Equity Securities Services

Registration for dematerialized securities

(1) Operational basis

On June 30, 2000, the revision to Article 8 of the Securities and Exchange Act has passed its third reading in the Legislative Yuan. Revised law had permitted the issuing and book entry of dematerialized securities. On November 12, 2001, two new articles — Articles 162-2 and 257-2 — were added to the Company Act, clearly stipulating that dematerialized securities must be registered with the particular agency responsible for centralized securities custody.

In response to these changes, TDCC (was TSCD) began planning the necessary adjustments to the central deposit account structure, in which the issuers could be included as participants, and also began developing registration and book-entry operations for dematerialized securities, which commenced on December 20, 2001. A solid foundation was therefore to be established for securities dematerialization in Taiwan.

(2) Book-entry delivery

Upon receipt of instruction from issuers, TDCC will transfer the securities into shareholders' TDCC accounts under each participant and notify the respective participants to record the transfer in their customer's account book. Securities delivered by such book-entry transfer may be issued without the actual physical securities print. Shareholders are still able to trade, settle, and pledge the shares recorded in their account books. For shareholders who do not have any TDCC account with a participant, TDCC will transfer their securities into the “registration” sub-account by the issuers.

(3) Termination of registration

TDCC may terminate the registration of dematerialized securities under the following circumstances:

Issuers qualified for issuing physical securities may apply to TDCC for terminating the registration of dematerialized securities and switching to physical issuance.

Except where the issuance of dematerialized securities is not required to be conducted by a public company only, TDCC may terminate the registration of such dematerialized securities if the issuer has been approved or forced to be converted into a private company by the competent authority.

TDCC may terminate the registration of dematerialized securities issued by companies that fail to meet the “Qualifications for Issuers to Apply for Dematerialized Issuance of Securities”, or that refuse or dodge TDCC’s investigation without justified causes, or that do not submit necessary materials for investigation, or that violate any relevant laws, regulations or provisions of TDCC’s account agreement.

Settlement and Book Entry of Securities

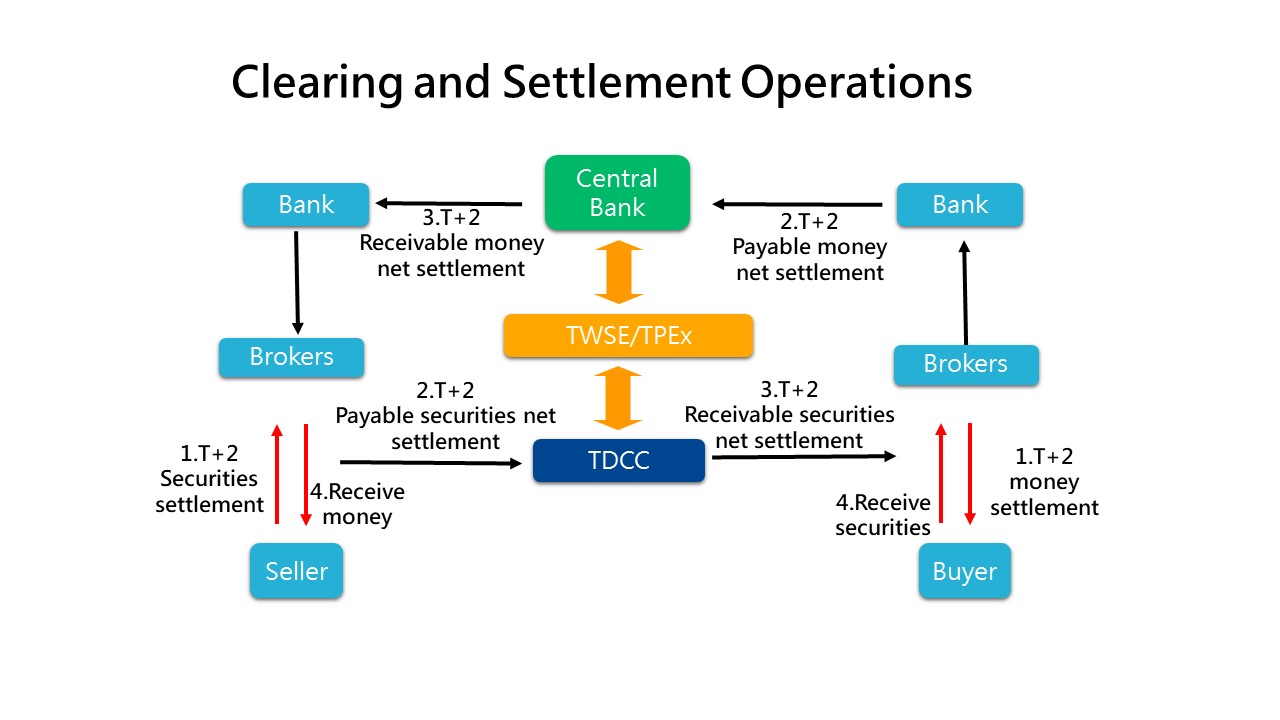

(1) Centralized Trades

In accordance with TWSE and GTSM operation regulations and rules, the delivery and settlement operations for securities traded on the TWSE or GTSM shall be handled by TDCC.

Appendix- Centralized trades’s operating procedures

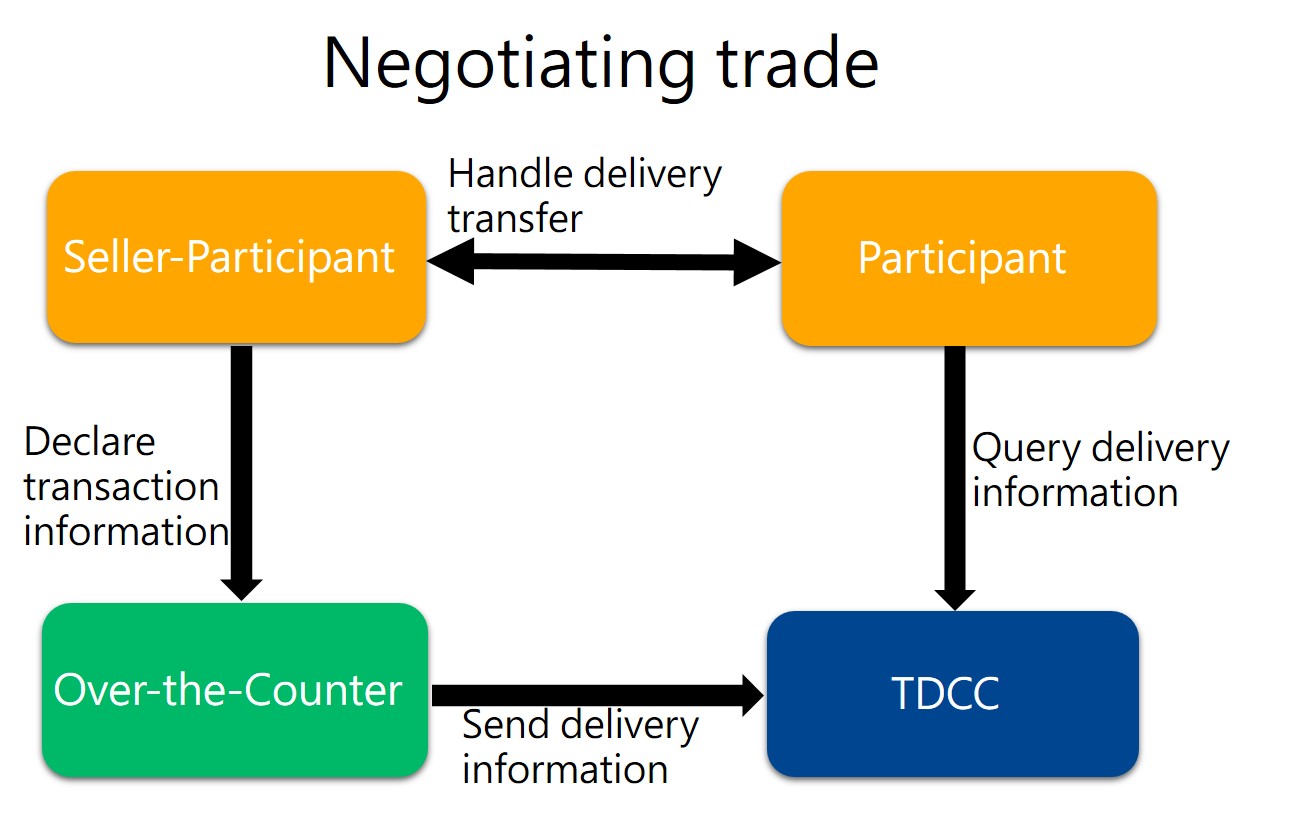

(2) Negotiable Trades in Over-the-Counter Market

TDCC provides book entry services for negotiable transactions between customer and Participant or between participants.

Appendix-The procedure of negotiable Trades in Over-the-Counter Market

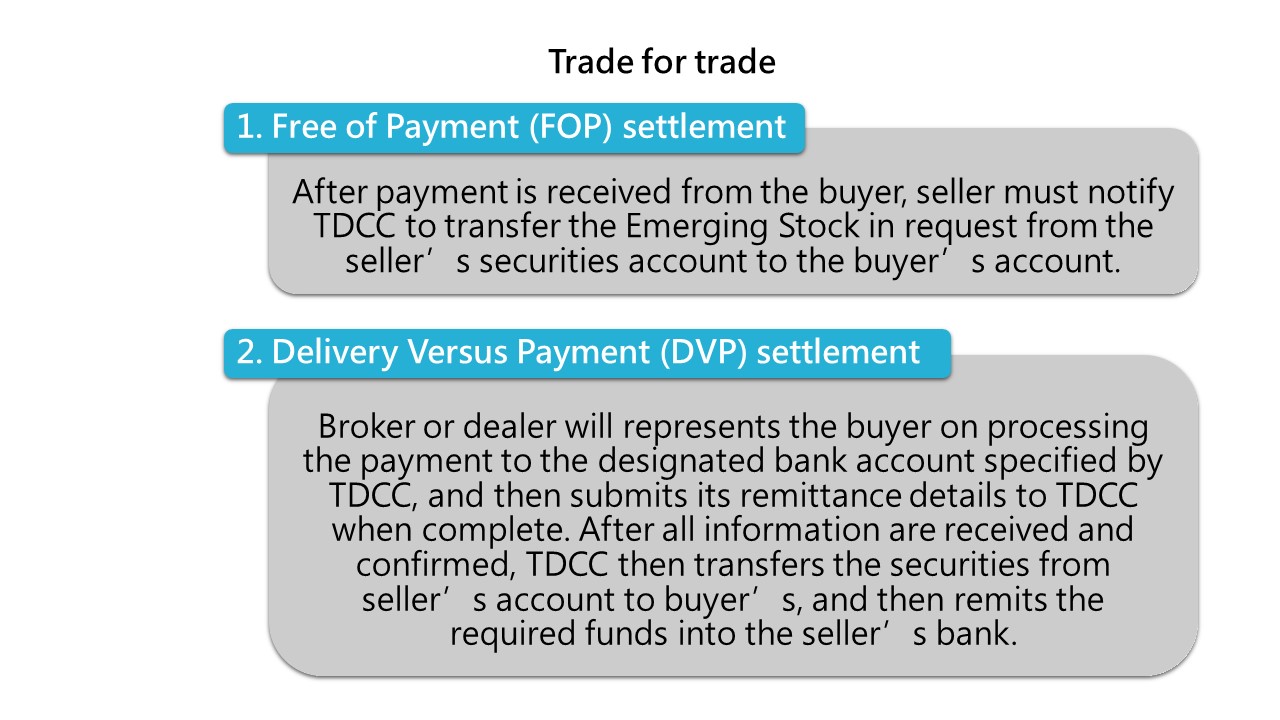

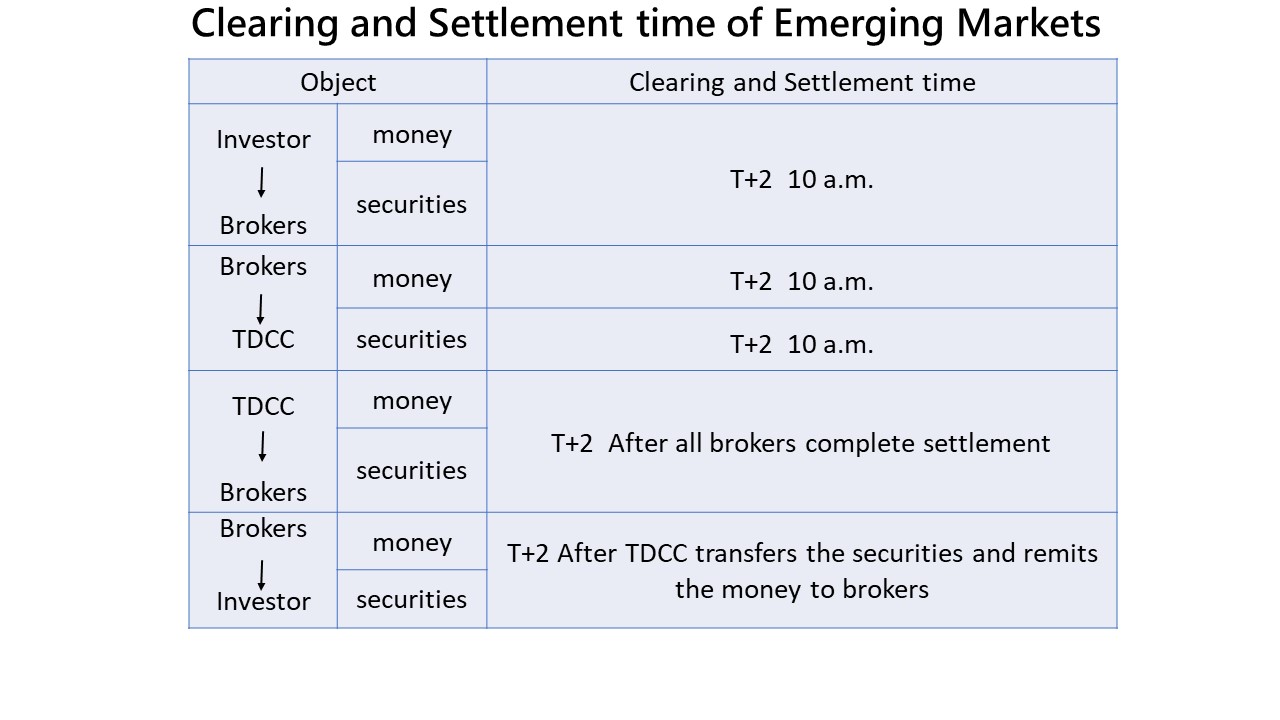

(3) Clearing and Settlement of Emerging Stocks

To provide unlisted stocks with a legal, secure and transparent transaction platform, GTSM has established an emerging stocks transaction system on January 2, 2002, while TDCC handles the clearing and settlement of emerging stocks.

Once securities firms complete a transaction in GTSM’s Emerging Stocks Electronic Negotiated Trading System, GTSM will notify TDCC of trading details and settlement methods. TDCC will then carry out the subsequent payment and settlement operations as described below based on the GTSM notice:

Trade for trade: Buyers and sellers complete settlements on the trade day.

Netting: Buyers and sellers complete settlements with TDCC on T+2.

Appendix-Clearing and Settlement of Emerging Stocks’s operating procedures

Book Entry Operations for Pledged Securities

In order to eliminate the risk and inconvenience incurred by pledgers and pledgees through being required to carry large numbers of physical securities with them when establishing pledges. TDCC began to provide book-entry services for pledged securities on May 2, 1994, including creation of pledge, closing of pledge, exercise of pledge, transfer of pledge and the transaction of pledge balance; as overall aim was to make these operations to be convenient and secure as possible.

Book Entry Operations for Securities Trust

To meet the needs of investors who put their securities under central custody into securities trust, TDCC has been providing central custody and book-entry transfer services for securities trust since 2004, including the opening of trust account by trustee, trustor putting securities in central custody under a trust, distribution of trust interest, transfer of trust securities when the trust ceases to exist, and distribution of stock dividends for trust securities.

Book Entry Operations for Securities Assignment

Book-entry operation for securities acquired by direct assignment, inheritance or gift Starting 2001, TDCC offers book-entry service for direct transfer of securities between individuals, securities acquired by inheritance and as a gift. Investors can submit supporting documents and tax information (tax payment or tax exemption) to their broker (TDCC participant) for application. After TDCC receives the above information from the participant, TDCC sends the information to issuer or its transfer agent for review. The issuer or its transfer agent will then conduct the transfer registration after verifying the documents, and advise TDCC to transfer the securities to the TDCC account of the assignee, heir or donee.

Book-entry Operation for Securities Used for Stock Payment or for Waiver of Shareholding Starting 2008, TDCC offers book-entry services for investors who use the securities under custody as payment for subscription of stocks issued by companies in the process of incorporation or as payment for newly-issued shares in capital increase. TDCC also offers book-entry services for waiver of shareholding. Investors may request such account transfer services through their broker (TDCC participant) by submitting the application form and relevant supporting documents. The participant will then pass on the relevant information submitted by the investor to TDCC, who will forward the information to the issuer or its transfer agent for review. The issuer or its transfer agent will then conduct the transfer registration after verifying the documents, and advise TDCC to transfer the securities to the TDCC account of the company which is in the process of incorporation, the company issuing new shares for capital increase, or the company to take over the shares waived by the shareholder.

In case the investor mentioned in the preceding paragraph is using stocks to pay for the subscription of shares of a company in the process of incorporation, the representative of the company being incorporated should submit the relevant supporting documents to the issuer of stocks used for payment and open a “General Depository Account” in the name of “○○ Company Preparatory Office, Representative ○○○” before the application is processed.

(Chinese version only)