Review of the Taiwan Stock Market in 2023: Surge in New Accounts among Those Aged 19 and Below, Unveiling the Stock Market Favorites of the Year

2024/01/04

As we step into the Year of the Dragon, let's review the performance of the Taiwan Stock Market in 2023. The main index started the year at 14,108 points and experienced a continuous upward trend, reaching a peak with an increase of over 3,800 points. In contrast to the global downturn in both stocks and bonds in 2022, the performance of the Taiwan Stock Market in 2023 was notably impressive. According to statistics from TDCC's big data platform, as of the end of December 2023, the number of securities accounts in Taiwan increased by 978,000 throughout the year, with a total of 12.27 million account holders. This highlights the vibrant participation of domestic investors in the Taiwanese stock market.

Examining the age distribution of first-time stock market entrants, the majority is the 20-29 age group which constituted over 40%. There is a trend towards younger first-time investors, with the proportion of those aged 19 and below increasing from 15.26% in 2022 to 21.07% in 2023. This suggests a growing interest in investment and financial education among younger individuals. Looking at the top holdings of domestic investors by the end of 2023, the top 10 were, in order: China Steel, TSMC, Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF (00878), Yuanta Taiwan Dividend Plus ETF (0056), China Development Financial, Hon Hai, UMC, Yuanta P-shares Taiwan Top 50 ETF (0050), E.SUN Financial, and CTBC Financial.

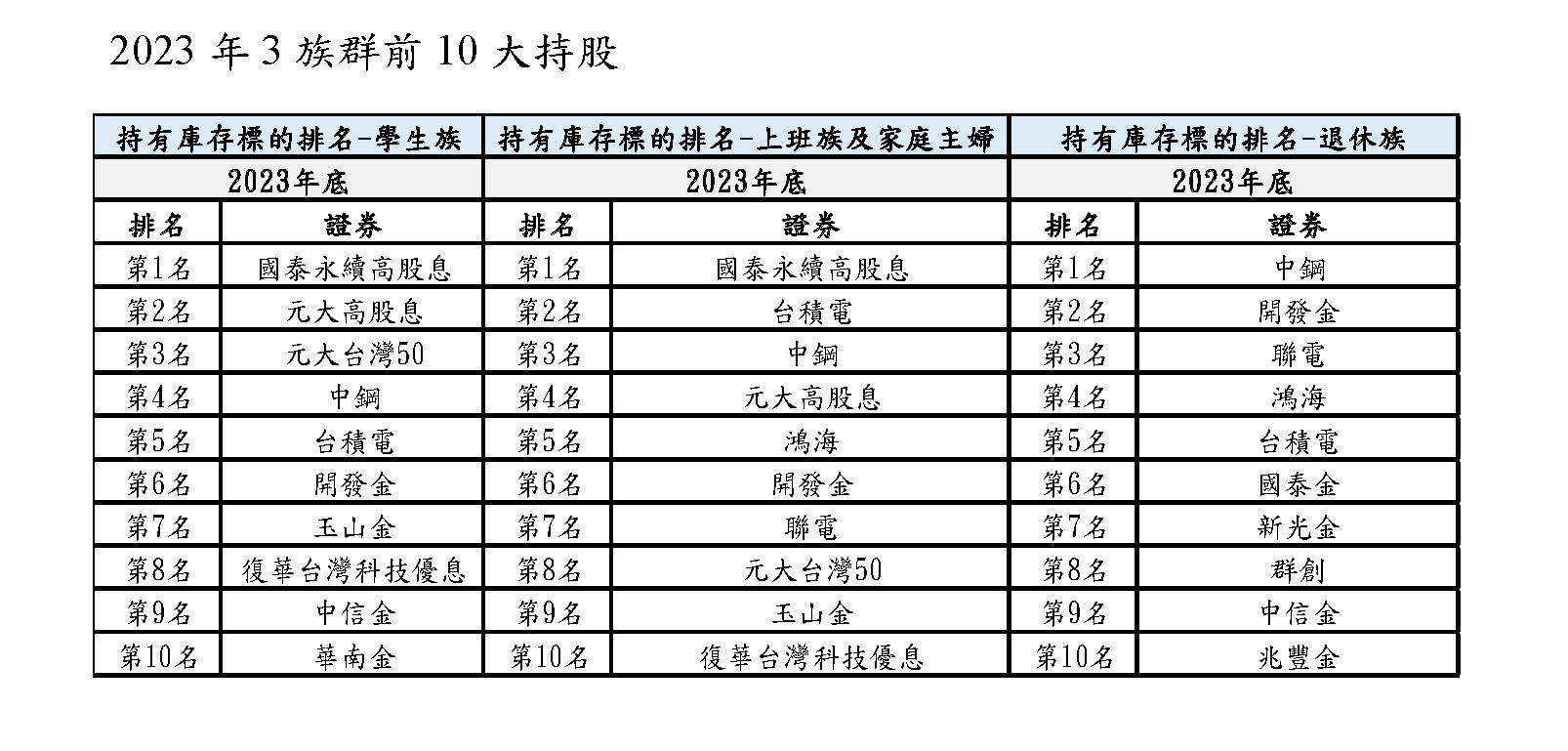

Further analysis by TDCC's big data platform, categorizing investors into students (22 and below), working individuals and housewives (23-65), and retirees (66 and above), revealed significant differences in stock preferences among age groups. For students, the top 5 holdings by the end of December were Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF (00878), Yuanta Taiwan Dividend Plus ETF (0056), Yuanta P-shares Taiwan Top 50 ETF (0050), China Steel, and TSMC, with Taiwan Stock Exchange Traded Funds (ETFs) dominating the top 3 positions. This indicates that ETFs, with their diversified and fixed dividend features, appeal to student investors.

For working individuals and housewives, who are the main stock investors, together accounted for approximately 67.9% of the total market value, the top 5 holdings were Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF (00878), TSMC, China Steel, Yuanta Taiwan Dividend Plus ETF (0056), and Hon Hai. Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF (00878) had over a million shareholders, and TSMC also had nearly a million shareholders. In contrast to student investors, working individuals and housewives showed a clear preference for large technology stocks.

Despite the rapid rise of Taiwan Stock ETFs in recent years, retirees still prefer individual stocks. As of the end of December, none of the top 20 holdings included a Taiwan Stock ETF, and financial stocks accounted for half of the top 10, including China Steel, China Development Financial, UMC, Hon Hai, TSMC, Cathay Financial, Shin Kong Financial, InnoLux, CTBC Financial, and Mega Bank. This highlights a strong contrast in ETF investment preferences between retirees and younger investors, with the latter favoring diversified investments.

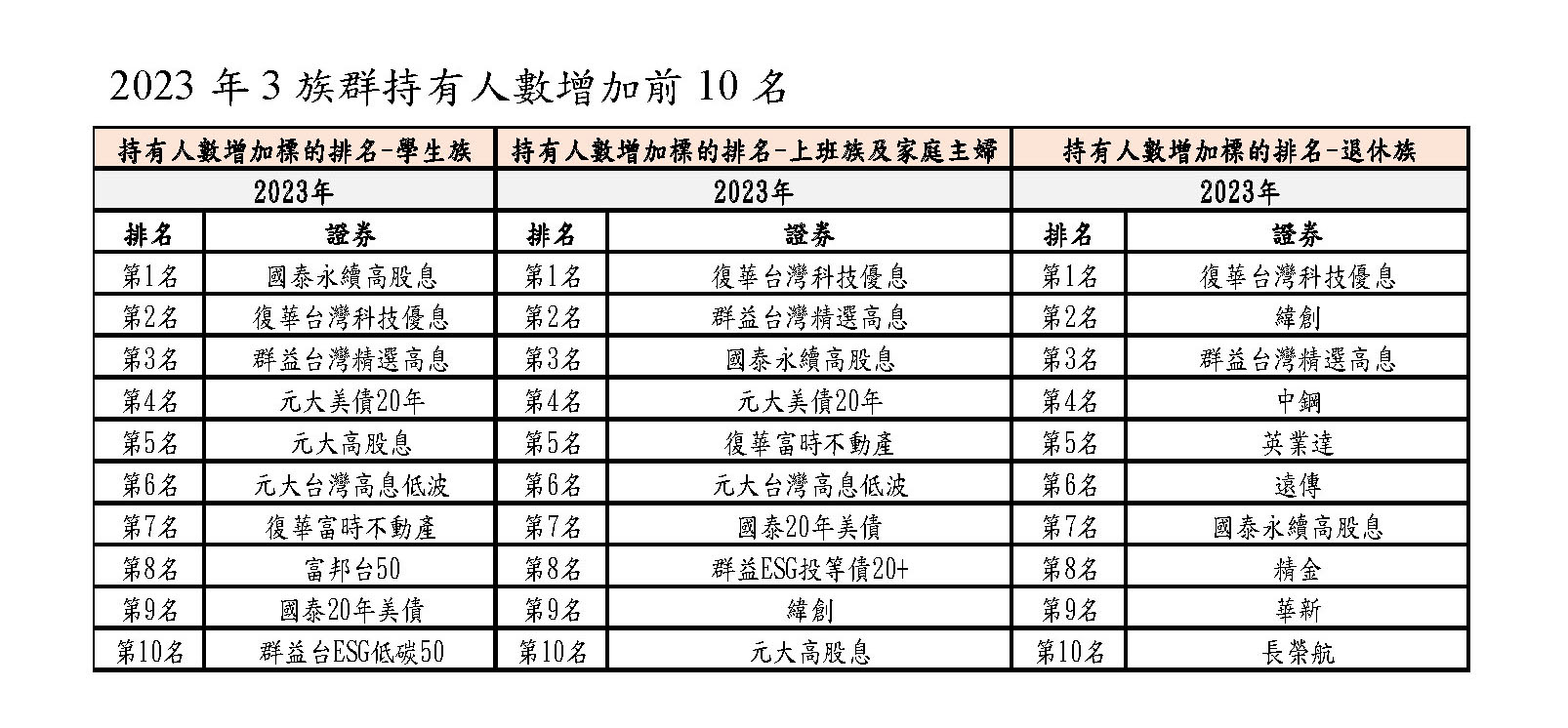

Looking at the most popular stocks among investors in 2023, the top 5 new additions in terms of shareholder numbers were almost identical among students, working individuals, and housewives. All of them were ETFs, including Fuh Hwa Taiwan Technology Dividend Highlight ETF (00929), Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF (00878), Capital Tip Customized Taiwan Select High Dividend Exchange Traded Fund (00919), Fuh Hwa FTSE Mortgage REITs ETF (00712), and Yuanta Taiwan Dividend Plus ETF (0056). For retirees, apart from Fuh Hwa Taiwan Technology Dividend Highlight ETF (00929) and Capital Tip Customized Taiwan Select High Dividend Exchange Traded Fund (00919), the rest were individual stocks, indicating an increasingly diversified investment landscape among Taiwanese investors in recent years, with ETFs playing an increasingly important role and gaining market recognition.

In conclusion, looking back at 2023 and looking ahead to 2024, investors should carefully assess their investment capabilities and risk tolerance, choose investment portfolios that suit their needs, and periodically review whether the conditions of their investments align with their investment goals. This approach will help avoid chasing highs and selling lows, allowing investors to make rational decisions and create investment benefits.