Cross-Border Custody Services

As part of the government’s policy objectives to achieve better alignment of Taiwan’s financial system with global standards, facilitate the operations of Taiwanese businesses in the global market, and serve the needs of institutional investors, TDCC was approved by competent authorities to engage in cross-border custody and book-entry settlement of foreign securities, and to establish a web-based custody system, which became officially operational in August 2015, in accordance with Article 5, Paragraph 6 of the Regulations Governing Centralized Securities Depository Enterprises, and Article 2, Paragraph 3 of the Regulations Governing Book-Entry Operations for Centrally Deposited Securities.

Cross-border custody

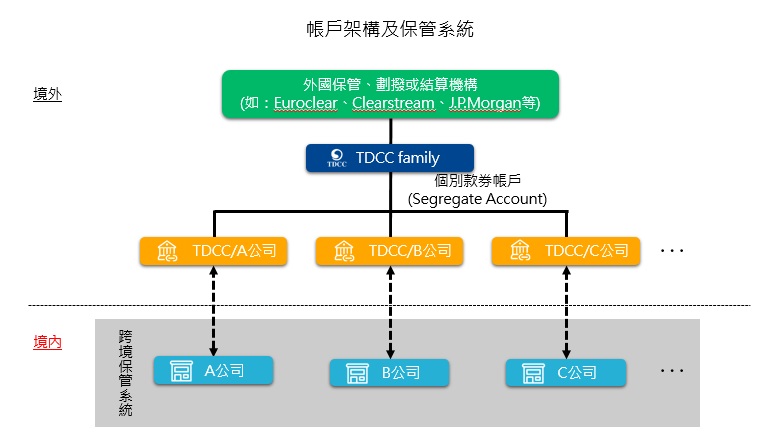

TDCC provides cross-border custody of foreign securities via a foreign depository, book-entry or clearing service provider (hereafter referred to as a foreign depository). Only the following two types of participants are allowed to request TDCC to open an account with a foreign depository on their behalf:

- qualified institutional investors as defined in Article 4, Paragraph 2 of the Financial Consumer Protection Act;

- securities issuers that deliver securities in book-entry form.

Participants wishing to apply for foreign securities custody services via TDCC should submit relevant documents so that TDCC may open a segregate securities account (hereafter referred to as segregate account) with a foreign depository. Upon opening of a segregate account with a foreign depository, TDCC will create a cross-border custody ledger holding the transaction records and securities/cash balances of the account for the participant. Cross-border custody participants should inform TDCC of instructions regarding cash/securities settlement and transfer, securities lending and borrowing, and foreign exchange via a computer terminal or other designated transmission devices. Upon receiving such instructions, TDCC will notify the corresponding foreign depository. When the transaction is completed, TDCC will send a notice to the participant and update the ledger entry.

An overview of our account structure and custody system

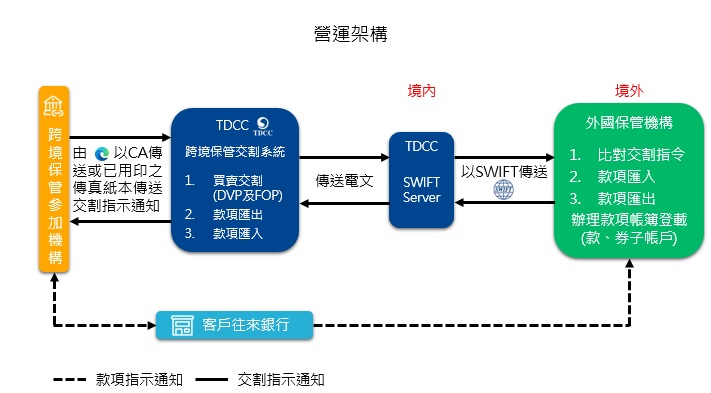

Overview of our operating structure

Transaction settlement

Participants that wish to make cash payment or transfer securities via TDCC should inform TDCC of such request by operating the functionality of “instruct settlement” on a computer terminal, or by manually filling in a “settlement instruction letter” carrying a stamp of their specimen chop, and then sending the letter to TDCC by facsimile.

TDCC will review the request and client information before sending a notice to the foreign depository to carry out the settlement. The foreign depository will notify TDCC after the settlement is completed and the participant’s segregate account updated. TDCC will then document such transaction in the participant’s ledger and notify the participant.

Payment transfer

Participants that wish to transfer cash from their segregate account to an external financial account or to another segregate account with the same foreign depository via TDCC should inform TDCC of such request by operating the functionality of “outward payment” on a computer terminal, or by manually filling in a form for cash transfer, which must carry a stamp of their specimen chop, and then sending the form to TDCC by facsimile. TDCC will review the request and client information before sending a notice to the foreign depository to carry out the remittance or transfer. The foreign depository will notify TDCC after the remittance or transfer is completed and the participant’s segregate account updated. TDCC will then document such transaction in the participant’s ledger and notify the participant.

Participants that wish to transfer cash to their segregate account via TDCC should inform TDCC of such request by operating the functionality of “inward payment” on a computer terminal, or by manually filling in a form for cash transfer, which must carry a stamp of their specimen chop, and then sending the form to TDCC by facsimile. TDCC will review the request and client information before sending a notice to the foreign depository to carry out the transfer. The foreign depository will notify TDCC after the transfer is completed and the participant’s segregate account updated. TDCC will then document such transaction in the participant’s ledger and notify the participant.

Taxation

Participants who wish to register as a tax payer in a foreign country should fill in an application form, which must carry a stamp of their specimen chop, and any forms requested by the foreign depository before submitting the documents to TDCC. TDCC will review the documents to ensure the information provided is correct, and then send the application forms to the foreign depository. The foreign depository will notify TDCC when the status of tax payer is registered. TDCC will then inform participants of such registration. Principal and interest payments TDCC will credit the segregate accounts of participants when a foreign depository informs TDCC of the arrival of principal and interest payments. When a foreign depository informs TDCC of a corporate action to be taken by a securities issuer, TDCC will create an entry for such corporate action and notify relevant participants. If the corporate action requires a response from participants, participants should operate the functionality of “reply corporate action” on a computer terminal within the time frame designated by TDCC. When the foreign depository completes the updating of segregate accounts and inform TDCC of such updates, TDCC will document the action in the participant’s ledger and notify the participant.

Bookkeeping

TDCC receives securities and cash account balances from foreign depositories on a daily basis. After receiving the data, TDCC reviews every transaction for reconciliation purposes. Cross-border custody participants may examine the balances of their securities and cash accounts, as well as securities settlement and payment statements to see if they are consistent with the records in their ledger.