Fund investment made easier with TDCC’s Fund Clear

2022/03/02

The global economy gradually recovered from the COVID-19 pandemic in 2021 and investors turned to risk-adjusted assets, creating a frenzy in stock and fund markets around the world. Enterprises have come to put more emphasis on sustainability, social responsibility and governance, and sped up their investment towards sustainable development.

As of February 21, TDCC's "Fund Clear"--an integrated portal site with extensive fund information--includes a section for onshore ESG funds, whose statistics are accessible with just a few clicks. The diverse information provided by the site helps investors make more informed decisions and grasp trends of ESG investment. The data on ESG can aid their investment strategies and involvement in the operation results of excellent enterprises. All these will lead to a better social environment and better sustainability.

Onshore ESG section promotes responsible investment

Having become more aware of the concept of sustainable operation, enterprises in recent years have been applying such ideas to their investments, particularly in ESG. Continuous refinement in their operation and business models not only bring about positive social changes, but also create value for their investors.

As more ESG-related products emerge, TDCC is working with the Financial Supervisory Commission's "Sustainable Finance" and "Green Finance Action Plan," among others, to help investors identify government-approved ESG funds. A dedicated ESG section on the Fund Clear website provides domestic investors with relevant information, which could bring ESG issues to their attention and help them make investment decisions with sustainable ideas in mind. This process could facilitate long-term benign cycles for enterprises, industries, society, and the environment.

Analyses of big data on funds for better grasp of investment trends

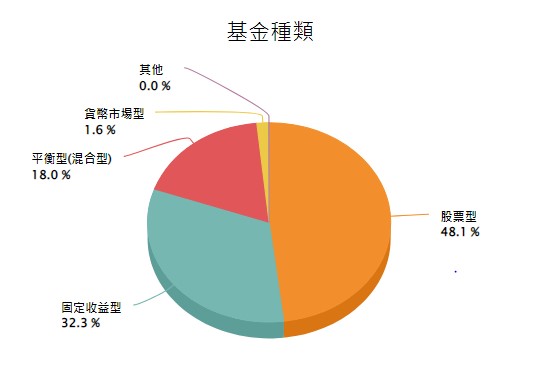

Despite the market being influenced by the pandemic in 2021, Western countries have begun to accept the new norm--coexist with COVID--and resumed normal economic activities. Overall, the global economy is showing growth, and stock markets performed surprisingly well--an overall 18.5% global growth in 2021 in spite of fluctuations, according to FTSE Global All Cap Index. According to the information from the Fund Clear website,In the past year, domestic investment has also reflected this trend, and the type of overseas fund subscription has gradually shifted to the equity type. As of December 2021, of all the funds that received more investment from investors in Taiwan, 8 out of the top 10 were equity funds. In terms of investment sum, more than half of the top 10 funds were equity funds. Also, 48.1% of the sum went to equity funds. Overall, it is obvious that investors are optimistic about the long-term return on investment of equities and favor risk-adjusted assets. Active asset allocation strategies are reflected in such preferences.

Distribution of offshore fund investments between January and December, 2021.

(Source: www.fundclear.com.tw)

Distribution of offshore fund investments between January and December, 2021.

(Source: www.fundclear.com.tw)

Making informed investment decisions with Fund Clear

Ever wondered where to start investing when faced with over a thousand fund choices? How to pick out the most suitable fund? TDCC's integrated portal site "Fund Clear" presents informative data with a user-friendly interface. Various types of onshore and offshore funds, investment areas, and denomination currencies can be quickly searched and displayed in visually-pleasant graphics, so investors can promptly grasp market dynamics and observe crucial number changes. Fund Clear makes putting together a personal investment portfolio easier for everyone!