Short-Term Bill Services

TDCC provides Negotiable Certificates of Deposit (NCD), Commercial Paper I (CPI), Commercial Paper II (CPII), Banker's Acceptance (BA), Beneficial Securities and Asset-Backed Commercial Paper (ABCP), Municipal Notes and other short-term bills approved by the competent authorities. The services include physical securities depository, registration and book-entry delivery for dematerialized securities, clearing and settlement for both payments and securities, book-entry service for pledged bills, presentation notice and redemption for maturity bills.

Bills finance companies and investors can use the transmission interface provided by TDCC to execute trading, settlement and pledge operations via electronic means.

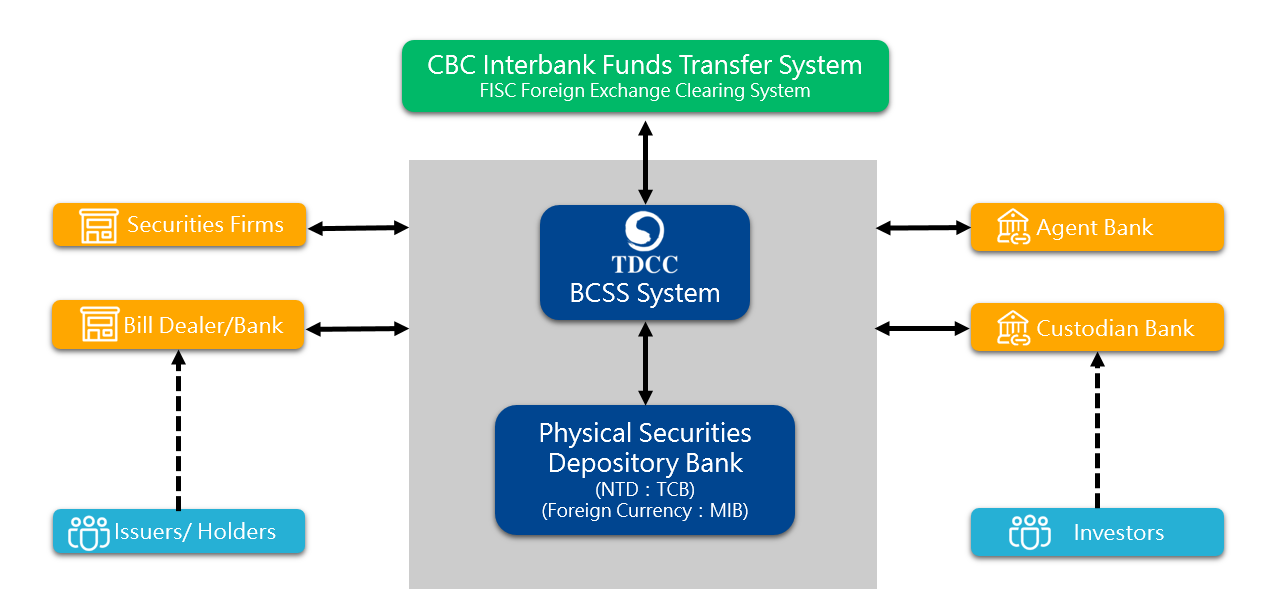

Operation Flow Chart of Short-Term Bill Services

Operations for registration, physical custody, and underwriting and initial purchase of short-term bills

Issuance and registration of short-term bills

Operations for custody of physical short-term bills

Operations for underwriting and initial purchase of short-term bills

Clearing and settlement operation

Transactions between bill dealers and investors

Transactions between bill dealers