2024 Taiwan Stock Market Review: The Number of Shareholders in the Top 5 Holdings Exceeded One Million, High-Dividend ETFs Have Become the Mainstream Investment Tool in the Taiwan Stock Market

2025/01/08

As we step into the Year of the Snake, let's review the performance of the Taiwan Stock Market in 2024. Driven by corporate profit growth, Taiwan's stock market saw the TAIEX rise from 17,930 points to a historic high of 24,416 points, achieving an annual increase of over 36%. The bullish momentum continued, with the last year's performance being truly surprising. According to the TDCC's big data platform, as of the end of December 2024, the number of individual investors in Taiwan's stock market increased by 700,000 to reach 12.98 million, showing significant growth.

Observing changes in stock holdings, the top 5 individual investor holdings in 2024 showed a continued rise in the appeal of high dividend yield ETFs compared to 2023. In 2023, the top 5 holdings were China Steel, TSMC, Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF, Yuanta Taiwan Dividend Plus ETF, and the KGI Financial. In 2024, high dividend yield ETFs took the lead, with the top 5 holdings consisting of Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF, TSMC, China Steel, Yuanta Taiwan Dividend Plus ETF, and Capital Tip Customized Taiwan Select High Dividend ETF. Each of these stocks had over a million shareholders, reflecting a shift away from individual stocks and increasing interest in high dividend yield ETFs.

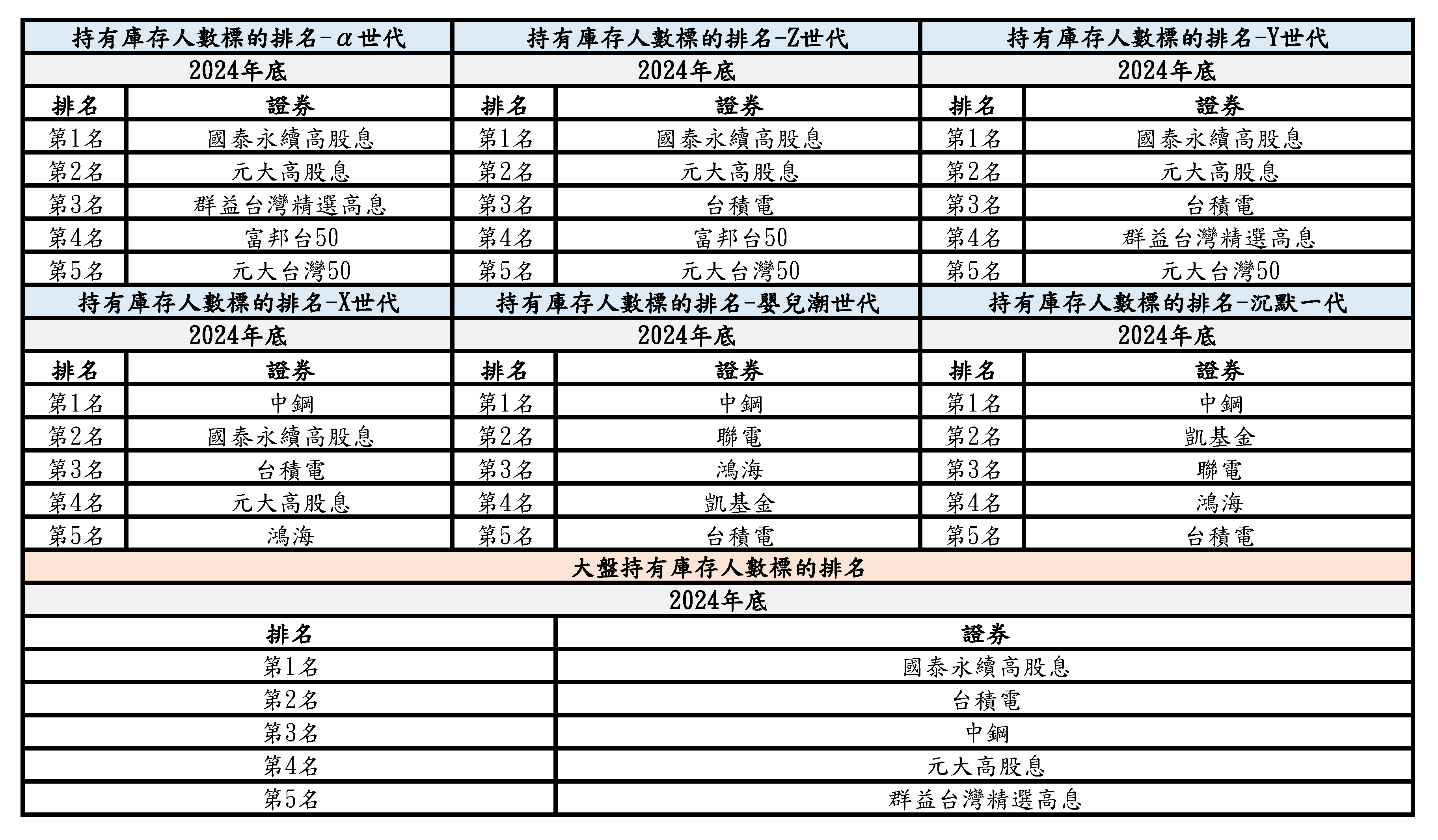

Furthermore, if we categorize investors into six generations : α Generation (0-11 years), Z Generation (12-27 years), Y Generation (28-43 years), X Generation (44-59 years), Baby Boomer Generation (60-78 years), and Silent Generation (79+ years). We observe certain differences in stock distribution across generations. For the α (0-11 years), Z (12-27 years), and Y (28-43 years) Generations, aside from TSMC, their top 5 holdings are predominantly high dividend yield and market-cap ETFs, with Cathay MSCI Taiwan ESG Sustainability High Dividend Yield ETF being the top holding for all three generations. In contrast, for the X (44-59 years), Baby Boomer (60-78 years), and Silent (79+ years) Generations all have China Steel as their top holding.

Compared to older generations, younger generations clearly prefer holding Taiwan stock ETFs, and the number of individual stocks in the top 10 holdings has gradually decreased. For example, in 2023, the α Generation (0-11 years) had only three ETFs in their top 10 holdings, with the remaining seven stocks mostly being financial stocks, aside from TSMC and China Steel. In 2024, however, the top 10 holdings for α Generation included only TSMC, E.SUN Financial, and China Steel among individual stocks, with the remaining seven being Taiwan stock ETFs: Cathay MSCI Taiwan ESG Sustainable High Dividend Yield ETF, Yuanta Taiwan High Dividend Plus ETF, Capital Tip Customized Taiwan Select High Dividend ETF, Fubon FTSE TWSE Taiwan 50 ETF, Yuanta/P-shares Taiwan Top 50 ETF, Fuh Hwa Taiwan Technology Dividend Highlight ETF, and Yuanta Taiwan Value High Dividend ETF. This shows that parents of the α Generation, primarily from the X and Y Generations, are increasingly inclined to treat Taiwan stock ETFs as a core long-term investment.

In 2024, after the U.S. Federal Reserve's interest rate cuts and the U.S. presidential election, Taiwan's stock market faced multiple fluctuations amidst a changing international financial landscape. Compared to holding individual stocks, ETFs, which offer a diversified basket of stocks and stable cash flow, have become increasingly popular with investors. Looking ahead, as market conditions evolve, it is crucial for investors to continue monitoring global economic changes, understanding the logic behind market fluctuations, and adjusting their investment strategies in a timely manner to ensure stable returns.