TDCC Uses Digital Technology to Mitigate the COVID-19 Crisis, “2020 Taiwan Proxy Preview Online Conference” Comes to a Successful Conclusion

2020/05/04

Many large-scale international events are postponed or canceled due to the COVID-19 pandemic. As the peak of the proxy season is approaching and the foreign shareholding ratio of the domestic capital market is increasing year by year, TDCC has invited international institutional investors, scholars and experts at home and abroad, as well as representatives of TWSE-listed and TPEx-listed companies to attend the 2020 Taiwan Proxy Preview Online Conference on April 30. TDCC hopes to help TWSE-listed and TPEx-listed companies make sure shareholders' meetings run smoothly. The conference has attracted over 300 TWSE-listed and TPEx-listed companies as well as institutional investors. There were approximately 600 participants joining the forum online. An impressively large audience shows that shareholders’ meeting is an important issue for companies in Taiwan.

Active Ownership Is a Hot Topic, both Regionally and Globally

TDCC, the organizer, has invited speakers and panelists from Blackrock, ISS Corporate Solutions, an international corporate governance advisor and the Taiwan Institute of Directors, as well as a representative from Business Today to be the panel moderator. Many speakers pointed out that Active Ownership is absolutely vital to enterprises in Taiwan. The concept values active communication between issuers and their institutional investors throughout the year, as well as proactive demand for improving environmental, social, and governance (ESG) indicators, which means institutional investors are more than just voters in shareholders’ meetings. As key foreign investors are scaling up their stewardship teams, it requires Taiwanese issuers more than just reaching out to their shareholders before shareholders’ meetings, they also need to incorporate ESG indicator enhancement into management plans. In addition, some speakers also indicated that there are still gaps between foreign and domestic’s expectation of board member. Most foreign investors are looking for more independent directors and fewer directors with multiple board appointments. They are also expecting TWSE-listed and TPEx-listed companies to establish formal nomination committees. Issuing companies in Taiwan can make relevant adjustments accordingly.

Responsible Investment Will Change Taiwan's Investment Ecosystem

Ms. Julie Wang, Senior Vice President and Head of Issuer Services Department, introduced the Blueprint for Responsible Investment Service (RI Service) at the conference. TDCC will provide institutional investors with core RI strategies, including filtering out enterprises in highly controversial industries, companies involving negative controversies, and issuers with undesirable overall ESG performance. The new system can rule out candidates with potential ESG risks, suggesting more secure and steady portfolios for institutional investors. The RI Service will also support institutional investors by identifying those companies' primary ESG-related issues. Institutional investors are able to formulate engagement plans and take initiatives to improve investee companies' ESG performances. Thus, active ownership can be further fulfilled in the Taiwanese market.

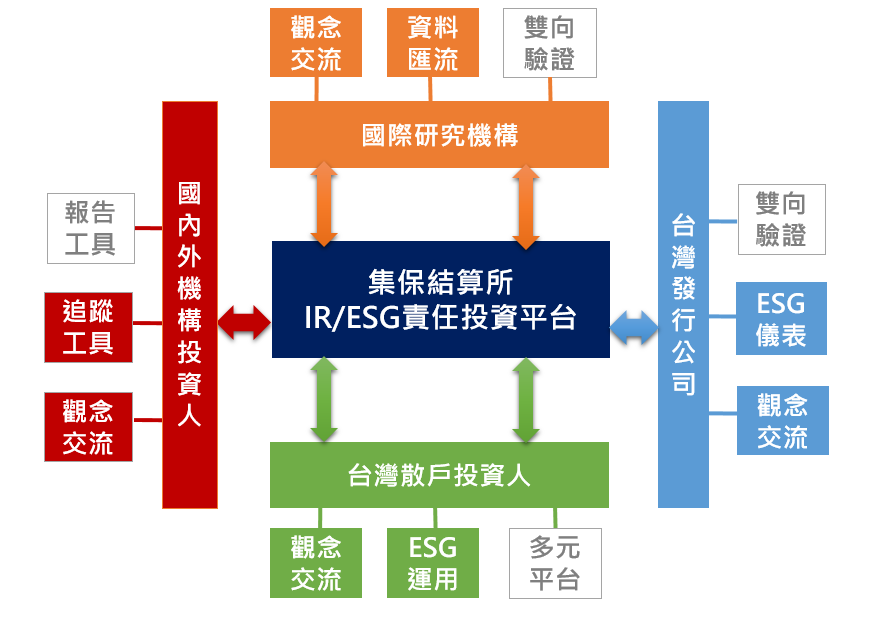

Taiwanese Enterprises and Institutions Are Invited to Join the RI Ecosystem

Mr. Han-Chiang Chu, TDCC President, stated that under the supervision of the Financial Supervisory Commission (FSC), the TDCC Investor Relations Platform (TDCC IR Platform) was launched at the beginning of 2019 and started to offer issuing companies major factors for international ESG ratings. TDCC is planning on putting the RI Service online in the second half of the year. Follow-up services that assist Taiwanese companies in interacting with the world’s leading ESG rating agencies will also be available along with the new service. The new system will help domestic institutional investors achieve RI and foster the development of the domestic RI ecosystem. In the hope of facilitating bilateral communication, TDCC will keep bridging the gaps between issuers and investors.

UN Principles for Responsible Investment vs. TDCC Responsible Investment Service System

| UN PRI | TDCC RI Service System |

|---|---|

| Before investment: ESG indicator integration | Comprehensive ESG screenings (products, controversies, ratings) |

| After investment: shareholder communication | ESG ratings |

| After investment: shareholder voting | E-voting platform |