Corporate Action Services

Stock Dividend Distribution

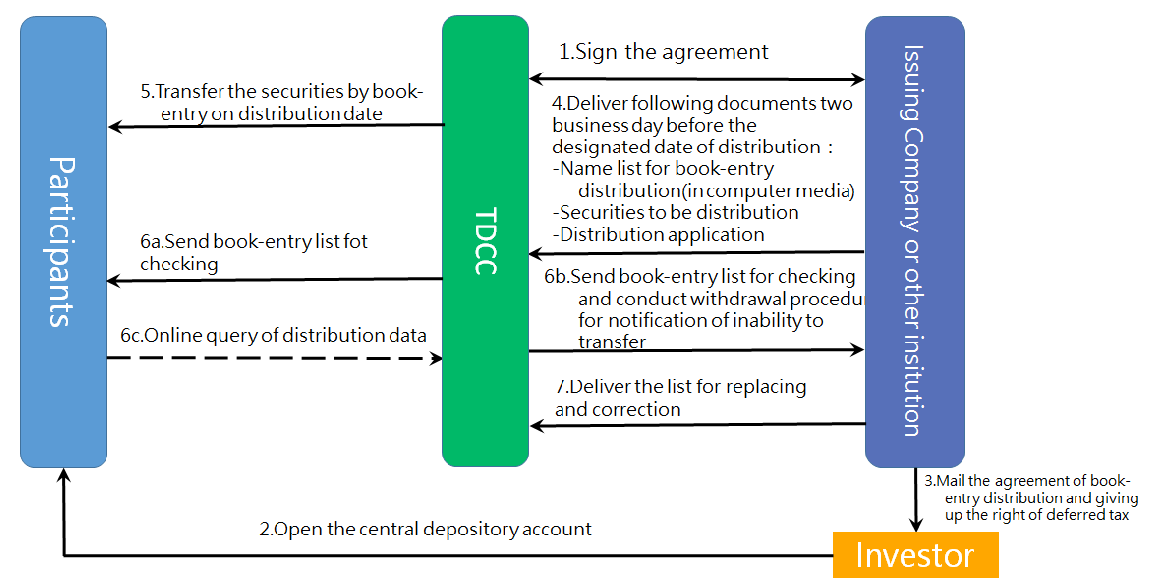

To reduce the manual process to distribute new issued shares and the inconvenience of shareholders to acquire the certificates in person, TDCC has offered distribution service of new share via book entry since November 1992. With the appearance of new financial products in Taiwan, eligible securities are no longer limited to shares issued for capital increments; it now extends to warrants, treasury stock, beneficiary certificates and stock dividends, together with the transfer operations required for the use of securities as collateral and for discretionary accounts, in order to provide safer, more convenient service for stock market participants. By the request and instructions of the issuer or its transfer agent, depository institutions, underwriter or other institution, TDCC will post new shares issued in the accounts of the participants and their customers by book entry on the date designated by the aforesaid institution.

Computerized securities processing

The contractual relationship between investors and TDCC is indirect in the sense that investors open an account with a participant, and the participant opens an account with TDCC to be involved in our central custody system. That being said, investors can directly access our custody services thanks to the contracts participants signed with TDCC.

TDCC provides account administrative services, including statement print-out, documentation and data storage to the clients of participants. Below is an overview of our computerized processing functionality:

The functionality is mainly comprised of two modules: connected and batch processing

Connected processing

Participants can connect to our server to perform the following tasks:

- Information maintenance

When an investor opens a securities account with a participant, the participant should input the client's full name, ID number, domicile, correspondence address, payment account number and agent (broker) symbol to our system. Changes to the aforesaid information should be made in the same manner. - Holdings update

When a client makes a deposit, withdrawal, appropriation or real-time transfer of securities, the participant should input the transaction data to our system for update on the client's passbook. - Passbook management

When a new passbook is issued to a client, either for account opening or replacement, and when a passbook undergoes entry update or is reported lost, the participant should input the data to our system. - Clearing and settlement

When an out trade is reported in the daily transactions, or when there's an error in the account number, or a change of order instruction is required, the applicant should make corrections where applicable to the stock exchange. - Daily account reconciliation

Participants may reconcile client accounts and print out records of margin trading via our system. - Review of previous trades

Participants may look into the background information, account balance, transaction records and records of insufficient deposit of their clients via our system.

Batch processing

TDCC processes the transfer of securities and distribution of new shares in book-entry for clients of securities brokers, and produces a backup of important data in batches when the connected processing system is closed at the end of a trading day. Below is an overview of our batch processing operations:

- Preliminary calculation of transactions

TDCC examines the accounts of participants' clients to see if the deposit balance is sufficient to carry out book-entry settlement based on the transaction records compiled by TSWE or TPEx on a daily basis. Any insufficient deposit will be documented. Participants can connect to our system to see if any of their clients have insufficient deposits so that they could remind clients to make up the shortfalls as soon as possible to complete the settlement. - Transfer of transaction data

TDCC compiles the transactions data (in two different entries of BUY and SELL) on the day of transaction and investors will be able to update their passbook entry the next day. - Book-entry distribution of new shares

When a company issues new shares, TDCC carries out book-entry delivery of the new shares a day before they become tradable on the market based on the custody account number, name, owner's ID (the owner could be an individual or a company) or tax code number of withholding agency, and quantity data provided by the issuer. The distribution will be registered and a statement will be produced for participants' reference. - Title transfer and principal/ interest payment agent services

TDCC compiles an ownership register, which is a list of people, that is, participant clients, holding the securities of a company when the issuing company announces suspension of title transfer. The register is provided to the issuing company or its registrar agent for title transfer before the record date. Principal and interest payments of bonds in the central custody of TDCC are made entirely in book-entry, so the clients (bond holders) have to open an account with a financial institution designated by the securities broker they do business with in order to receive the payment. The redemption bank will transfer funds directly into clients' accounts according to the register and amount details provided by TDCC. - Main data file maintenance and backup

TDCC processes the main data file for every participant containing daily account reconciliation, passbook issuance, and contract termination data after the connected system is closed at the end of a trading day. A duplicate of the main data file is produced and stored at a separate device. - Securities lending

TDCC handles the borrowing and returning of securities for securities brokers based on the instructions of stock exchanges.

Ledger production

According to the regulations of TDCC, participants should keep a ledger recording the daily changes in holdings and the balance of their clients. The ledger is in electronic form and entrusted to TDCC for production. To make sure participants have a complete copy of the general ledger and sub-ledger, an electronic statement of daily transactions and balance is sent to participants for their safekeeping.

Safekeeping of certificates

Participants are required by law to keep their client ledger and related certificates for at least fifteen years. To help relieve the pressure of keeping all the documents, TDCC is appointed by participants to keep the ledger and other documents in electronic form. In case participants need a hardcopy of the documents in the future, TDCC can print out the documents and put on a company seal as a proof of authenticity upon the formal request of a participant. In case a public issuer requests an investor to provide a proof of holding certain securities for a long time, TDCC can also provide the record on behalf of the participant.