It’s time to make good use of your annual bonus, and an investment portfolio adjustment could be a good start

2021/01/05

At we begin 2021, we would like to highlight some of the largest and most sought-after funds by Taiwanese investors in 2020 at our associated Fund Clear website (www.fundclear.com.tw).

Offshore MIP funds and onshore ETFs were the main investment targets

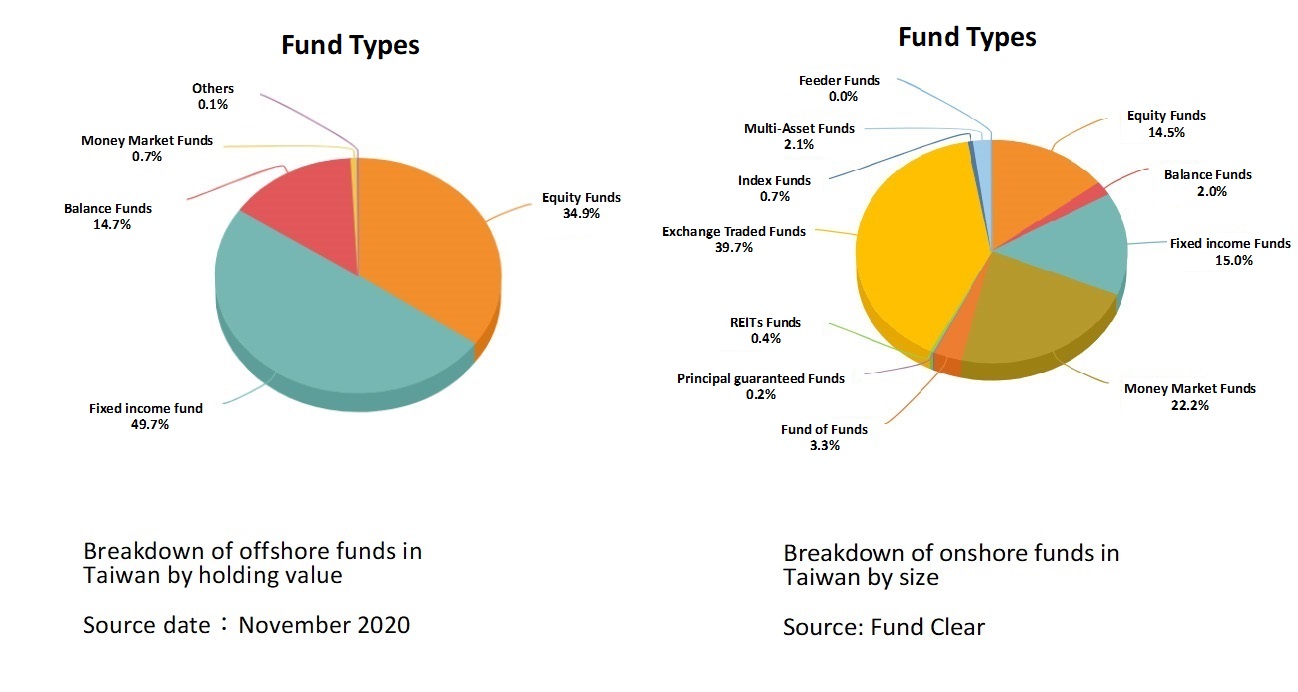

The aggregate value of the offshore mutual funds held by Taiwanese investors reached NT$3.6 trillion as of the end of November 2020, according to Fund Clear. The majority of investors in Taiwan had a clear preference for fixed income and balanced funds that offer monthly dividend payouts. The two types of funds accounted for 49.7% and 14.7% of the total holding value respectively. Holdings in the three most popular offshore funds were worth over NT$900 billion, representing about 25% of the total. These three are monthly income plan (MIP) funds, suggesting that funds which offer stable monthly dividends were still favored by Taiwanese investors. Regarding onshore funds, exchange traded funds (ETFs) issued by securities investment trust companies took the lion’s share of the market value at 39.7%, followed by money market funds at 22.2% and fixed income funds at 15%.

Stock funds gaining traction after stock market volatility in 2020

Global stock markets underwent drastic swings in 2020, prompting investors to substantially adjust their portfolios. According to Fund Clear, stock funds have been increasingly favored by mutual fund investors in Taiwan over the past six months. As of the end of November 2020, half of the ten most purchased mutual funds were stock funds, and the weighting of stock funds in total fund subscription arrived at 49.7%, while the weighting of fixed income funds fell to 37.8%, implying investors might have restored confidence. This is also evidenced by increased subscriptions of higher-risk stock funds after major stock market swings came to an end.

As for onshore funds, the purchase of ETFs accounted for only 27.2% of total subscription over the past six months, down from 43.4% in 2019. As of November 2020, the weighting of money market funds in gross onshore fund subscription in Taiwan peaked at 55.9%, while the weighting of ETFs fell to 15.8% and the weighting of stock funds edged up to 13.1%. This indicates that investors have reshuffled their portfolios in the wake of major stock market swings across the globe.

Online fund investment platform a useful tool to build fortune

If it’s been a long time since you last checked your mutual fund investments, now is the time to make a thorough review of your portfolio as companies are about to distribute annual bonuses to their employees, and you can put that money to good use by building or expanding your investment portfolio. In fact, a lot of mutual funds can be traded online now. To cater to the needs of younger and less affluent investors, three mutual fund online trading platforms, namely Fund Rich, Anue Fund and Ezfunds, have been operational in Taiwan, boasting a wide array of products with low transaction fees. Additional fee discounts are also offered on a sporadic basis. These online trading platforms have been quite popular among fund investors, and like Fund Clear, we believe their roll out makes investing easier for everyone.