The Pandemic Has Become the Driving Force; Electronic Issuance of Commercial Papers Has Increased Exponentially

2020/04/23

With COVID-19 spreading rampantly around the globe, all of the citizens have gone out less often and avoid unnecessary social gatherings. Business without human contact or counter process has become people’s first choice. Due to this pneumonia, there is a boost to the “stay-at-home” economy, and trading volume through online and mobile banking has seen an upward trend. Indeed, the pandemic has become the driving force that accelerates Taiwan’s digital financial transformation.

According to TDCC’s big data statistics, there has been a significant increase in the proportion of electronic application for commercial paper issuance recently. From the beginning of this year, electronic application has occupied over 7 billion NT dollars’ worth of commercial paper issuance out of every 10 billion NT dollars. The figure is nearly 40% higher compared with the same period last year; it’s clear that corporations have been gradually adjusting their financial transaction pattern and become more accepting toward the digitalization of short term financing.

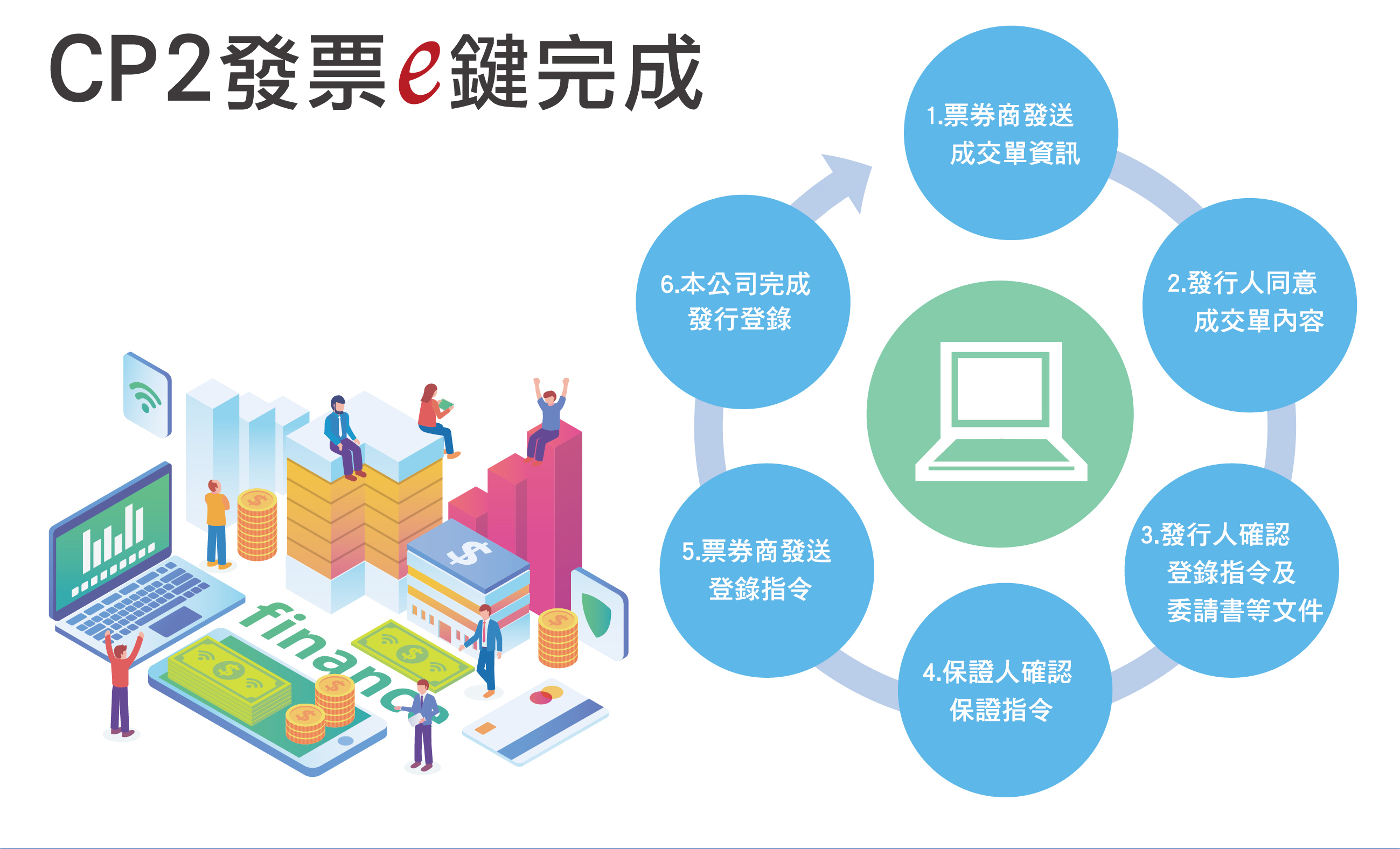

According to TDCC’s analysis, because of the pneumonia, some financial institutions and corporations have set up a separate workplace or activated a work-from-home pattern. Issuers adopt online application for commercial paper issuance , which can not only solve the problem of location limitation but also avoid the risk of disease transmission through sending and receiving paper documents. In the past, to issue commercial papers, the bill dealers had to deliver documents between the issuer and guarantee bank, and the entire process took 2-3 hours. As the process went digital, issuers don’t have to deliver paper documents anymore, and it takes only 5 minutes to complete the whole process, increasing the speed of receiving funding.

TDCC has been devoting time and effort to the commercial paper market for over a decade, and in recent years the company has continued to carry out digital transformation. Through innovative thinking, a variety of digital services have been launched, allowing the commercial paper market to develop a Fintech environment. This time, the service for digital issuance and registration of commercial paper has received favorable feedback from issuers. It not only improves the efficiency of financing but also serves as the hero in disease prevention unexpectedly.

Issuance of Dematerialized Commercial Paper (Chinese Version Only)