Anti-Money Laundering

AML/CFT Screening Platform

- TDCC is a financial institution that is required to comply with Money Laundering Control Act. In order to perform customer due diligence, we established the Anti-Money Laundering and Counter-Terrorist Screening Platform (AML/CFT) in April 2016.

- AML/CFT Screening Platform was provided for external units to apply for inquiry in November 2016. It covers financial institutions and designated non-financial businesses or professions (DNBPs) that are required to comply with Money Laundering Control Act. To both assist our country in promoting AML/CFT and share the database with other units complying with Money Laundering Control Act.

- AML/CFT Screening Platform helps to raise awareness and prevalence of AML/CFT among units that are required to implement Anti-Money Laundering policy. The synergy of the platform was also recognized by the third round of mutual evaluations from Asia-Pacific Group on Money Laundering (APG) in 2018.

Company Transparency Platform (Report)

- The Ministry of Economic Affairs designated TDCC to establish and operate the "Company Transparency Platform" (CTP) in August 2018.

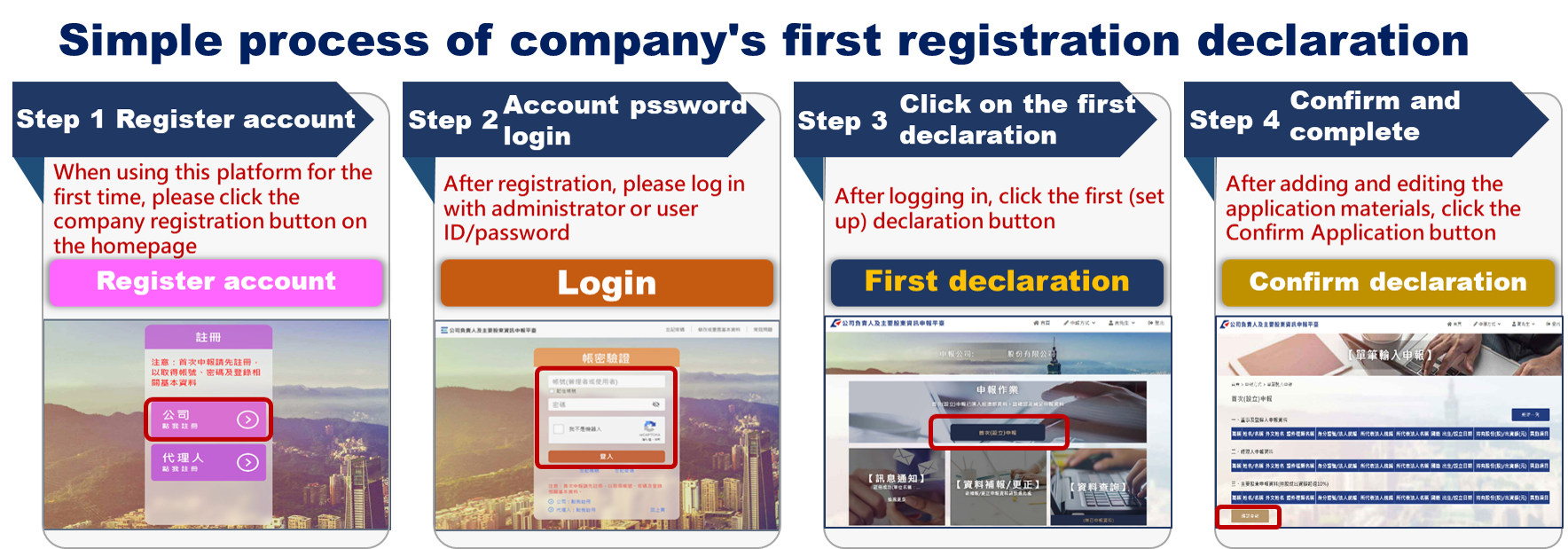

- CTP is established under Article 22-1 of the Company Act, which requires domestic companies to report the information of their directors, supervisors, managers, and shareholders holding more than ten percent of the issued shares or capital to the designated platform.

- CTP helps to enhance the information transparency of domestic companies, it is in accordance with the requirements of international anti-money laundering organizations. Starting from November 1, 2018, CTP has provided a reporting services for domestic companies (except for state-owned enterprises and public issued companies). CTP is highly praised by APG since the outstanding reporting ratio.

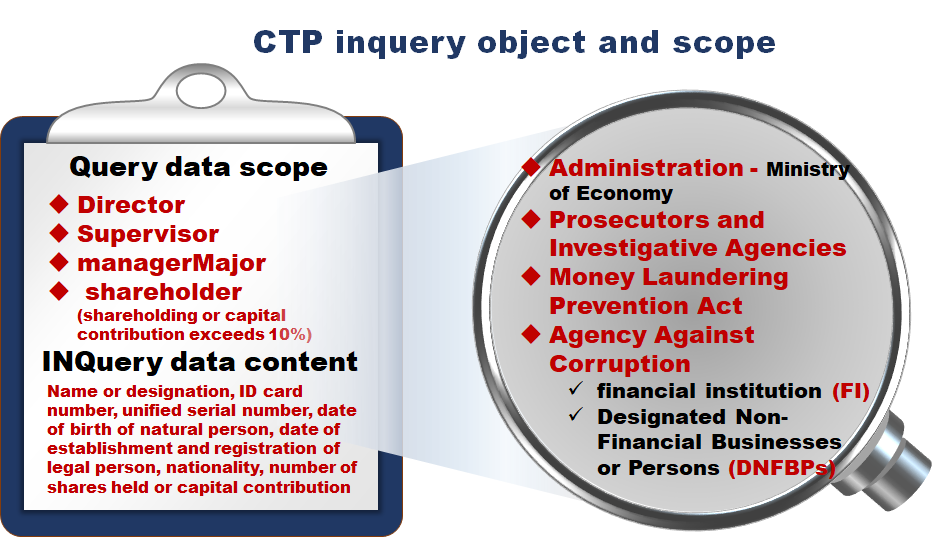

Company Transparency Platform (Inquiry)

- In accordance with the Money Laundering Control Act, financial institutions and DNBPs conducting customer due diligence should include identification of the beneficial owner.

- CTP has launched inquiry services for financial institutions and DNBPs since February 25, 2019, which helped to identify beneficial owners and enhance information transparency. Additionally, by providing the function to scan lists through our AML/CFT Screening Platform and report incorrect information, the platform was praised by APG evaluators, leading to our country achieving the best level of "Regular follow-up" in the third round of evaluations.