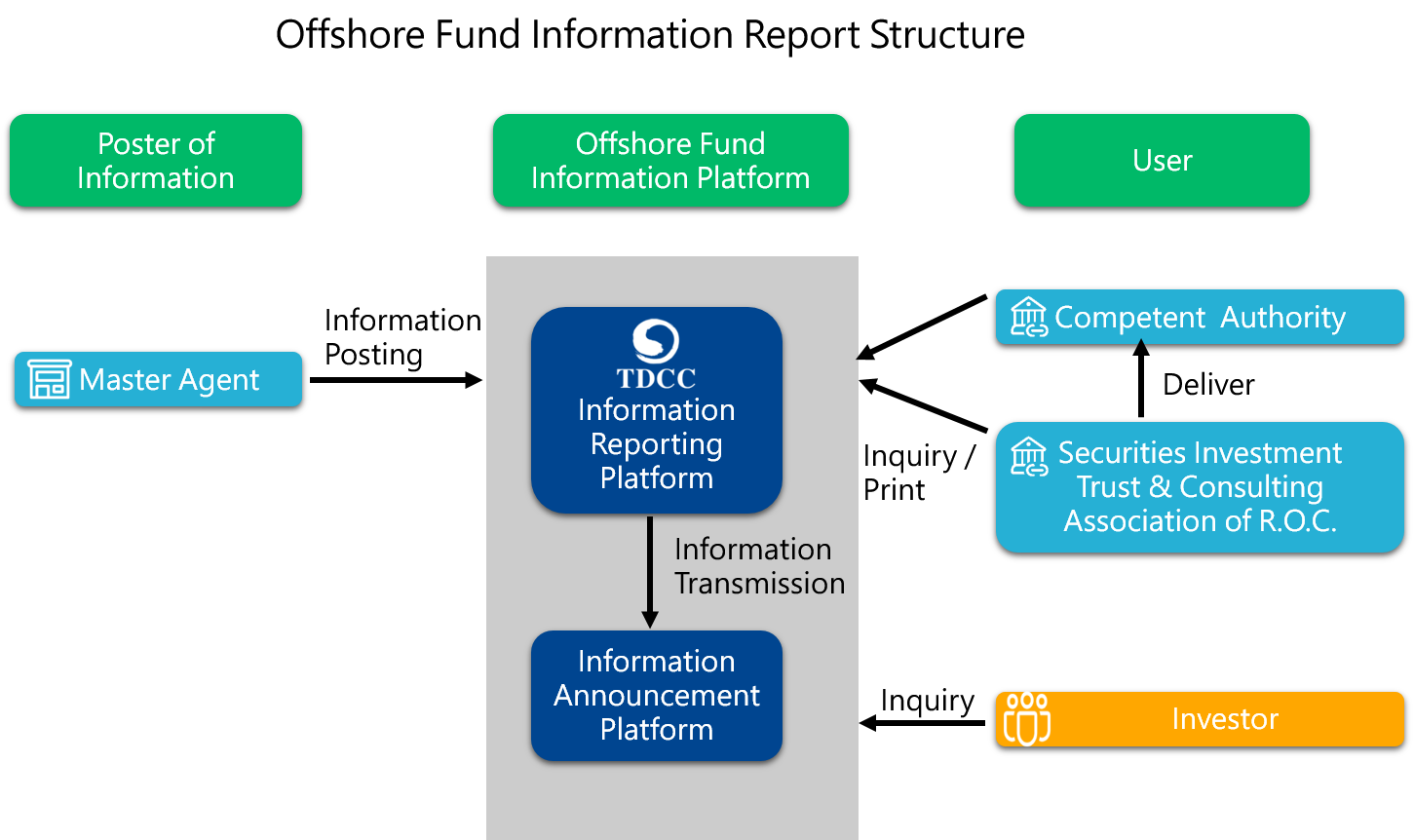

Offshore Fund Information Reporting and Announcement

The Regulations Governing Offshore Funds stipulates that on each business day master agents or distributors should post the following information of transaction on the previous business day through TDCC system: fund title, total amount and units of confirmed subscription, redemption or switch. Concerning investors’ rights, the Regulation also stipulates that master agents should post the following information of offshore funds, including the basic information, NAV per unit, annual financial report, prospectus, and investor information summaries, the Chinese translation, corporate actions, and subsequent changes. TDCC therefore established the “Offshore Fund Observation Post System,” consisting of an information reporting platform and an information announcement platform. Master agents and distributors can report and publish offshore fund information as required by the Regulations through the information reporting platform, while the investors can find relevant fund information through the information announcement platform. The system thus greatly enhances the information transparency by allowing investor to obtain information directly online. The operation structure is as follows:

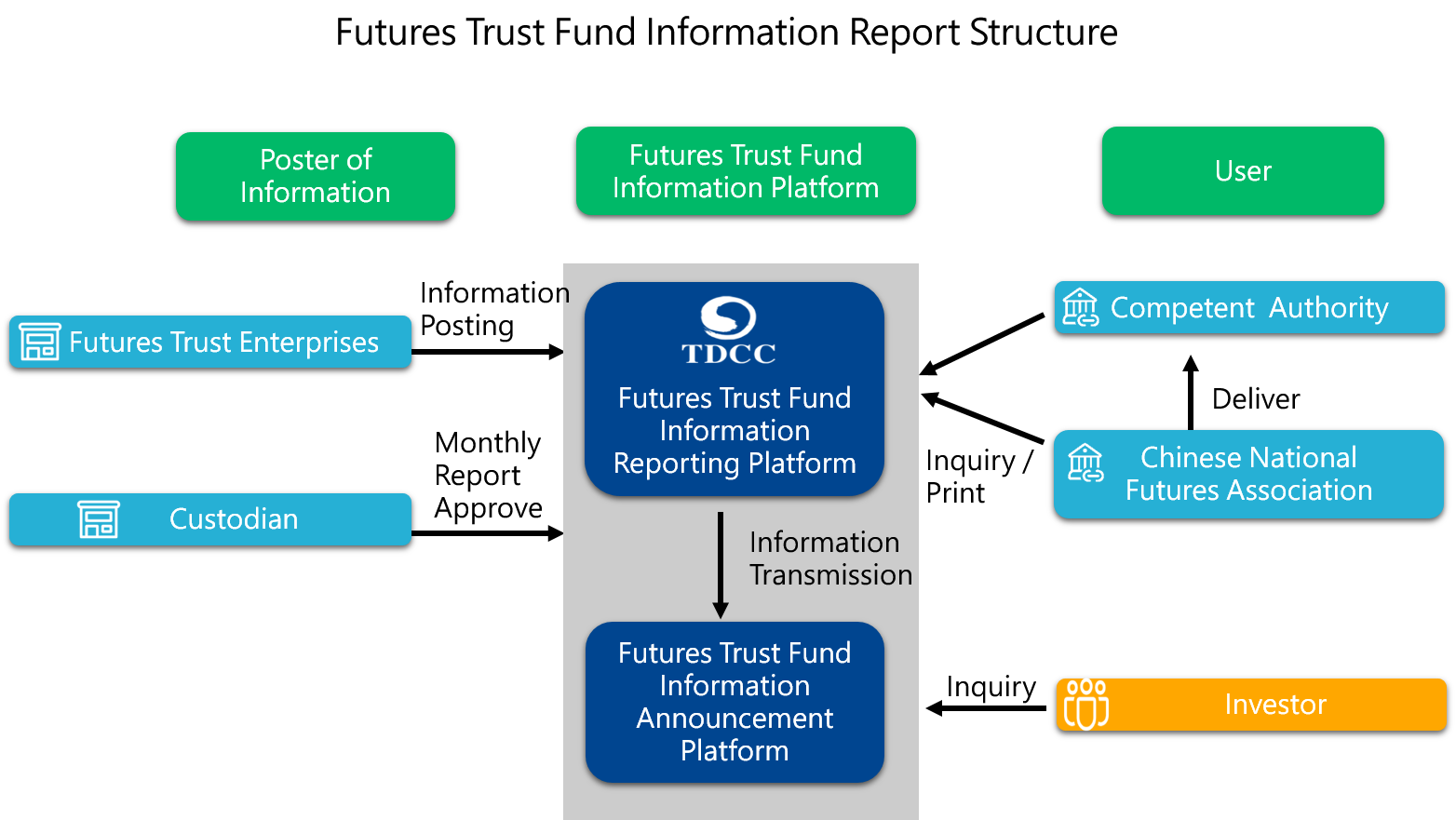

Futures Trust Fund Information Reporting and Announcement

To provide investors with comprehensive information services, enhance information transparency and investor protection, TDCC and the Chinese National Futures Association together launch “the Futures Trust Fund Observation Post System” (http://www.fundclear.com.tw/), providing daily information of futures trust funds which have been approved by the Financial Supervisory Commission (FSC) or filed for effective registration.?

The “TDCC's Futures Trust Fund Observation Post System” is divided into two separate platforms, the information reporting platform and the information announcement platform. Futures trust enterprises can use the information reporting platform to report daily fund's net worth and related material information to the competent authority, and custodian institutions can carry out monthly statement review operations through this platform. In addition, investors can look for information of futures trust funds through the system, including basic information on the futures funds approved by the competent authority, as well as their net worth, annual financial reports, public prospectuses, and material information.

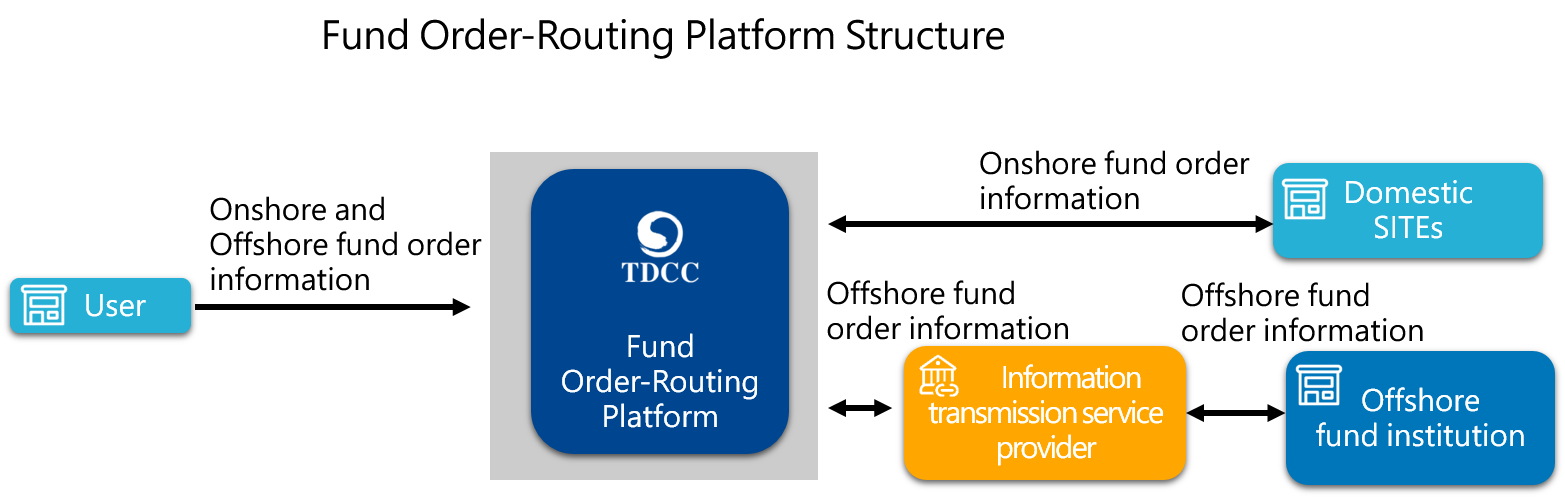

Fund Order-Routing Service

To improve the current manual operation of master agents, sub-distributors, and insurer-entrusted custodians (collectively referred to as “user” hereunder) placing orders for funds by fax, TDCC has established a fund order-routing platform that provides automated transmission service to enable users to transmit order information on the subscription, redemption and transfer of funds (collectively referred to as “order information” hereunder) to domestic securities investment trust firms (SITEs) and offshore fund institutions and receive order status report and transaction confirmation from them. This platform provides automated transmission service not only for the order of domestic funds, but also for the order of offshore funds through collaboration with information transmission service providers. It provides domestic users a single window for the transmission of order information, thereby reducing their manual operation risks, while improving the operating efficiency of the fund market.