First-time Taiex investor number hit decade high in 2020 as liquidity party began

2021/01/28

For many stock investors, 2020 was a “frantic” year, as global stock markets crumbled in the face of the COVID-19 pandemic before undergoing a V-shaped turnaround beginning in April 2020 thanks to aggressive easing policies introduced by the central banks. Many investors saw this as the opportunity of a lifetime to make a fortune in the stock market. According to TDCC’s Big Data analysis, the number of first-time investors in the Taiex market (TWSE and TPEx combined) jumped almost a twofold, from 340k in 2019 to 670k, in 2020. The total number of securities investors in Taiwan hit 10.78 million in 2020, accounting for 46% of the country’s population.

Notably, stock investors as a percentage of Taiwan’s total population have been on the rise: from just 36% in 2011 to 46% as of the end of 2020. TDCC President Chu Han-Chiang said that in the previous decade, the figure had edged up by 1ppt per year on average, but in 2020, it went up 3ppts, suggesting the influx of novice investors in 2020 was the strongest that is has been over the past ten years.

The number of newly opened brokerage accounts rose exponentially, and investors were way more active than usual. According to TDCC, in 2019, about 3.48 million retail investors actually traded in the stock market, and the number surged to 4.52 million in 2020, up almost 30%. This means 4 out of 10 account holders participated in trading last year, representing a decade long high.

Last year, the average daily turnover of the Taiex market was NT$254.6 billion, and in December 2020, the average daily turnover was even higher, reaching NT$338.4 billion. Thanks to this intense market activity, last year the government collected an all-time high of NT$150.2 billion in securities transaction taxes. It is clear that the government’s market boosting policies, including intraday odd lot trading, day trading tax cuts, and regular saving plans have been effective, ultimately contributing to the government’s treasury.

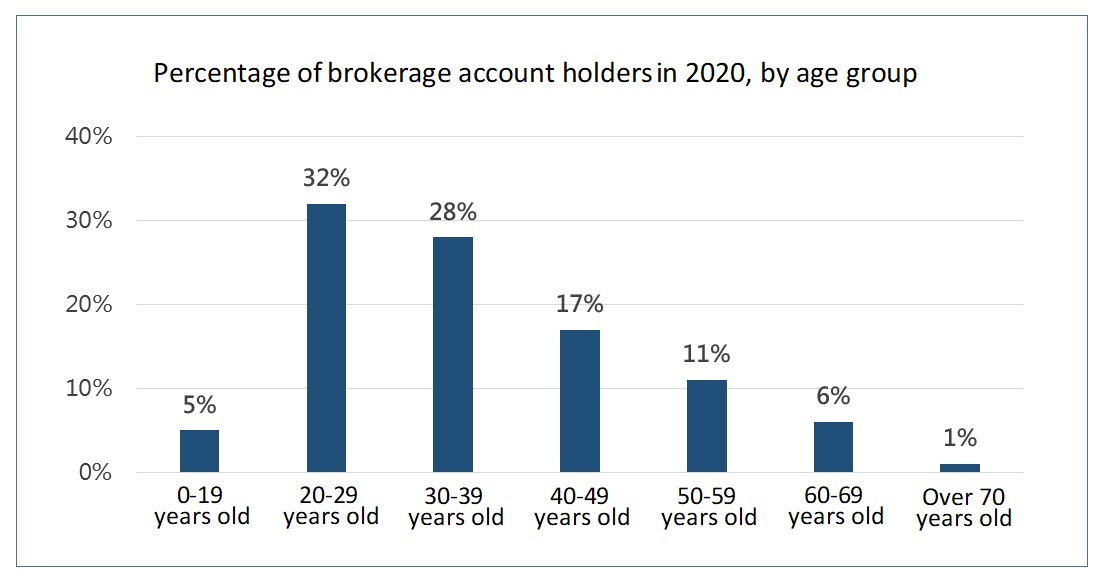

The Financial Supervisory Commission, the competent authority of the securities market, has also put in place measures that encourage the younger generation to engage with the stock market and learn more about investment and asset management. These measures have borne fruit in recent years. Of all the new brokerage account holders in 2020, 60% belonged to the 20-39 year old age group. The percentage of investors aged between 20-29 years with unsold holdings in 2020 rose 29%, from 7% in 2019 to 9% last year, and it was the same for the age group of 30-39 which also climbed 7%, from 15% in 2019 to 16% in 2020, whereas most of the other age groups saw the figures remain flattish, or even decline in 2020. In a nutshell, youngsters are clearly more willing to buy and hold shares.

In terms of the market value of holdings by age group, the median holding value of the 20-29 group rose 14% from NT$140k in 2019 to NT$160k in 2020, as they may not have enough money for investment being new entrants to the job market. The 30-39 age group saw their median shareholding value increase substantially from NT$210k to NT$260k over the same period as their incomes rose with seniority, giving them more resources to take advantage of the market pullback in 2020. For reference, the 40-49 age group registered a 31% increase in median holding value.

What this tells us is that the younger generation has become more financially savvy, meaning that they are more aware of the importance of making preparations early for retirement as they make more money, and stock investment is indeed one of the most favorable options. While TDCC statistics suggest investors aged 50-69 years control the majority of holdings by value, it was the most productive younger generation that registered the strongest growth in holding value. Together, they turned into a formidable force that pushed the Taiex to new highs despite the most aggressive net-selling in recent years by FINI investors in 2020.