Multiple Policies Contribute to Taiwan Stock Market’s Investing Population Rejuvenation

2022/05/12

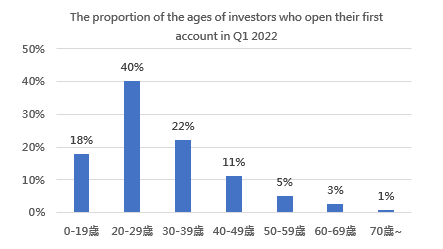

After Taiwan stock market showed its outstanding performance in 2021, TDCC’s statistics indicate that during the first quarter of 2022, the number of investors opening their first account in the securities market is 180,000, which is still a sharp increase. Among the investing population, the group under 20 years old accounts for an impressive 18% (more than 33,000 people), which shows the rejuvenation of the investing population. Of course, in addition to investment concepts being deeply rooted in the youth’s hearts, there’s a new trend of parents willing to accumulate stocks for their children.

According to TDCC President Han-Chiang Chu, the Authority’s inclusive financing policies have brought benefits. Dollar cost averaging carries the concept of “buy and hold,” and intraday odd lot trading allows small amount transactions. Therefore, the threshold for the younger generations to participate in the securities market is lower, and there are even more diverse and efficient investment options and channels. These are the factors in the increasingly lower age of the investing groups.

Source: TDCC Big Data Platform

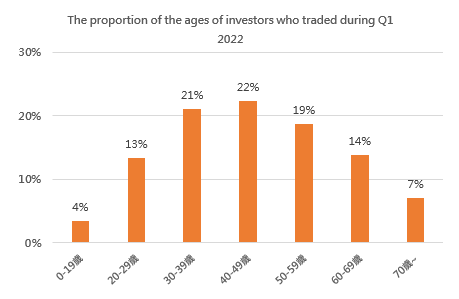

Besides, according to the Big Data Platform analysis of traders’ ages, 760,000 people under the age of 29 traded in the first quarter of 2022, accounting for 17% of the entire investing population. The average total trading amount per trader per quarter reaches NT$ 2.48 million, which instills new momentum in Taiwan stock market. Obviously, even though the instability of international politics increases the volatility of Taiwan’s stock market, the younger generations still actively participate in securities market investment and put their financial management concepts into practice. This is indeed a positive phenomenon for the securities market development in the long run.

Source: TDCC Big Data Platform