Be Your Own Investor! Fund Subscription Value of the TDCC Platform Again Reaches a Record High and Subscriptions Through Dollar-Cost Averaging Grow Beyond Expectations

2022/06/09

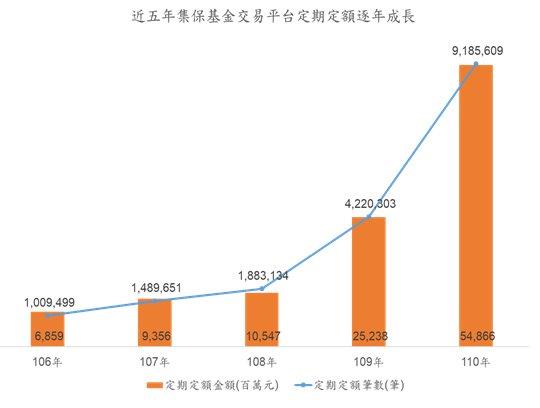

Last year, the COVID-19 pandemic had impacts on the world’s financial market, and both local and international investors were investing in truculent stock markets. According to the statistics of the Taiwan Depository Clearing Corporation (TDCC) Fund Settlement Platform, the platform has attracted over NT$150 billion in mutual fund subscriptions in 2021. With a 33% growth rate, the number of subscriptions also reached 11.35 million. Among those figures, NT$54.9 billion or 9.19 million subscriptions adopted the dollar-cost averaging strategy. They account for 35% of the subscription value and 81% of the subscription number. Besides, the number of subscriptions in Q1 2022 are up 10% year over year. Relevant data show that fund investment has grown increasingly with dollar-cost averaging becoming the mainstream, and the popularity of purchasing funds through online services has also increased.

The main distribution channels for funds in Taiwan are banks, securities firms, investment trusts, and online fund distribution platforms that have rapidly grown in recent years, including FundRich Securities, AnueFund, and EZFunds. These online fund distribution platforms’ back-office service system is the Fund Settlement Platform run by the TDCC. As investors can completely enjoy their decision-making power on online fund platforms which free them from the influences of financial consultants or their family and friends, such channels are especially popular with price-sensitive investors with relatively low incomes.

Julie Wang, Senior Vice President of TDCC Fund & Global Services, stated that the subscription value and number in the past five years have gone through a process of leaps. During the same time interval, the compound annual growth rate (CAGR) of the subscription value accounts for 30%, and the orders made with dollar-cost averaging strategy in 2021 are as high as eight times or more of that five years ago. Averagely speaking, each order has to pay out almost NT$6,000. Obviously, more and more investors choose to invest through online fund distribution channels. Besides, investors are accumulating their property with dollar-cost averaging to minimize risk exposure against market fluctuations.

As Taiwan is aging fast, a lot of people will need to work on their retirement planning. The Financial Supervisory Commission (FSC) is promoting investment ideas like “use dollar-cost averaging practice, make long-term and regular investments, and plan ahead of retirement.” Threfore, the FSC also asked the TDCC to organize retirement planning programs like ReLife Project—Experimental Project for Self Pension Saving Investment and Pension Platform. The competent authorities have detected the public’s demands to prepare for their retirement through fund investment, and now people in Taiwan are getting used to accumulating their property with dollar-cost averaging. To have the best retirement, we need to start early and be responsible investors for ourselves. The trend for retirement planning is to buy funds online through fund distribution platforms, and don’t forget to use dollar-cost average method. Are you ready to swim with the tide?