TDCC Enhancing Book-Entry Transfer Services in Response to the Widespread Adoption of Electronic Signatures

2025/06/02

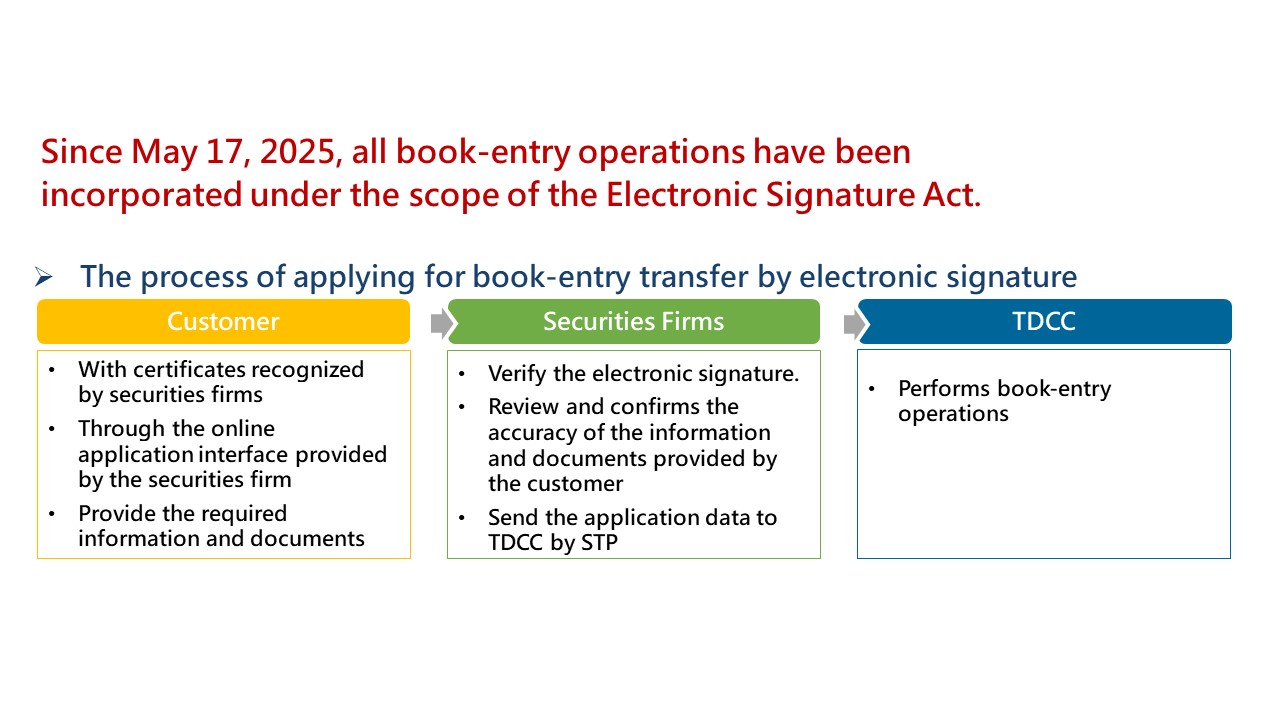

In view of the advantages of electronic signatures in enhancing transaction security and operational efficiency, the government is actively promoting amendments to the Electronic Signatures Act, aiming to broaden the application and adoption of electronic signatures in areas such as e-Government and digital finance. The Financial Supervisory Commission (FSC) has announced that, effective May 17, 2025, all book-entry transfer transactions previously excluded from the applicability of the Act will now fall within its scope and may utilize digital signatures. Consequently, all book-entry transfer operations are now subject to the Electronic Signatures Act. Clients, with the consent of their securities firms, will be able to apply for book-entry transfers in accordance with the provisions of the Act, thereby benefiting from the convenience, efficiency, and security offered by electronic signatures while jointly advancing the digital transformation of the financial market.

To support securities firms in implementing operations accepting electronic signatures and integrating automated book-entry transfer processes, the Taiwan Depository & Clearing Corporation (TDCC) has completed the expansion of its Straight-Through Processing (STP) service for book-entry transfers. This enhanced service now covers nine of book-entry transactions and 29 related transaction functions, and was officially launched on May 19, 2025.

Mr. Daniel Chen, President of TDCC, stated that the Corporation continues to align with policy developments and remains committed to optimizing the back-end infrastructure of Taiwan's securities market. Since its launch in 2016, the book-entry STP service has enabled securities firms to automate transaction data transmission, replacing manual operations and becoming a cornerstone of their digital transformation. The STP mechanism not only enhances operational efficiency but also empowers securities firms to provide clients with comprehensive, secure, and convenient digital financial services. In recent years, the service has processed approximately 8 million transactions annually, with the number surpassing 10 million in 2024—demonstrating the financial sector's strong adoption of the STP model.

TDCC remains committed to fostering a fully digitalized book-entry processing environment and will continue to expand system automation functions based on the practical needs of securities firms. These efforts aim to strengthen the flexibility and resilience of Taiwan’s financial market infrastructure and proactively align with international trends in preparation for potential changes to settlement cycles. Looking ahead, TDCC will continue to provide more standardized and automated services to support the digital transformation of the market and contribute to the sustainable development of Taiwan’s capital markets.