Dematerialized Registration/Delivery

Book-Entry Distribution of Securities show or hide details

-

1.

Can investors sell or settle a short sale with stocks distributed via book-entry on the distribution date? Can investors apply for withdrawal and transfer?

show or hide detailsOn the distribution date, customers can sell or settle a short sale. However, withdrawal is not allowed. Also, to prevent the use of newly distributed stocks for settlements of sale amount in one and two business days before, the stocks are listed under the "controlled securities from book-entry deposit" in the customer's balance on the distribution day and the following business day. The transfer shall be conducted by executing the "Controlled Securities - Deposited Securities Transfer" transaction (Code: A63). The customer's balance of the transferee shall still be listed under "controlled securities from book-entry deposit."

-

2.

Why are stocks distributed through TDCC via book-entry are not transferred to investors' expected accounts?

show or hide detailsThis situation may occur when investors have central depository accounts with different securities firms. During the stock's book closure period, TDCC would compile the securities owners list based on the latest updates to the contact address. Issuing company would then apply to distribute stocks to that central depository account based on the information. Therefore, if investors intend to designate an account, they shall specify the account number on the "Notice of Stock Book-Entry Distribution" and mail it back to the issuing company or its shareholder services agent for shares to be distributed to the designated account.

-

3.

When the securities to be distributed via book-entry are stock dividends of highly weighted stocks, how do TDCC deposit them to each credit institution?

show or hide detailsIn accordance with the official letter Taiwan-Finance-Securities (IV) No. 04456 issued on December 1, 1999, starting from January 1, 2000, if the stock dividend yield of stocks acquired by investors via margin purchase exceeds 20%, the new stocks shall be collateral to securities firm handling margin purchases and short sales of securities. If the securities to be distributed are collateral with dividend yield exceeding 20%, they would be distributed to the securities owner's central depository account first by TDCC. TDCC will calculate the number of stock dividends to be used as collateral based on the dividend yield rate provided by the issuing company. The quantity calculated will be transferred from the securities owner's central depository account to credit institution's segregated account for margin purchases and short sales.

-

4.

What are the advantages when investors agree to provide the listed companies with the numbers of their financial institution accounts used for securities trading?

show or hide detailsIt can simplify the listed companies' dividend distribution operation. Starting from July 1999, if investors would fill out the fund transfer agreement, consenting to provide the numbers of their financial institution accounts used for trading of securities, and the numbers are entered by the securities firms into systems connected with TDCC, TDCC would include the account information into the securities owners list and duly provide it to the listed companies. The latter can then distribute investors' dividends, bonuses or other items directly to these designated accounts. The payout operation would be more convenient.

Pledge Operations show or hide details

-

1.

How do shareholders pledge dematerialized stocks when they are book-entry transferred to the "registration account"?

show or hide details- The issuer shall open a depository account of the pledgee and the pledgor and a pledge account under the issuer's depository account.

- The issuer shall transfer pledgor's stocks from the "registration account" to the pledgor's depository account.

- The issuer shall execute online transactions in accordance with applications filled out by the pledgor and the pledgee to transfer the pledgor's stocks to "pledge depository account" and hand the single-entry passbook with seals affixed to the pledgee for retention.

- The transfer agent shall ask the pledgee to apply for the "Online Account Information Inquiry Registration." Once the registration and pledge creation are completed, it shall ask the pledgee to login in the centralized securities depository enterprise website and obtain the "certification number" so that the pledgee can proceed with pledge-related operation later.

Tax-Deferred Stocks show or hide details

-

1.

Q16: If the shareholder's stocks are book-entry transferred to "registration account" and they are tax-deferred stocks, can the shareholder apply to transfer these stocks to his/her depository account at the securities firms?

show or hide detailsWhen the paper tax-deferred stocks are deposited to the centralized securities depository enterprise, the shareholders shall waive the rights to tax deferral and the issuer shall file the shareholders' income tax by the deposit years. Thus, when these stocks are exchanged for dematerialized stocks, they can be transferred to shareholders' depository account at the securities firms, if the shareholders have already applied to the issuer to wave the rights to tax deferral.

-

2.

Shall the income statement for waiving the rights of tax-deferred stocks be reported by the issuing company or securities firm?

show or hide detailsStarting from September 1, 2000, the issuing company shall fill in the non-withholding tax statements or dividend statements for shareholders who waive their rights to tax deferral on their tax-deferred stocks, as defined in Articles 16 and 17 of the Statute for Upgrading Industries and Article 13 of the former Statute for Encouragement of Investment, in the year of waiver. The issuing company shall file the aforesaid information to the competent tax authority before the end of January in the year following the waiver by investors.

Transfer Operation show or hide details

-

1.

Q30: Once the shareholders' stocks are transferred into the depository account under security firms, can they apply to transfer the stocks back to the issuer's general custody account or the registration account?

show or hide detailsIf shareholders plan to have securities managed by the issuer, they can present the securities passbooks and seal or signature in their securities transfer applications to the participants. The participants would execute the "Securities Transfer" transaction (transaction code 130) and transfer the securities to the general custody accounts opened by the shareholders at the issuer. However, these stocks shall not be transferred to "registration account." For stocks transferred by the transfer agent into shareholders' depository accounts by mistake, if the transfer agent has already stated the reason for correction to the centralized securities depository enterprise and obtain the latter's approval, shareholders can apply to the participants by filling out the "Application for Transfer of Securities in an Issuer's Depository Account/Registration Account." After the participants have duly applied for approval to the centralized securities depository enterprise, they can transfer the stocks from shareholders' depository accounts to the issuer's "registration account" by executing the "Transfer of Securities in an Issuer's Depository Account/Registration Account" transaction (transaction code 671) in accordance with the approval notice from the centralized securities depository enterprise.

-

2.

Q34: How do securities owners apply for transfer of stocks on their first day of listing in the TWSE or the TPEx or the Emerging Stocks, shares restricted for TWSE/TPEx listing or shares with transfer restrictions in the central depository accounts of centralized securities depository enterprise's participants?

show or hide details- The securities owner shall fill out the "Securities Transfer Application (Substitute for Debit Voucher)," affixing it with the seal/signature-of-record with the participant, and present the securities passbook in his/her application of transfer to the participant.

- Upon receiving the application, the participant shall verify the data and seal/signature-of-record and execute the "Controlled Securities - Deposited Securities Transfer" transaction (transaction code A63).

- Upon receiving participant's securities transfer data, the centralized securities depository enterprise shall record the book-entry transfers immediately.

Withdrawal show or hide details

-

1.

Q28: How do securities owners apply to the securities firms for the withdrawal of securities with terminated registration?

show or hide detailsTo withdraw securities with registration terminated and replaced by physical securities, securities owners may apply to any transacting participant and the aggregated account withdrawal shall be adopted. Relevant procedures are as follows:

- The securities owners, before 2.30 pm of the day of application, shall present to the transacting participants with the securities passbook and filling out the "Deposited Securities Aggregated Account Withdrawal Application - Substitute for Debit Voucher" in duplicate with seal/signature-of-record. The owners shall also agree to authorize the participant to apply to the centralized securities depository enterprise for aggregated account withdrawal.

- After reviewing and verifying the securities owners' applications for the aggregated account withdrawal, the participants would execute the "Aggregated Account Withdrawal Application" transaction (transaction code A23) using the online system to notify the centralized securities depository enterprise. Upon receiving the notice, and after verification by other participants, the centralized securities depository enterprise would, except for securities subject to court's attachment or pledged securities, transfer the balances of securities requested by the securities owners from the owners' accounts under those other participants to the owners' account of the withdrawing participant.

- The securities owners would then withdraw securities at the participant's business premises upon receiving notice from the withdrawing participant.

-

2.

Q29: Once the securities owners withdraw securities with registration terminated and replaced by physical securities from the centralized securities depository enterprise, shall they apply to the company for a transfer of ownership?

show or hide detailsThe stocks withdrawn by the securities owners are printed in the owners' name and registered in the company's shareholder register. Thus, application for a transfer of ownership is not required.

Other show or hide details

-

1.

What does dematerialized issuance mean?

show or hide detailsDematerialized issuance means the companies would not print paper securities. Instead, the issue quantities are registered at the centralized securities depository enterprise, and the shares are delivered to owners’ depository accounts by book-entry transfer.

-

2.

Q2: Do stocks or corporate bonds issued by companies not listed on the Taiwan Stock Exchange (TWSE), the Taipei Exchange (TPEx), or the Emerging Stocks have to be in the dematerialized form?

show or hide detailsStocks or corporate bonds issued by companies not listed on the TWSE, the TPEx, or the Emerging Stocks can still be in the paper form.

-

3.

Once the company intends to issue dematerialized stocks, does the Articles of Incorporation need to be amended?

show or hide detailsIf the Articles of Incorporation contains wordings that indicate paper stocks, e.g. "The Company's stocks shall be registered certificates. The stock certificates shall be affixed with the signatures or personal seals of the director representing the company, and shall be duly certified before issuance.," the proposed amendment would be "The Company's stocks, except for ones that are exempted from printing in paper form in accordance with relevant rules, shall be registered certificates. The stock certificates shall be affixed with the signatures or personal seals of the director representing the company, and shall be duly certified before issuance." Alternatively, the Articles of Incorporation may contain wordings showing that the company may issue stocks in dematerialized form, so that dematerialized stocks are in conformity with the company's Articles of Incorporation.

-

4.

Q4: If the issuer’s stocks are issued in dematerialized form and intends to issue corporate bonds, financial bonds or other types of securities, shall it still undergo the audit on the eligibility requirements conducted by the centralized securities depository enterprise?

show or hide detailsFor an issuer who issues stocks in dematerialized form to issues corporate bonds, financial bonds or other types of securities, if the securities services for the corporate bonds and financial bonds are handled by a transfer agent, the issuer does not have to undergo the audit on the eligibility requirements conducted by the centralized securities depository enterprise prior to the issuance. If the securities services for the corporate bonds and financial bonds are not handled by a transfer agent, the audit on the eligibility requirements conducted by the centralized securities depository enterprise prior to the issuance would be required.

-

5.

Q5: Can a non-public company apply for stock dematerialization to the centralized securities depository enterprise?

show or hide detailsAccording to Article 161-2 of the Company Act, for the shares to be issued by a company, the issuing company may be exempted from printing any share certificate for the shares issued. Therefore, a non-public company may issue dematerialized stocks. It shall register its stocks at the centralized securities depository enterprise and follow the regulations of that enterprise.

-

6.

Q6: For a company issuing dematerialized stocks, in what way can it connect with the centralized securities depository enterprise to conduct transactions?

show or hide details- It can apply for the SMART connection to the centralized securities depository enterprise. Through private network (TDCC ADSL network or four-in-one integrated network) connecting to the centralized securities depository enterprise, it can use personal computers as terminals to execute transactions.

- If the company is temporarily unable to conduct transactions via the private network connecting to the centralized securities depository enterprise, it can borrow equipment from the latter (by filling out the equipment borrowing application).

-

7.

Q7: What expenses shall be borne by the company for connecting to the centralized securities depository enterprise via Chunghwa Telecom's private line?

show or hide details- The centralized securities depository enterprise does not charge any connection fee.

- The company shall pay Chunghwa Telecom the ADSL network installation fee and the monthly rental fee.

-

8.

How do investors make inquiry on how many dematerialized stocks the issuer has issued?

show or hide detailsInquiries can be made at TDCC's shareholder services information platform under investor service. The website is https://www.tdcc.com.tw/smWeb/.

-

9.

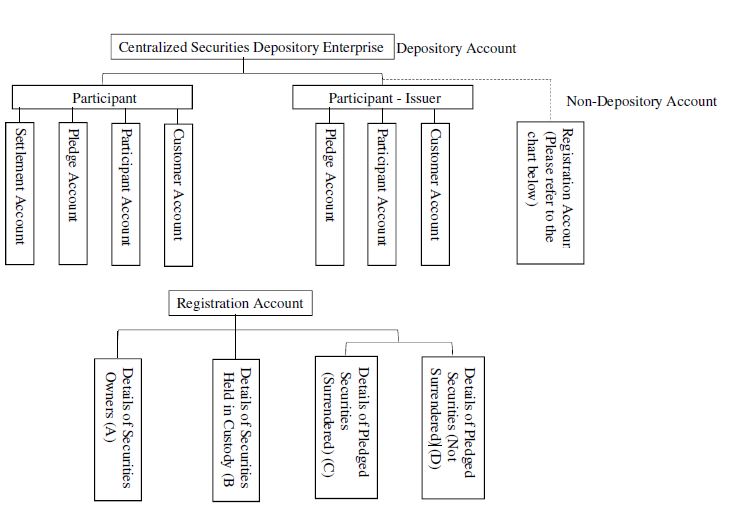

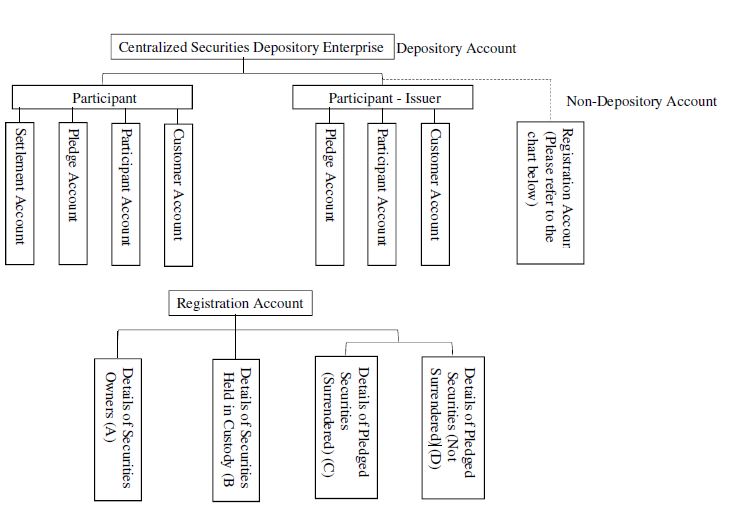

Q9: When the issuer adopts dematerialization, what is the structure of the " depository account"?

show or hide details

-

10.

Q10: What are the features of the registration account?

show or hide detailsSecurities owners of the registration account have no passbooks, nor can they apply for deposit, withdrawal, and pledge.

-

11.

Q11: After stocks are issued in dematerialized form, how to record the number of stocks held by the shareholders?

show or hide details- If the stocks are transferred into the depository accounts opened by the shareholders with a participant, the shares would be recorded in the shareholders' depository passbooks.

- If the stocks are transferred into the issuer's registration account, the account would keep a record of each shareholder's balance under each particular. Shareholders can apply to the issuer's transfer agent for the query forms as certificates of shareholding.

-

12.

Q12: Where an issuer applies to be listed on the TWSE or the TPEx, when shall its directors, supervisors, and specific shareholders apply to the centralized securities depository enterprise for central custody of the securities?

show or hide detailsAfter the issuer has been approved by the review committee or the board of directors of the TWSE or the TPEx, they can apply to the centralized securities depository enterprise for central custody of the securities.

-

13.

Q13: After stocks are issued in dematerialized form, can an investor apply for transfer, direct trade between parties, inheritance, and endowment, etc. during the share transfer suspension period?

show or hide detailsUnless there is trade suspension during the share transfer suspension period, transfer, direct trade between parties, inheritance, and endowment can still be executed.

-

14.

Q14: If stocks deposited at the "registration account" is required to be book-entry transferred due to direct trade between parties, inheritance, and endowment, how do one transfer these stocks to the transferee's (heir's) depository account at the securities firms?

show or hide detailsThe transferee (heir) shall apply to the issuer's transfer agent for account opening at "registration account" and the transfer agent would then adjust the unpledged stocks balance from transferor’s (legator’s) name to transferee's (heir's) name. Only then can transferee (heir) apply to transfer these stocks to his/her depository account at the securities firms.

-

15.

Q15: Where stocks are exchanged in dematerialized form, if stocks are book-entry transferred to "registration account", can a shareholder apply to the company for transfer, direct trade between parties, inheritance, and endowment, etc. before paper stocks are returned?

show or hide detailsNo. Shareholders shall return paper stocks to the company in exchange for dematerialized stocks before they can apply for transfer, direct rtrade between parties, inheritance, and endowment.

-

16.

Q18: If the dividends of pledged stocks are deposited at the "Details of Securities Held in Custody" of the "registration account" via book-entry transfer, how does the pledgee apply for transferring them to his/her participant's "pledge account" and continue to serve as pledged stocks?

show or hide details- When the pledgee and pledgor have agreed for the pledgee to receive the pledged stocks' dividends, pledgee can fill out the "Application for Transfer of Pledged Stocks' Dividends at the Registration Account (Substitute for Debit Voucher)" with the seal-of-record of central depository account affixed and present it along with the seal verification certificate to the issuer's transfer agent for application.

- The transfer agent would examine whether the information on the "Application for Transfer of Pledged Stocks' Dividends at the Registration Account (Substitute for Debit Voucher)" is correct; execute the "Pledge Delivery Data Inquiry" transaction (transaction code 366) to print the "Pledge Delivery Data Inquiry Form" and confirm the agreement between pledgor and pledgee concerning pledged stocks' dividends; and verify the amount applied to be transferred.

- The transfer agent would execute the "Notice for Transfer of Pledged Stocks' Dividends at the Registration Account" transaction (transaction code A47) to transfer the pledged stocks' dividends in the registration account's "Details of Securities Held in Custody" into the "pledge account" of pledgee's participant.

-

17.

Q19: How to impose court-ordered attachment on stocks in the registration account?

show or hide details- Execute the "Data Maintenance of Court-Ordered Attachment Execution Unit" transaction (transaction code 154) to query the execution unit's number.

- Fill out the "Court-Ordered Attachment Information Setup Application" based on the court’s letter and execute the "Court-Ordered Attachment Information Setup" transaction (transaction code 150). Print the information in the application's certification field, affix the document with the in-charge's seal and submit it to the supervisor for approval.

- Once the supervisor verifies the application is in line with the court’s letter, he/she would affix his/her seal at the supervisor field.

- The application shall be retained by the issuer. Relevant supporting documents (e.g. the court’s letter) shall be copied as attachments to the application.

-

18.

Q20: How to lift the court-ordered attachment on stocks in the registration account?

show or hide details- Execute the "Data Maintenance of Court-Ordered Attachment Execution Unit" transaction (transaction code 154) to query the execution unit's number.

- Fill out the "Court-Ordered Attachment Information Setup Application" based on the court’s letter and execute the "Court-Ordered Attachment Information Amendment" transaction (transaction code 151, Amendment type 1: Lifting of attachment). Print the information in the application's certification field, affix the document with the in-charge's seal and submit it to the supervisor for approval.

- Once the supervisor verifies the application is in line with the court’s letter, he/she would affix his/her seal at the supervisor field.

- The application shall be retained by the issuer. Relevant supporting documents (e.g. the court’s letter) shall be copied as attachments to the application.

-

19.

Q21: How to proceed when notified by the court to deliver the stocks in the registration account to the account designated by the court?

show or hide details- Execute the "Data Maintenance of Court-Ordered Attachment Execution Unit" transaction (transaction code 154) to query the execution unit's number.

- Fill out the "Court-Ordered Attachment Information Setup Application" based on the court’s letter and execute the "Court-Ordered Attachment Information Amendment" transaction (transaction code 151, Amendment type 2: Account transfer due to court-ordered attachment).

- Upon receiving the notice, the centralized securities depository enterprise will transfer the stocks from the registration account to the account designated by the court.

-

20.

Q22: How does a foreign issuer duly deliver stocks to overseas foreign-national or Mainland Area-national shareholders?

show or hide detailsWhere the overseas foreign-national or Mainland Area-national shareholders have provided their depository accounts at the participants, the transfer agent can apply to the centralized securities depository enterprise for delivery to the shareholder's depository accounts. If the account details have not been provided, the stocks shall be transferred to the registration accounts of companies with primary listing on the TWSE or the TPEx or the Emerging Stocks to complete the book-entry delivery procedure.

-

21.

Q23: How do stocks obtained by a foreign shareholder of primary listing on the TWSE or the TPEx or the Emerging Stocks prior to the listing be transferred from the general custody account, specific custody account, or registration account under the issuer's depository account into the investment account opened by the foreign shareholder at a custodian?

show or hide detailsShareholders shall apply to the issuer with their seal/signature-of-record and the following documents:

- "Application for Adjustment to the Shareholding Details of Registration Account" in duplicate (Applicable to registration account).

- "Application for Transfer of Securities in an Issuer's Depository Account/Registration Account" in duplicate.

- A copy of the contract between the foreign shareholder and the custodian.

- A copy of the certificate of completion of FINI or FIDI registration by the foreign shareholder.

- A copy of the notice of assignment of FINI or FIDI uniform ID number.

- The original specimen seal/signature card of the FINI or FIDI investment account and foreign investor.

After the issuer has verified the aforementioned documents, it shall proceed with the following procedures:

- For general custody account or specific custody account, after the centralized securities depository enterprise has approved the application, the issuer shall execute the "Customer Basic Data Amendment" transaction (transaction code 146) to amend the foreign shareholder's identification card number or profit-seeking enterprise number to a FINI or FIDI uniform ID number.

- For registration account, the issuer shall execute the "Shareholder Information Registration" transaction (transaction code 670) to add the FINI or FIDI investment account basic data, followed by the "Adjustment to the Shareholding Details of Registration Account" transaction (transaction code 673) to adjust the number of shares held under a foreign shareholder's identification card number or profit-seeking enterprise number to the number of shares held under a FINI or FIDI investment account uniform ID number.

- After executing transactions described in the preceding two subparagraphs, the issuer shall conduct the "Issuer Depository Account/Registration Account - Deposited Securities Account Transfer" transaction (transaction code 671) to notify the centralized securities depository enterprise. After the centralized securities depository enterprise receives the aforementioned notice, it will transfer the stocks from the general custody account, specific custody account, or registration account into the investment account opened by the foreign shareholder.

-

22.

Q24: How do stocks duly obtained by overseas foreign-national or Mainland Area-national employees of primary listing on the TWSE or the TPEx or the Emerging Stocks prior to the listing be transferred from the general custody account, specific custody account, or registration account under the issuer's depository account into the collective investment account for overseas foreign national or Mainland Area national employees opened by the issuer at a custodian?

show or hide detailsEmployees shall fill out the "Application for Transfer of Securities in an Issuer's Depository Account/Registration Account," indicating their nationality at appropriate places, and apply to the issuer. Once the issuer has verified the information, it shall fill out the "Application by Participant to Conduct a Restricted Online Transaction," indicating its employees are of foreign or mainland area nationality, and apply to the centralized securities depository enterprise for approval. After the centralized securities depository enterprise has checked the aforementioned documents and verify the employees' identities and transfer accounts, it will notify the issuer to execute the "Issuer Depository Account/Registration Account - Deposited Securities Account Transfer" transaction (transaction code 671). Once completed, the centralized securities depository enterprise will transfer the stocks from the general custody account, specific custody account, or registration account into the collective investment account for overseas foreign national or Mainland Area national employees opened by the issuer at a custodian. Employees referred to in the first paragraph do not include insiders such as shareholders who hold more than 10% of the issuer's shares.

-

23.

Q25: For companies originally listed on the TWSE, TPEx, or the Emerging Stocks with dematerialized stocks, if they intent to switch to paper stock issuance after delisting, what documents shall they present to the attestation bank for the application?

show or hide detailsThe companies shall present the termination of registration issued by the centralized securities depository enterprise to the attestation bank for stock certification.

-

24.

Q26: Once the registration of securities is terminated, how do securities owners make inquiry on their holdings?

show or hide details- The securities owner with depository account under securities firm may apply to his/her securities firm for documentary proof of holdings as of the registration termination date.

- For securities owners with issuer's depository account or under the registered account, when an issuer is unable to print paper securities nor provide shareholding information, they may apply to the centralized securities depository enterprise for a record of registered quantity notified by the issuer as of the registration termination date.

-

25.

Q27: After the centralized securities depository enterprise terminates the registration of securities, do book-entry delivery functions still apply to the securities?

show or hide details- Starting from the termination date, the centralized securities depository enterprise will suspend all book-entry delivery functions for the securities other than the extinguishment of pledge (transaction code 320), court-ordered attachment information setup (transaction code 150), court-ordered attachment information amendment (transaction code 151), and closing out of margin purchases and short sales.

- Once the issuer delivers paper securities to the centralized securities depository enterprise, except for the newly-added withdrawal function, all other book-entry functions are still subject to the aforementioned restrictions.

-

26.

Q31: After all companies listed on the TWSE, the TPEx, or the Emerging Stocks have switched to dematerialization, can shareholders still deposit the old paper stocks into the centralized securities depository enterprise via securities firms?

show or hide detailsThe centralized securities depository enterprise has stopped engaging in the deposit of paper stocks on the date when all paper stocks have been replaced by dematerialized stocks. However, shareholders can return the paper stocks to the transfer agent to complete the recording or to transfer the stocks to the shareholders' depositary accounts under security firms.

-

27.

Q32: For issuers who issue privately placed shares, shares restricted for TWSE/TPEx listing, and restricted stock awards in the dematerialized form, how do they confirm the balance of each security type upon book closure?

show or hide detailsIn the event that an issuer, who has issued privately placed shares, shares restricted for TWSE/TPEx listing, and restricted stock awards, announces its book closure date, the centralized securities depository enterprise would still prepare a register of securities holders to the issuer based on the balance of securities owners' holdings. In addition, the centralized depository enterprise would issue owners lists for privately placed shares, shares restricted for TWSE/TPEx listing, and restricted stock awards as a way of providing information to the issuer.

-

28.

Q33: If a securities owner has depository accounts with the securities firms and the issuer, how does the centralized securities depository enterprise provide the securities owners list at the record date ?

show or hide detailsIf the securities owner has a depository account with the securities firms and a "general custody account" with the issuer, the centralized securities depository enterprise would aggregate based on the owners' depository accounts with the securities firms in preparing the register of securities holders at the record date.

-

29.

Q35: How do an issuer proceed with the exchange operation when it has issued exchangeable corporate bonds?

show or hide details- The issuer shall open an "exchangeable bond account" (account type 41) under its central depository account and transfer the underlying stocks into this account for central depository purpose.

- The issuer shall inform the centralized securities depository enterprise the following matters before issuing the exchangeable bond: (1) Approval documents issued by the competent authority (except for exchangeable bonds issued by the central government); (2) Issuance terms and the rules of public announcement and issuance; (3) Exchange price or adjusted exchange price; (4) Exchange suspension period; (5) Buy back/redemption period; and (6) Other requirements associated with exchange. Issuer shall notify the centralized securities depository enterprise of any changes to the aforementioned matters three business days prior to the effective date.

- During the exchange period stipulated by the issuers, exchangeable corporate bond holders may present their securities passbooks and seal/signature-of-record to their participants to apply for an exchange of their bonds. The centralized securities depository enterprise will e-mail the exchange application data to the issuer or its transfer agent on the business day following the application date.

- Once the issuer or its transfer agent has verified the information from the centralized securities depository enterprise, it would execute the "Exchangeable Bond Transfer" transaction (transaction code 259) within the period prescribed by the competent authority to provide relevant information to the centralized securities depository enterprise.

- After the centralized securities depository enterprise confirms the data entered by the issuer or its shareholder services agent against the applicant's application, it would transfer the underlying stocks from the issuer's exchange account to the applicant's central depository account, and prepare and email the "Details of Underlying Stocks of Exchangeable Corporate Bonds Transferred" (report code ST120) to the issuer or its shareholder services agent on the business day following the stock transfer.

-

30.

Q36: What are the procedures for securities owner who intends to use the stocks in his/her participant's central depository account as capital contributions or to abandon the stocks?

show or hide details- As capital contributions to a company in the process of incorporation: where the issuer of the stock is the participant of the centralized securities depository enterprise, the representative of the company being established shall present documents of proof, including the proof of identity and a promoters list, and open a general custody account in the name of "XXX, Representative of XXX Company's Preparatory Office" with the issuer of stocks to be used as capital contribution. As capital contributions for new shares issued in capital increase or stock abandonment: the company shall already have a central depository account with the participant.

- The securities owner shall fill out the "Transfer/Cancellation of Inheritance, Endowment, Provision as Capital Contributions, or Stock Abandonment Application" with seal-of-record, and present his/her passbook along with the following documents in his/her application to the participant: (1) As capital contributions to a company in the process of incorporation: relevant supporting documents, including a list of promoters of the company under establishment and the agreement on using the stocks as capital contribution, shall be attached. (2) As capital contributions for new shares issued for capital increase: relevant supporting documents, including stock subscription agreement and the board meeting minutes of the company issuing news stocks in capital increase, shall be attached. (3) Stock abandonment: relevant supporting documents such as the "Statement of Stock Abandonment" (with seal-of-record affixed) shall be attached.

- After the participant receives securities owner's application and execute the "Transfer/Cancellation of Inheritance, Endowment, Provision as Capital Contributions, or Stock Abandonment Application" transaction (transaction code 376) using the online system to notify the centralized securities depositary enterprise, it would deliver the application to the centralized securities depository enterprise on the business day following the application date. The centralized securities depository enterprise would consolidate relevant documents delivered by the participants and submit them along with the "Details on Applications of Securities Transfer" to the issuer for review within two business days following the application date.

- The issuer shall complete its review within three business days upon receiving the documents from the centralized securities depository enterprise and fill out the "Review Notice on Securities Transfer" or execute the "Review Notice" transaction (transaction code 675) using the online system to notify the centralized securities depository enterprise. If the issuer is unable to complete the review within the prescribed period, it shall fill out the "Notice of Delay in the Review on Securities Transfer" to inform the centralized securities depository enterprise of the reasons for the delay. The issuer would contact the securities owners to provide supplementary information if needed upon review.

- Where the applicant is found to be ineligible upon notice from the issuer, the centralized securities depository enterprise shall cancel the transfer application. Where the applicant is found to be eligible upon notice from the issuer, the centralized securities depository enterprise shall proceed with the transfer after it has verified the securities owner's account balance. (1) For applications to use stocks as capital contributions to a company in the process of incorporation, the stocks will be transferred from the securities owner's depository account with the participant to the general custody account opened by the company in the process of incorporation with the issuer. (2) For applications to use stocks as capital contributions for capital increase, the stocks will be transferred from the securities owner's depository account with the participant to the depository account opened by the company issuing new shares with the participant. (3) For stock abandonment applications, stocks will be transferred from the securities owner's central depository account with the participant to the central depository account opened by the issuer with the participant.

-

31.

Q37: Where companies listed on the TWSE, TPEx or the Emerging Stocks return stock capital in cash due to capital reduction or perform cash merger pursuant to the Business Mergers and Acquisitions Act, how to handle the cash payment corresponding to stocks under attachment or pledge, or in the account designated by the court for auction or surety?

show or hide detailsWhen companies listed on the TWSE, TPEx or the Emerging Stocks return stock capital in cash due to capital reduction or perform cash merger pursuant to the Business Mergers and Acquisitions Act, the centralized securities depository enterprise would provide the transfer agent with relevant data on the details of pledge, attachment, court's auction account, and data on court surety. For cash payment corresponds to these stocks, the transfer agent shall note the following:

- Pledge: proceed in accordance with the pledge data of dividend distribution agreement between the pledgee and the pledgor provided by the centralized securities depository enterprise. If there is no distribution agreement between pledge parties concerning capital reduction/merger and acquisition/buy back/return of capital, the field shall be left blank and the monetary amount shall be placed under the issuer's or its transfer agent’s custody. Once the pledgor, pledgee or the buyer provides documents proving the removal of pledge, acquisition of pledged items or transfer of court auctions, the transfer agent would then deliver the monetary amount to the pledgor, pledgee or the buyer.

- Attachment: the centralized securities depository enterprise would compile and provide the "Summary of Court Attachment Data" (report code ST56J) to the transfer agent and inform the execution agencies the reasons for changes in the companies listed on the TWSE, TPEx or the Emerging Stocks. Thus, the transfer agent shall place cash associated with attachment under custody and wait for the execution agencies' instructions to deliver the cash.

- Details on court auction: place cash associated with the "Auction Details of Securities Owners List" provided by the centralized securities depository enterprise under custody and wait for the court's instructions to deliver the cash.

- Court surety: money is remitted into the court surety account in accordance with the "Court Surety List" provided by the centralized securities depository enterprise to continue to serve as surety.

-

32.

Q38: Where the issuer's stocks in the registration account are transferred into the court's auction account due to court-ordered attachment, how to return the stocks in the court-auction account to shareholders if the need arises subsequently?

show or hide details- When the centralized securities depository enterprise's participant intents to return the stocks in the court's auction account to investors due to revocation of court orders, or returns of remaining auction items or dividends, the participant shall confirm the securities and the quantities to be returned in accordance with relevant documents, such as a court's letter. It shall then execute the "Auction Account Return Transfer" transaction (transaction code C64) to enter data of investors receiving the return or the "Transmittance of Auction Account Return Transfer Transactions" (transaction code C645) to deduct the remaining balance of the court's auction account and the quantities from the details of investors.

- Upon receiving the notice, the centralized securities depository enterprise would transfer the stocks from the court's auction account to the "Details of Securities Owners" under the issuer's registration account and register them in the shareholders' names.

- When reconciling accounts, the transfer agent can execute the "Details Change under Registration Account Query" transaction (transaction code A54) and choose "C64-Auction Account Return Transfer" as query transaction code to verify data transferred and maintain relevant information.

(Chinese version only)