TDCC's Onshore Fund Centralized Clearing Platform Enhances Fund Market Service Ecosystem

2022/10/12

In order to make the domestic fund market more competitive, the Financial Supervisory Commission (FSC) announced on May 12, 2022 that it would promote a centralized clearing and payment mechanism for investment trust funds, and TDCC was instructed to establish "Onshore Fund Centralized Clearing Platform" to follow the way of advanced international markets. The system aims to standardize and automate the settlement and delivery mechanisms of Taiwan's fund market, as well as to expedite an overall upgrade via platform economy.

Onshore Fund Centralized Clearing Platform for Service Transformation and Upgrade

At the end of 2020, the FSC announced the "Capital Market Roadmap" policy with the goal of building a forward-looking and internationally competitive capital market. The FSC's major tasks include "enhancing the market function and competitiveness of financial intermediaries", and advocating the adoption of the Onshore Fund Centralized Clearing Platform among investment trust companies, both of which promote the progress of the capital market, and aim to improve the operational efficiency of the domestic fund market, thereby enhancing the competitiveness of the overall industry.

President of TDCC Te-Hsiang Chen said that in order to accomplish the policy mission of the transformation and upgrading of the fund market, TDCC considered the centralized clearing systems of fund markets in Europe, the United States, Japan, and South Korea. With the company's experiences in Taiwan's fund market services over the years, TDCC will establish the Onshore Fund Centralized Clearing Platform and make it the core of its fund business in the next three years. The system will be set up in and launched in three phases, and gradually streamline the market's remittance operations from the existing many-to-many into many-to-one and one-to-many relationship. The Onshore Fund Centralized Clearing Platform will add to Taiwan's existing resilient fund market infrastructure and reduce costs for fund companies. However, in order to make the Onshore Fund Centralized Clearing Platform more effective in platform economy services, it takes not only TDCC's role as the intermediary agent for fund market services, but further requires active participation from everyone in the fund market (including investment trust companies, distributors, custodians, etc.) to change the current complex and labor-intensive operation processes, and bring about more convenient and efficient fund market services.

A market hub that nurtures diversified services in the fund market.

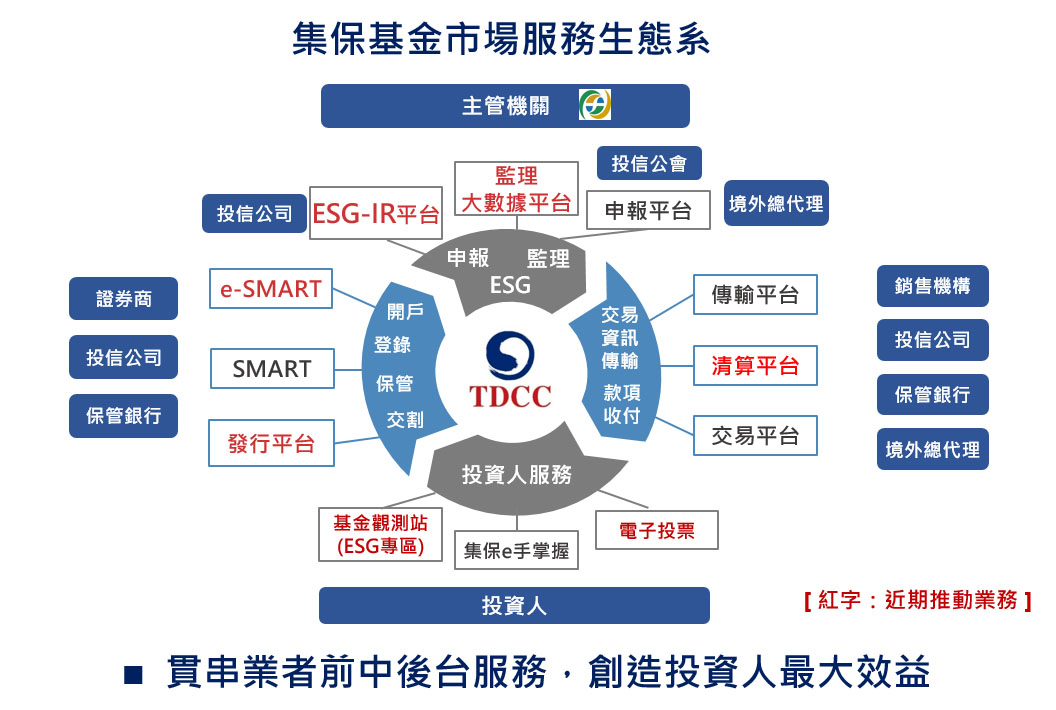

Over the years, TDCC has been dedicated to developing a variety of services for the fund market, including the registry of dematerialized issuance of funds, transaction information transmission, receipts and payments, Fund Clear, and integrating fund assets and product information in the e-Passbook APP, among others. These digital services are the result of TDCC's long-term cultivation for the fund market. The establishment of the Onshore Fund Centralized Clearing Platform is a prominent project from TDCC this year to assist the competent authority in upgrading Taiwan's fund industry.

Altruism and seeking the common good for the fund market service ecosystem.

Looking to the past while keeping a prospect for the future, TDCC will not only deepen the fund market through the Onshore Fund Centralized Clearing Platform, but will also optimize Fund Clear in the coming years to facilitate market information transparency, strengthen fund investment education, provide inclusive financial services, and extend the use of data with AI for the developmental work in fund market supervision. Under the guidance of the competent authority, TDCC will continue to work closely with relevant associations and market participants in the fund market, and integrate diverse fund services so as to create a better, more complete fund service ecosystem in the market.