TDCC Deepens Cooperation with JASDEC - Fruitful Results from Visit to Japan

2024/04/15

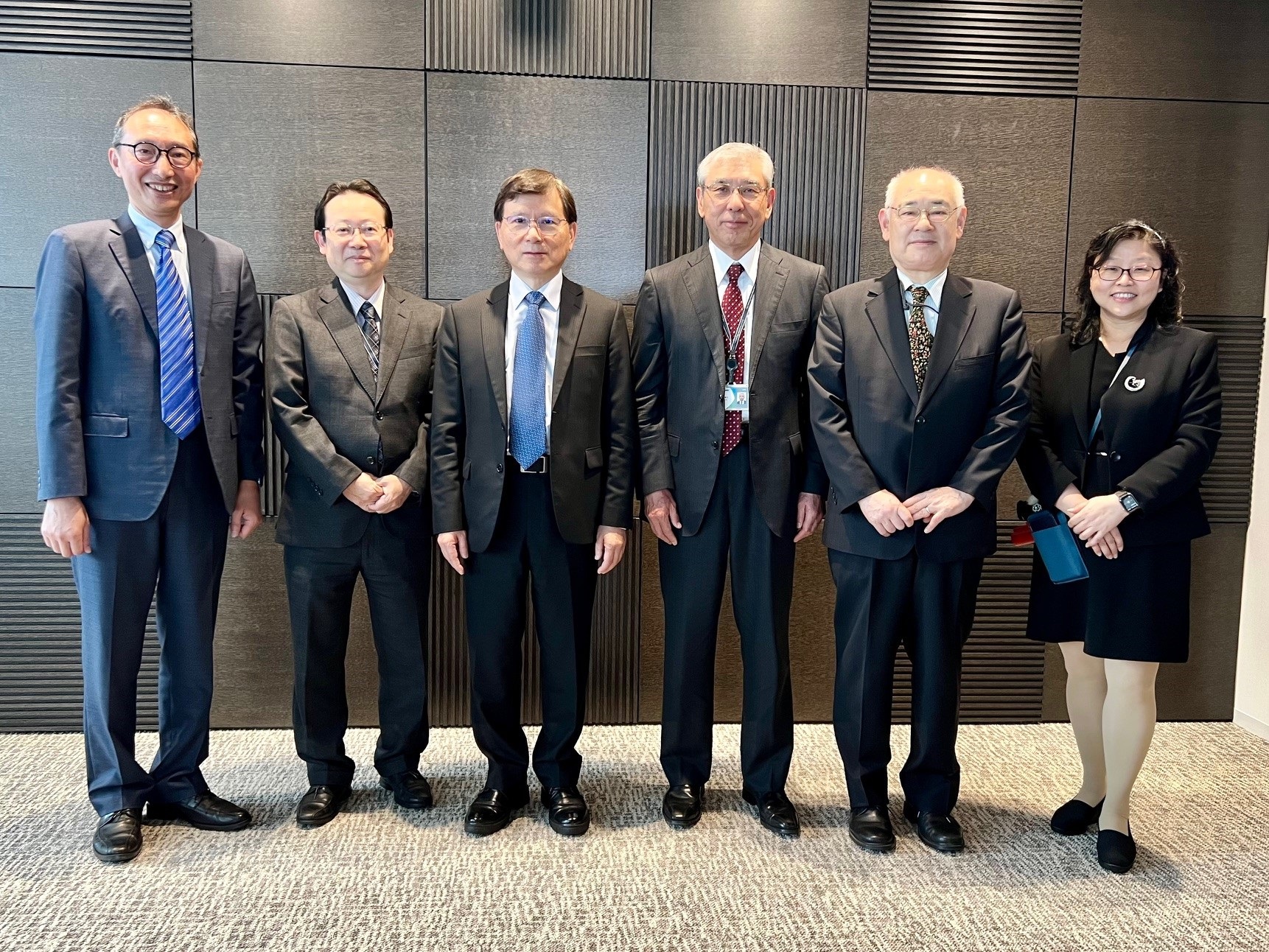

To strengthen the connection between the capital markets of Taiwan and Japan, Bing-Huei Lin, Chairman of TDCC, led relevant department heads on a visit to institutions in Japan, including the Japan Securities Depository Center, Inc. (JASDEC), Investor Communications Japan (ICJ), and Japan Investment Trusts Association (JITA), from April 11th to 13th, reaching a consensus on deep cooperation in multiple areas and exchanging fruitful results.

Japan recently announced the end of negative interest rates. With various policies and market reforms driving it, the Nikkei Index in the Japanese stock market has recently reached new highs, surpassing the peak set during Japan's economic bubble in 1989. Japanese stocks have once again become the leader in Asia, attracting international attention to the new wave of "Japan's resurgence."

To draw lessons from Japan's capital market development experience, and with both JASDEC and TDCC celebrating their 40th and 35th anniversaries respectively this year, the two institutions, both founding members and executive committee members of the Asia-Pacific CSD Group (ACG), have been promoting the modernization of regional capital markets and nurturing a profound friendship for over 30 years. During the meeting, Akio Nakamura, President and CEO of JASDEC, personally led various department heads to welcome the delegation. They not only discussed business development and future cooperation, but Akio Nakamura also expressed hope for enhanced exchanges between Taiwan and Japan, two earthquake-prone countries, particularly in disaster response, to enhance the resilience of capital market services.

Investor Communications Japan (ICJ) is a joint venture established in 2004 by the Tokyo Stock Exchange and Broadridge, a U.S.-based company. The company provides services such as domestic and cross-border shareholder voting, virtual shareholder meetings, and shareholder-related big data services to over 1,800 listed companies in Japan. During the meeting, both sides felt a similarity in their respective business development trajectories and recognized their critical roles in facilitating communication between companies and shareholders in their respective markets. ICJ President Shigeo Imakiire expressed his anticipation for continued exchanges between the two sides in innovative services and personnel training, further contributing to the growth and development of the markets in Taiwan and Japan.

The Japan Investment Trusts Association is a peer organization of Japan's investment trust industry. In recent years, it has played a key role in the development of asset management centers in Japan. In order to align with the policies of the Financial Supervisory Commission and study Taiwan's potential as an Asia-Pacific asset management center, TDCC visited the association to gain a deeper understanding and learn from Japan's institutional development background and specific practices. Jun Sugie, Vice Chairman of the association, personally explained the Japanese government's "nation built on asset utilization" policy and related measures. Both sides exchanged views on the current status and development of the asset management industry in Taiwan and Japan, and the interaction was lively.

Bing-Huei Lin stated that the three institutions visited during this trip all expressed their concern and condolences for the strong earthquake in Hualien on April 3rd, demonstrating the deep friendship between Taiwan and Japan. TDCC will continue to break through in international cooperation, actively demonstrate Taiwan's market's diverse growth momentum through visits and information sharing with relevant foreign institutions, and enhance international visibility. In terms of business development, TDCC has promoted a series of digital shareholder services such as " TDCC Stockservice " in recent years, and has also provided various convenient measures in the field of sustainable finance, such as ESG ratings and institutional corporate governance, continuing to deepen the four major visions of "innovation," "resilience," "inclusiveness," and "sustainability," constructing Taiwan's digital financial infrastructure, solidifying operational resilience, and embracing market changes and sustainable finance.