TDCC's New eSMART Service Facilitates Digitalization of the Fund Market

2023/01/16

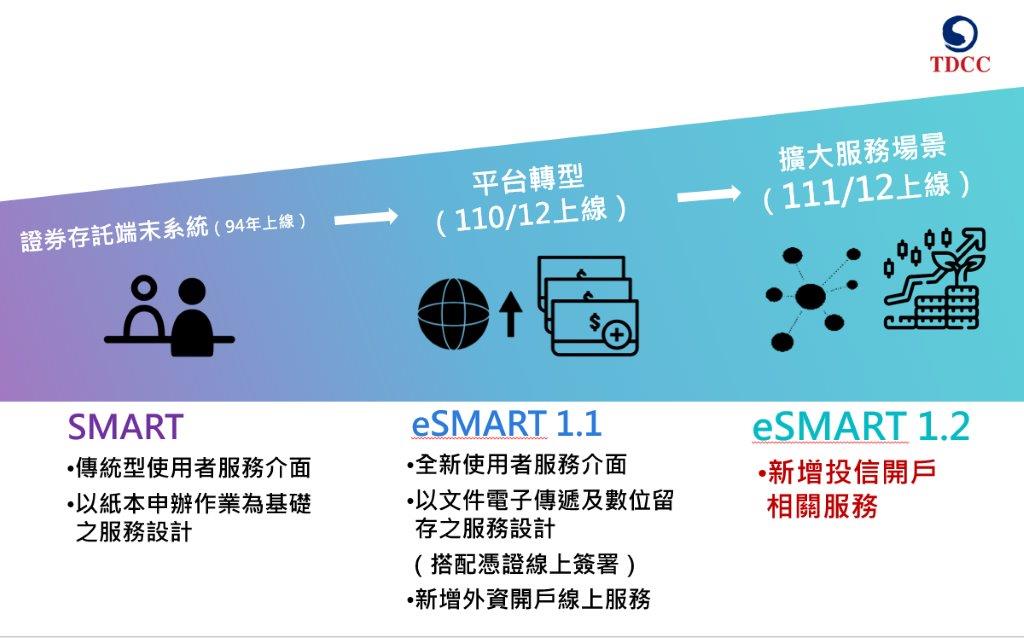

TDCC's eSMART system is a digital environment created with all investing participants in mind. In December 2021, TDCC introduced services that allow custodian institutions to open custodial accounts at securities firms for foreign investors online. With more services added to the system in 2022, investment trust companies could use the Internet to apply, sign, transfer and safe-keep documents related to custodial book-entry transfer accounts with custodian institutions and securities firm. These services went live on December 26, 2022.

Each year, there are over 60 offerings of securities investment trust funds in Taiwan. Once a fund is established, the opening of a custodial account is required by law for domestic investments, and multiple accounts at securities firms shall be opened as well. Currently, opening of such accounts with investment trust companies, fund custodian banks, and securities firms rely on manual labor for mailing paper applications, confirmation, certification and safe keeping. In order to facilitate the fund market's digital development and its service synergy on the platform, TDCC is introducing new digital services for investment trust funds to make account opening operations more efficient.

President of TDCC Te-Hsiang Chen said that when these services go live on the eSMART system, investment trust companies will be able to electronically send account opening information to multiple corresponding institutions, reducing operational costs derived from manual labor and making redundant physical application copies. All data will be handled in a secure environment and electronically signed to complete relevant procedures. The entire process and its documents will be stored digitally, which is in line with TDCC's social responsibility and its stance on sustainability. TDCC expects the new services to be adopted by relevant parties in the future for opening fund accounts and logging data change.

TDCC continues to honor its long-term commitment to providing ever-improving services for the fund market. Entering 2023, the company will build on existing solid foundations and expand various frontiers in the fund market, including Onshore Fund Centralized Settlement System, education on fund investment, and practices of inclusive financing, etc, all aiming to maximize its service capacity as a market hub and perfect the service ecosystem for the fund market.