Clearing and Settlement

To streamline the securities market's clearing and settlement operation, the Securities and Futures Bureau, Financial Supervisory Commission promotes the "Book-Entry Settlement System of Securities in Centralized Custody" and TDCC would be in charge of handling relevant matters. The system utilizes the highly efficient transfer function of computers to perform the securities market's clearing and settlement operation in order to enhance the securities market's operating efficiency, lower its operating costs, and expand its development. Since TDCC takes charge of matters associated with the "Book-Entry Settlement System of Securities in Centralized Custody," it has continuously studied and initiated various new businesses to reduce the securities market's cost in handling related matters. Businesses engaged by TDCC include securities custody, trade settlement and transfer, pledge and delivery, securities loans, conversion of convertible bonds, ETF creation and redemption, and all of which can be conducted via book-entry transfer.

Settlement and Book Entry of Securities

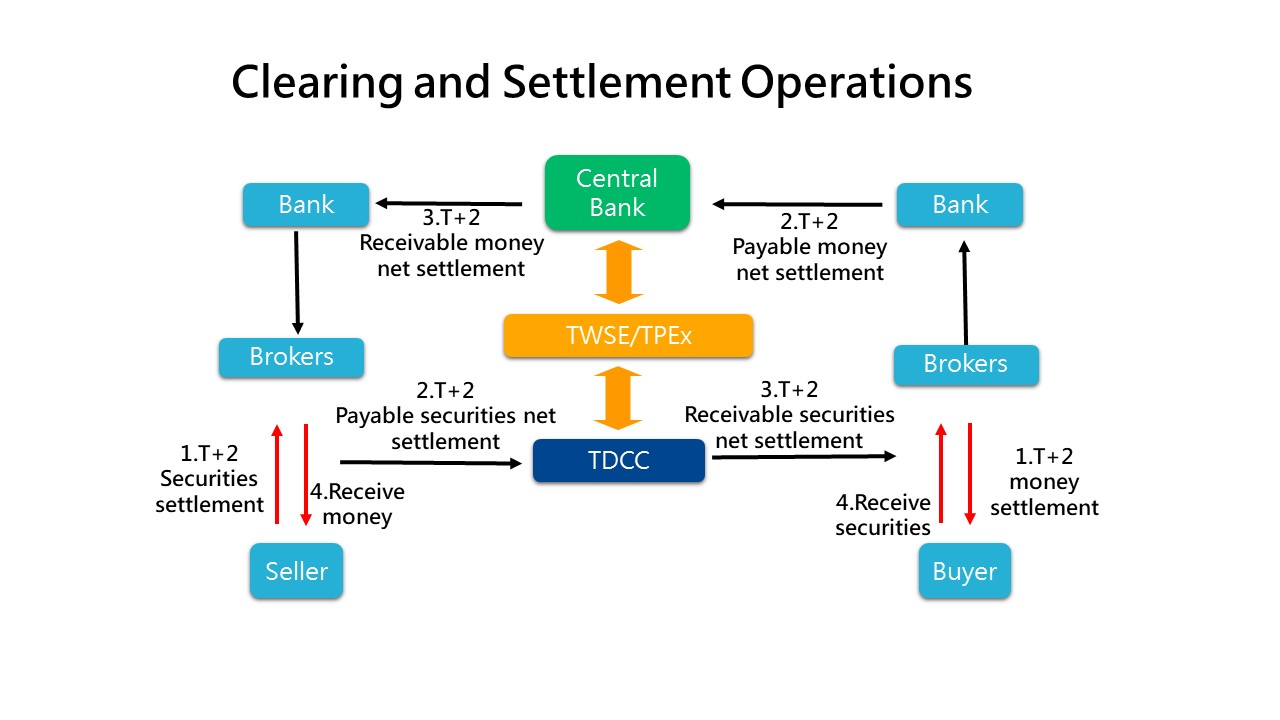

Centralized Trades

In accordance with TWSE and GTSM operation regulations and rules, the delivery and settlement operations for securities traded on the TWSE or GTSM shall be handled by TDCC.

Appendix- centralized trades’s operating procedures

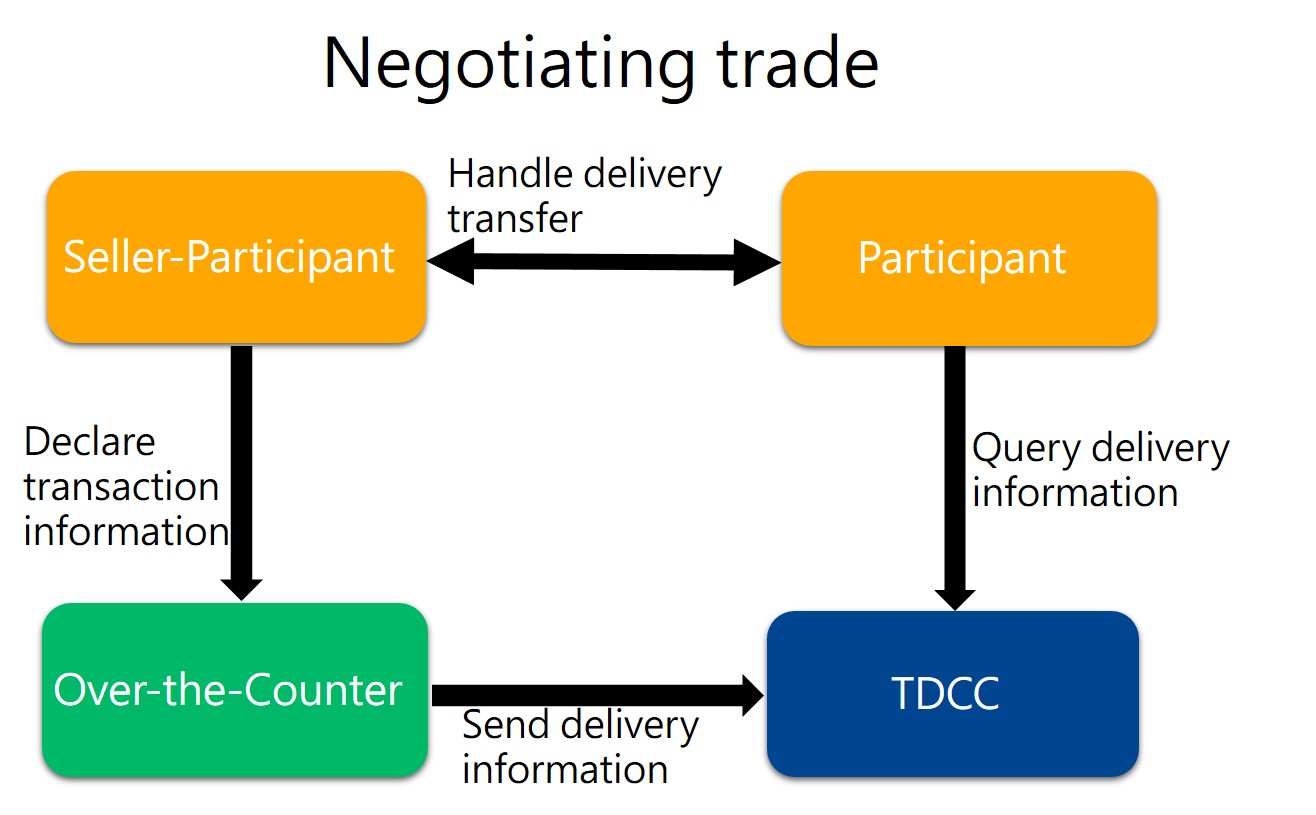

Negotiable Trades in Over-the-Counter Market

TDCC provides book entry services for negotiable transactions between customer and Participant or between participants.

Operating procedures:

Appendix-The procedure of negotiable trades in over-the-counter market

Clearing and Settlement of Emerging Stocks

To provide unlisted stocks with a legal, secure and transparent transaction platform, GTSM has established an emerging stocks transaction system on January 2, 2002, while TDCC handles the clearing and settlement of emerging stocks.

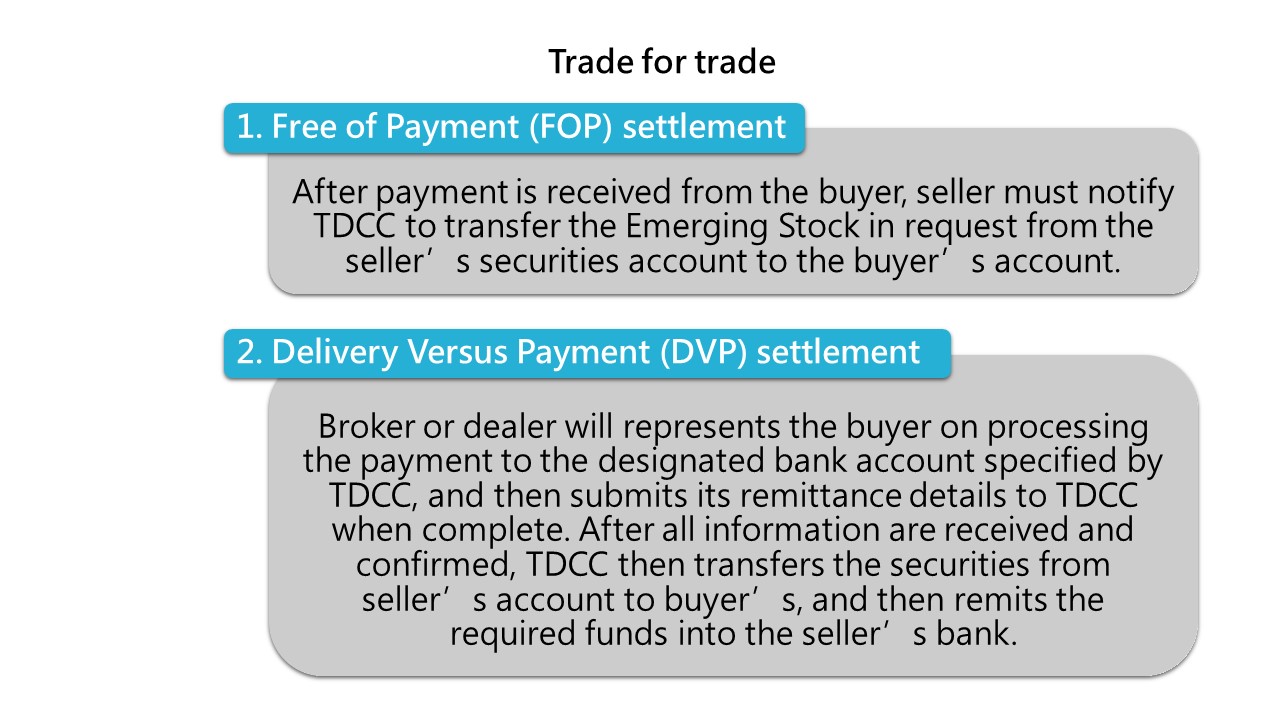

Once securities firms complete a transaction in GTSM’s Emerging Stocks Electronic Negotiated Trading System, GTSM will notify TDCC of trading details and settlement methods. TDCC will then carry out the subsequent payment and settlement operations as described below based on the GTSM notice:

Trade for trade: Buyers and sellers complete settlements on the trade day.

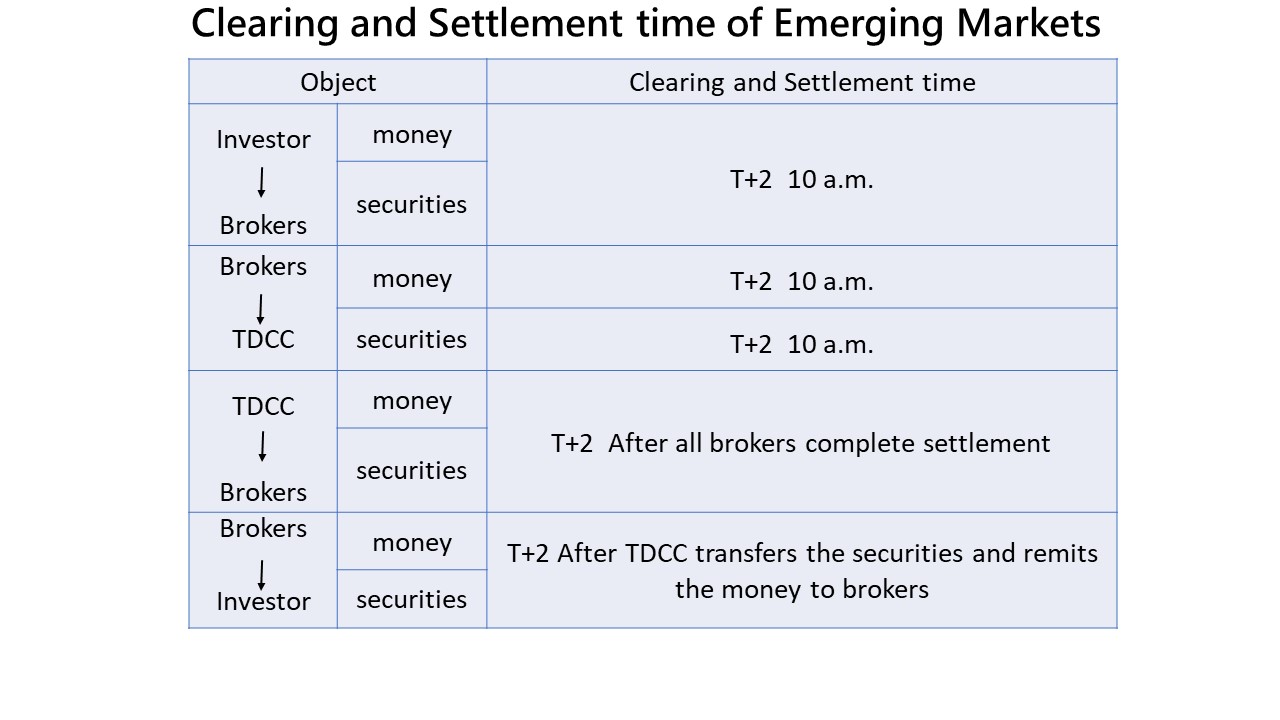

Netting: Buyers and sellers complete settlements with TDCC on T+2.

Appendix-Clearing and Settlement of Emerging Stocks’s operating procedures

(Chinese version only)