TDCC Boosts Back-Office Efficiency and Digitalization for Securities Firms

2025/07/02

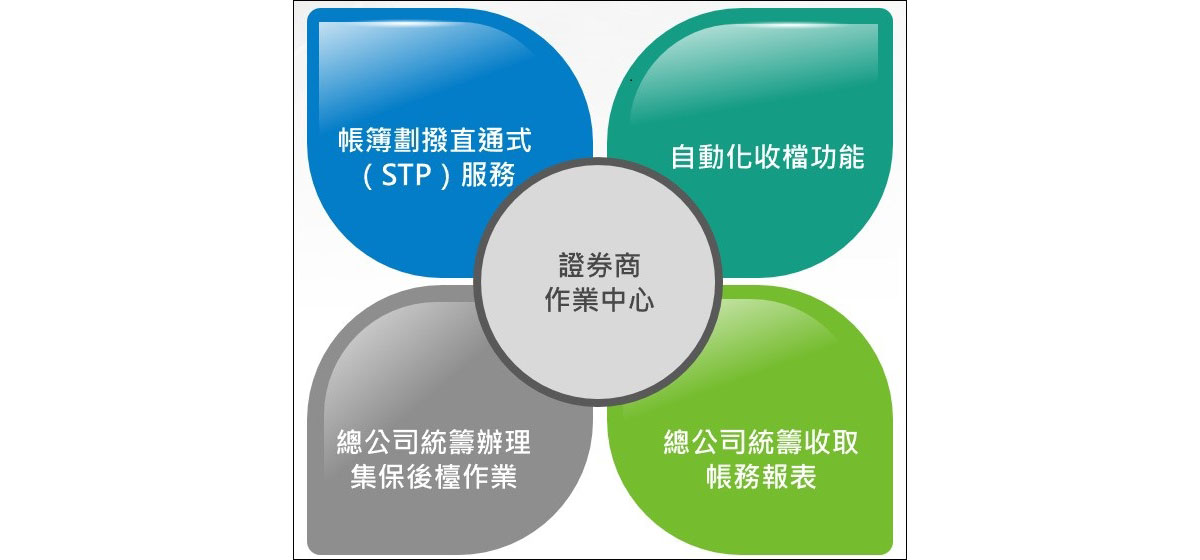

To assist securities firms in establishing back-office operation centers, the Taiwan Depository & Clearing Corporation (TDCC) has continued to optimize its book-entry transfer processes. TDCC has actively expanded its book-entry transfer Straight-Through Processing (STP) services and automated document collection functions. In June 2025, the final piece of the puzzle was completed with the launch of a new system function that allows head offices to centrally retrieve transaction reports. With this, the automation and streamlining of book-entry transfer operations for centralized back-office center has been fully achieved.

In line with the ongoing trend of financial digitalization, the Financial Supervisory Commission (FSC) has permitted securities firms to consolidate TDCC-related back-office operations based on their business needs. This replaces the previous model where branch offices duplicated efforts, thereby enabling firms to better integrate resources and enhance operational efficiency.

Mr. Daniel Chen, President of TDCC, stated that TDCC has long allowed investors to initiate book-entry transfers via securities firms using electronic signatures in compliance with relevant regulations. Securities firms then notify TDCC through the STP system, achieving full digitalization of the book-entry transfer process. While the STP system previously processed around 8 million transactions annually, the volume exceeded 10 million in 2024 and is projected to surpass 14 million in 2025, reflecting robust market demand. Since 2022, TDCC has also allowed customers to apply for book-entry transfers at any branch of their securities firm, enhancing flexibility for investors and enabling firms to centralize operations. Securities firm head offices can access transaction data across all branches, supporting more effective resource integration and centralized management.

President Chen emphasized that TDCC will continue to promote system upgrades and standardize operations to help securities firms seize opportunities brought by fintech transformation. These efforts aim to strengthen Taiwan's financial market infrastructure and digital resilience, thereby fostering the sustainable development of the capital market.